Played around with some video editing today.

Result is this #ICT $NQ_F Long

Seems like I accidentally took the only long possibility today :-)

Enjoy and have a great weekend!

Played around with some video editing today.

Result is this #ICT $NQ_F Long

Seems like I accidentally took the only long possibility today :-)

Enjoy and have a great weekend!

Hindsight $ES_F 1min chart annotating #ICT.

Was not on the trading desk the whole day, except last hour. Backtesting some #ICT concepts and see if I had spotted the move up before it happened.

Stops are pretty wide in current conditions, so 8 handles $ES_F is a huge stop.

It’s currently really quiet on my public timeline, since I take the market hours to watch and learn #ICT strategies.

I annotated the $ES_F 5min chart, in hindsight and this is what I came up with.

Thoughts?

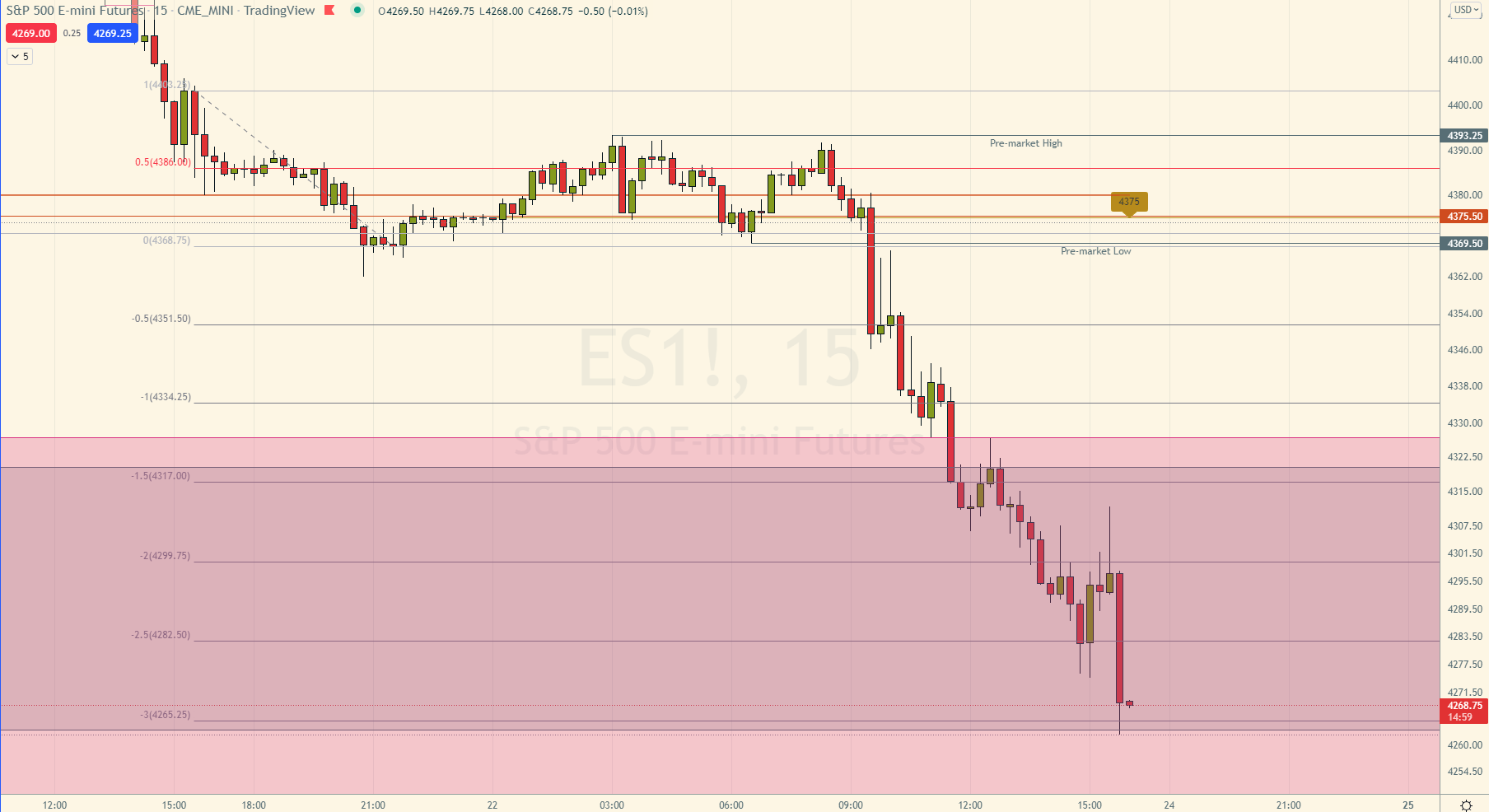

$ES 15min, when you have the correct setup marked on the chart since 08:30AM and still don’t trust that we go that low. Tried to long $ES on small pumps and lost. Instead of trusting my setup #ICT

That way, I missed ~100 $ES handles… #Mental issue

$SPY 60min - Lets talk about Broadening Formations #TheStrat :-)

$GM - RevStrat 1-2d-2u > 40.45 #TheStrat

$PLUG - possible 2d-2u > 26.94

$CVX - Actionable Inside Hammer 🔨 setup #TheStrat

$NET - possible outside week? #SSS50PercentRule #TheStrat

Sunday, April 10, 2022

Surprise, surprise!

Temperatures around freezing and snow on Friday ruined my plans to work on the outside of the house. Typical April weather.

So I had some time to scan through my watchlist of tickers to find some possible #TheStrat trade ideas for a mid-term swing.

$QQQ Long-term chart

Below #SSS50PercentRule on the Yearly again 👀 #TheStrat

PSA: Due to lack of time this weekend, I probably won’t be able to create a #SundaySwing issue.

This is the first time since Oct 21, but due to the better weather other projects around our house outside have priority. Maybe a short edition, but I can’t promise anything.

$SPY 15min 🤔 Broadening Formation drawn from 60min chart. #TheStrat

$NQ_F 60min Liquidity Purge&Revert

The annotations on this chart were drawn 3 days ago, just updated the exact lows for each day since then. Seems to work :-) #ICT

Tuesday, April 5, 2022

Trying to stick to the habit of journaling my papertrades and since today I found a good setup which I planned before ot happened, here is the journal and my thought process. No hindsight this time, as you’ll see on the pictures, they were taken during that trade. But of course, still paper. Note: I had to recreate the annotations because the screenshots I took during the trade showed all the information that I try to show as a development and thought process below, so if somethings seems a bit off or at one screenshot a box is there and on another it’s missing, I apologize.

Sunday, April 3, 2022

New Month and a new quarter, so go lite and let the month open up and see how some of the tickers “open” their quarter, but there were a lot of inside Qtr, so this will get interesting for sure.

I wanted to skip this weeks #SundaySwing issue for #TheStrat setups, but after scanning a bit through my @TrendSpider scanners on new monthly charts, I decided to post one :-)

Post and @buttondown newsletter finished. (9AM NY time it is)

Enjoy your rest of the weekend!

$NIO - possible 2d-2u Monthly Bullish Reversal above 23.86 #TheStrat

Watching for longer expiration 6/17 calls here PT: 26.40, 33.80

Possible #SundaySwing candidate as well…

Thursday, March 31, 2022

First, this is drawn all in hindsight after todays close on $ES_F. Those posts help me to learn all that #ICT stuff and getting better at spotting entries right when they happen during trading hours. I get back to theses posts even during the day and find similar setups. I’m nowhere near to see all the things during a live trading session, this is all learing and backtesting to me.

$PTON - possible #SSS50PercentRule Outside week? #TheStrat