My #SundaySwing ideas for the week of 4/4 based on #TheStrat

Sunday, April 3, 2022

New Month and a new quarter, so go lite and let the month open up and see how some of the tickers “open” their quarter, but there were a lot of inside Qtr, so this will get interesting for sure.

Since weather is getting better because of spring and I have a lot of DIY projects around the house to do, chart time is currently limited and I focus on other things more.

It is a weekend habit for me, to scan for possible swing setups with #TheStrat scans and approaches I try to find at least some good setups and post them here too.

Newsletter

If you want to read my #SundaySwing ideas and some other posts I write right in your email inbox, you can subscribe to my totally free Newsletter.

TLDR;

Going further out and buy some time is the motto of this issue, with one exception.

One shorter swing:

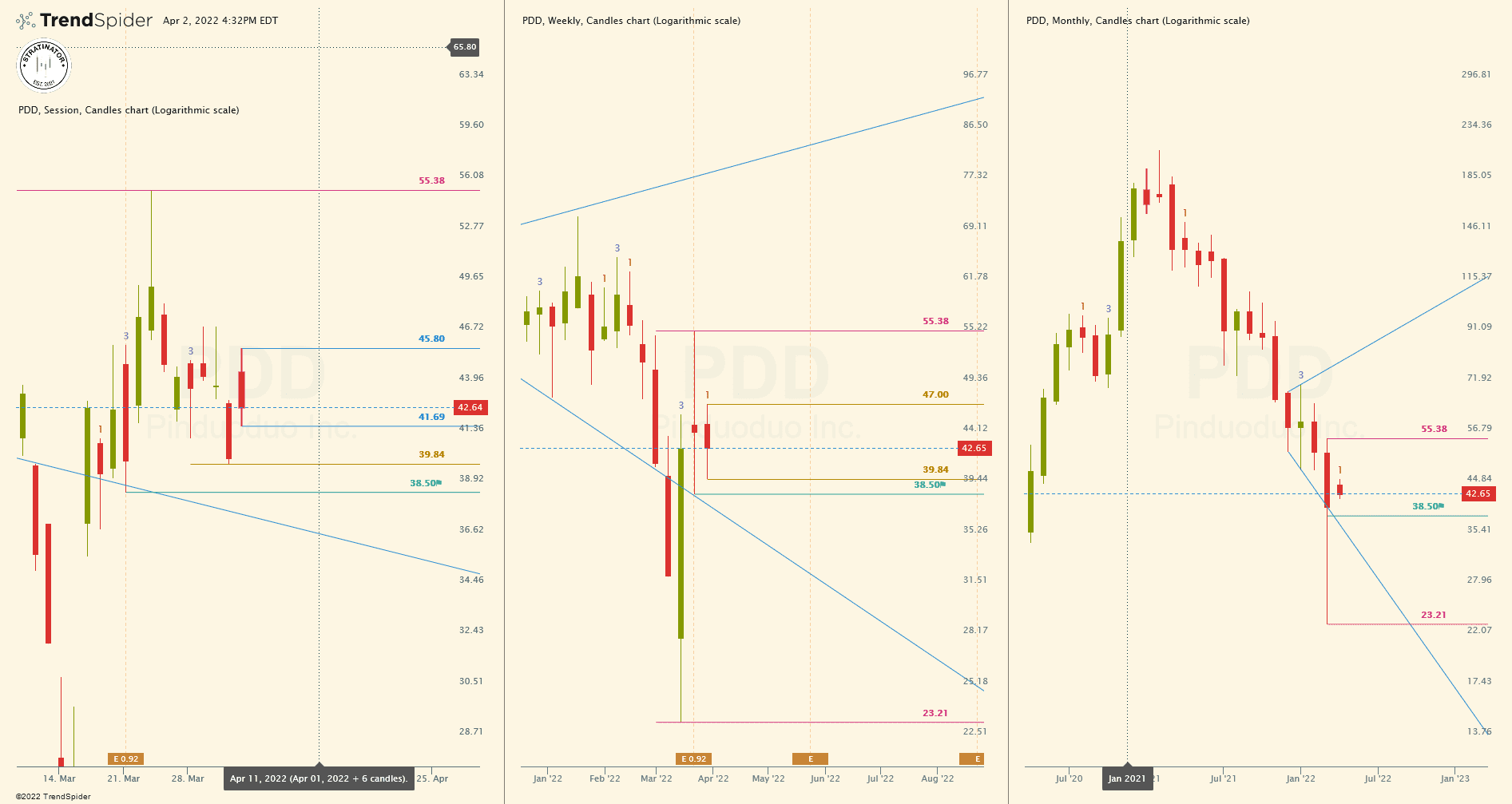

- $PDD 4/14 39p < 41.69

Longer swings:

- $AAL 6/17 20c > 18.45

- $LUV 6/17 50c > 46.39

- $NIO 6/17 30c > 23.86

Remember this trades are based on monthly triggers, so not only for the upcoming week, keep that in mind.

Recap of 3/27 SundaySwing

Last weeks #SundaySwing ideas:

Also swings are still currently hard to trade because of the volatility.

- $ORCL 5/20 87.5c - triggered and got stopped out, loss

- $PYPL 4/14 125c - triggered and reached 1st target, than dropped, profitable

- $LUV 4/14 45c - triggered and ITM, maybe roll out and over, see below

- $IWM 5/20 220c - triggered and reversed with market, not traded.

Disclaimer: Not advice, instead these are my ideas based on my knowledge analyzing the charts for possible swing trades based on #TheStrat. So please always do your own due diligence before entering a trade.

Chart setups

Since I keep getting questions about the colors in my charts and setups:

- I always chart in multiple time frames Monthly, Weekly, Daily, and 4-hour or 60min

- Purple lines last months high&low

- Orange lines last weeks high&low

- Blueish lines last day high&low

- Green lines are my targets

- Sometimes white and yellow for intermediate targets or 50% rule setups

- The brownish-boxes on the Daily and 4-hour chart you see sometimes show a gap that hasn’t filled yet.

If some of the broadening formation lines looking a bit curved, it’s because I changed the charts to a logarithmic scale, but they are still accurate.

Outlook

As always, lets take a look at $SPY and $QQQ for a rough prediction of what I think the market will do next. Or course, it’s just my interpretation, so keep that in mind!

$SPY

Conflict in times here but monthly 2u in April and we’re currently trading more in the upper range for a possible 2u-2u Continuation. However, the last week closed green but with a shooter-like candle and Friday has a red hammer-style candle. So lots of conflicts in here, no real prediction, could run in both directions, for now.

$QQQ

As written last week:

…$QQQ is a 2d green month and is already way above the Monthly 50% Rule trigger at 344.18. To get an outside month the target is 370.10 and this is possible

And $QQQ delivered and hit it’s target to go outside and after it hit it’s target it immediately reversed, so that’s why targets are so important to take profits.

Same conflicts as $SPY mentioned above, weekly shooter but green and month, obviously insight for now, but also closer to the upside trigger.

Profits and Stops

I usually target around 25-40% of profits on those swings and decide during the market hours if I leave a runner on a position or close the entire one.

To view the charts in full detail, click to open them in a new browser window.

$PDD 4/14 39p < 41.69

Starting with this short-term swing first, because Put may work, but often only for a short amount of time, so I will watch my targets here exactly and not risk a reversal.

I rewrote this section, because initially the idea was a 2u-1-2d Bearish Reversal Weekly below 39.84. But than I saw that this trigger is also the target from the Daily chart.

Since $PDD closed with a 2u red on Friday, the idea is an earlier entry for a possible 2u-2d Bearish Reversal on the Daily.

If this works out and hits the first target at 39.84, this than triggers the first idea, the 2u-1-2d Bearish Reversal Weekly below 39.84. Target is 38.50 and with the 4/14 expiration there is a bit of time left.

FTFC is down for extra confidence.

$AAL 6/17 20c > 18.45

The $AAL trade from a few weeks ago that is still valid with the 5/20 expiration. So this is not a copy&paste here.

The idea for this longer-term trade is a 1-2d-2u RevStrat Monthly above 18.45. Since the contracts are cheap and move slow for $AAL, I go with the 6/17 expiration and holiday season upfront, my confidence is high that this strike goes maybe ITM. Targets are all on the monthly 19.11, 19.76 and if all works in my prediction 20.16 as next and finally 20.56 (both from the weekly chart, because monthly would be to far away).

$LUV 6/17 50c > 46.39

Another airline, holiday season, re-opening. So I’m convinced that they should have some gas in thetank to take off. The 6/17 also has plenty of time and contracts aren’t that expensive.

The idea on $LUV is a 2d-2u Bullish Reversal Monthly above 46.39. My targets are 47.74, 48.31 and 49.38. The ladder two are from the weekly chart, because the next #TheStrat-like target on the monthly chart would be 52.79, th high of November ‘21, not sure if $LUV trades up into that. But for the fun, I marked it on the chart.

$NIO 6/17 30c > 23.86

I posted on Friday about a possible $NIO longer swing setup because of the green open, but we reversed a bit during the day and the monthly trigger is not that near, but I still think that $NIO might trigger above 23.86 the 2d-2u Bullish Reversal Month. This is also a PMG setup on the month, so the 6/17 contracts buys some time here and the 30c might get ITM if this trade works out.

Targets are 26.40 and 33.80. So a 6/17 25c might also be an option here.

As always, no trigger no trade and stick to your stops, we might see a reversal or a larger pullback before we run higher.

With that — thanks for reading!

Have a nice green successful week!