My #SundaySwing ideas for the week of 2/14 based on #TheStrat

The volatility we had the last couple of weeks are wonderful to trade, but also make it hard to collect a #SundaySwing list of trade ideas for a longer time frame.

Earnings season Q1 of the big tech companies is almost over, but we have other things affecting the markets heavily in the next couple of days and weeks. So be prepared to constantly adapt to the changed situation and change you mind from bear to bull and back again on a daily basis if necessary.

TLDR;

For this issue I focus on strong stocks of a sector that kept going up, Energy!

- $COP 3/18 100c > 94.33

- $DVN 3/18 60c > 54.15

- $KMI 3/18 18c > 17.63

- $SU 3/18 30c > 30.25

Recap of 2/6 SundaySwing

Not a good start into the week for my selected tickers from the 2/7 #SundaySwing list.

So far, $X is going in the direction and has triggered, $PEP is also triggered to the downside but not where I want it to be for a first target.

While $DKNG and $BYND both started strong in the complete other direction and didn’t even gave an entry. But this is not a negative thing, no trigger - no trade - no money lost!

Disclaimer: No advice, instead these are my ideas based on my knowledge analyzing the charts for possible swing trades based on #TheStrat. So please always do your own due diligence before entering a trade.

Chart setups

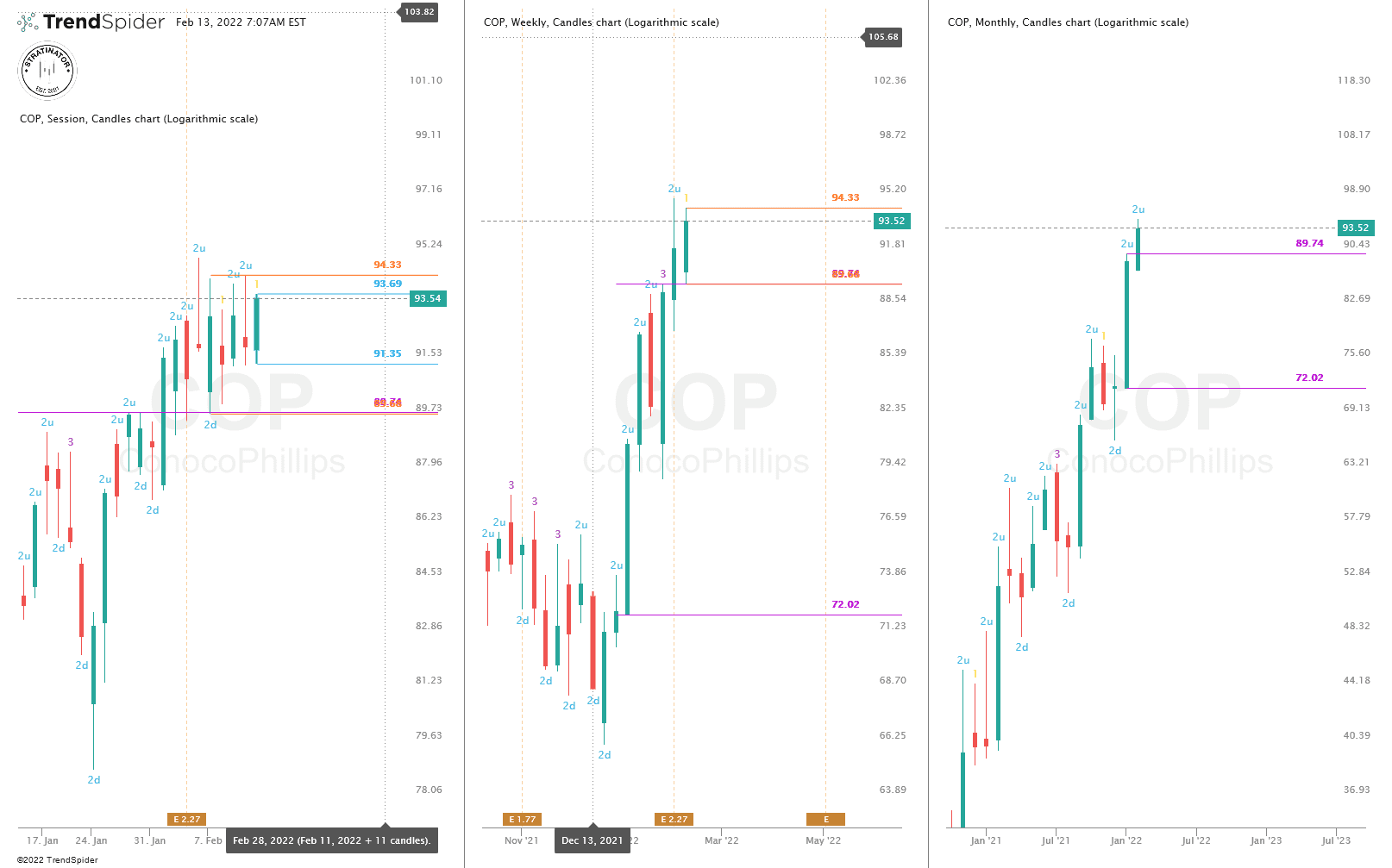

Since I got always questions about the colors in my charts and the setups:

- I always chart in multiple time frames Monthly, Weekly, Daily, and 4-hour or 60min

- Purple lines last months high&low

- Orange lines last weeks high&low

- Blueish lines last day high&low

- Green lines are my targets

- Sometimes white and yellow for intermediate targets or 50% rule setups

- The brownish-boxes on the Daily and 4-hour chart you see sometimes show a gap that hasn’t filled yet.

If some of the broadening formation lines looking a bit curved, it is because I switched to logarithmic scale on the charts, but they are still correct.

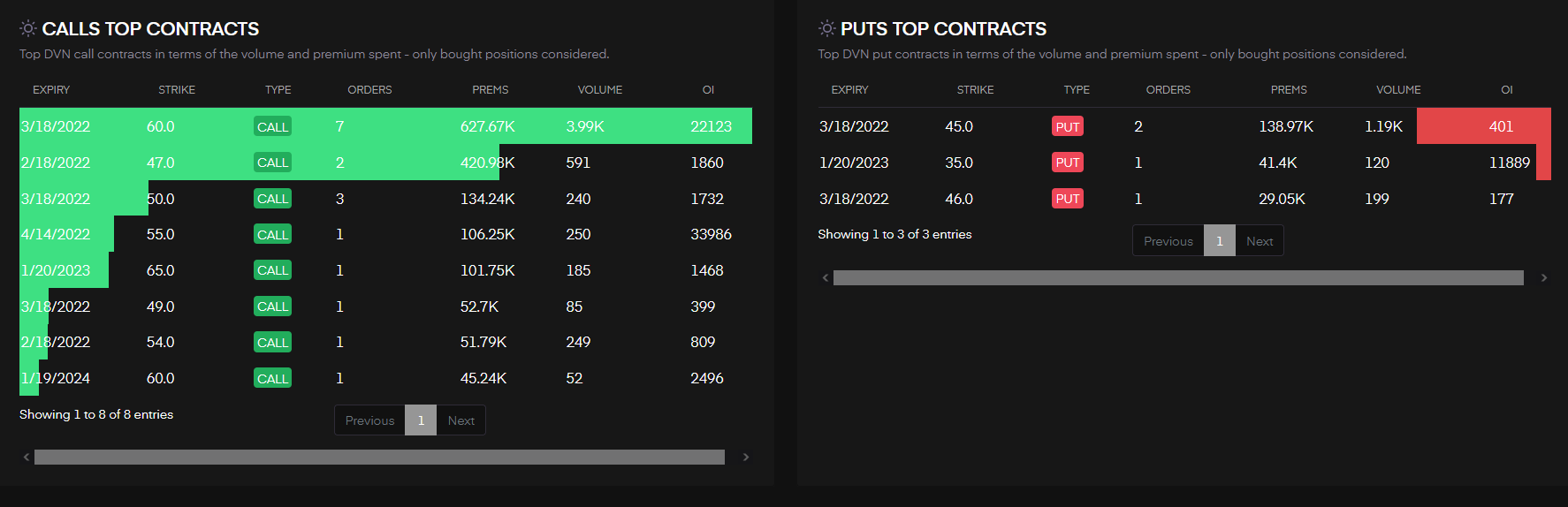

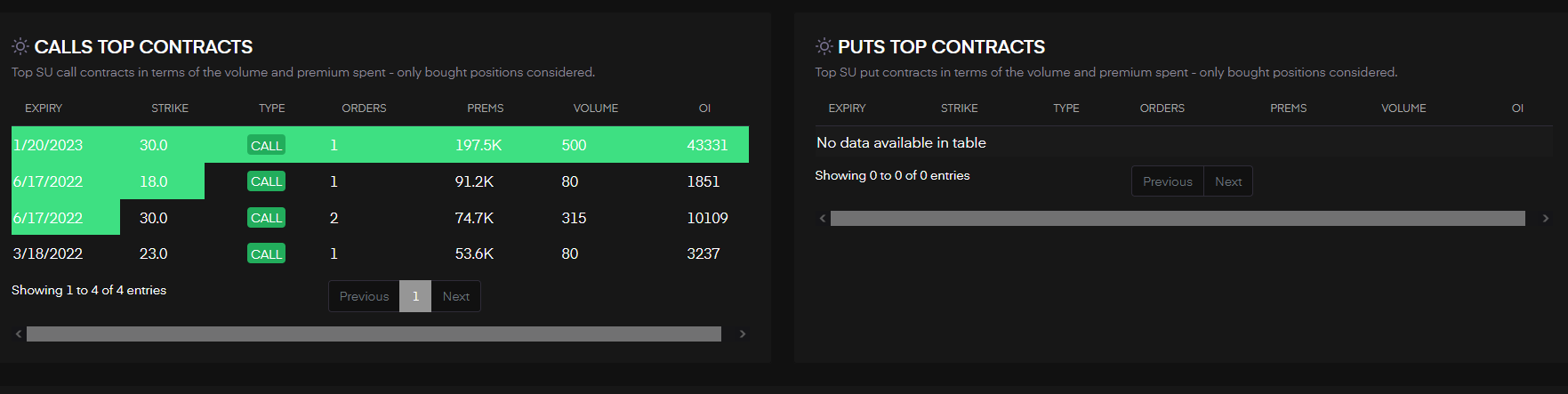

Flow info from Tradytics

I’m adding Tradytics screenshots for additional confirmation of my strikes. The link to Tradytics is a referral link, so if you find that service helpful and want to try it for yourself, I would appreciate it, if you use that link to support me.

Outlook

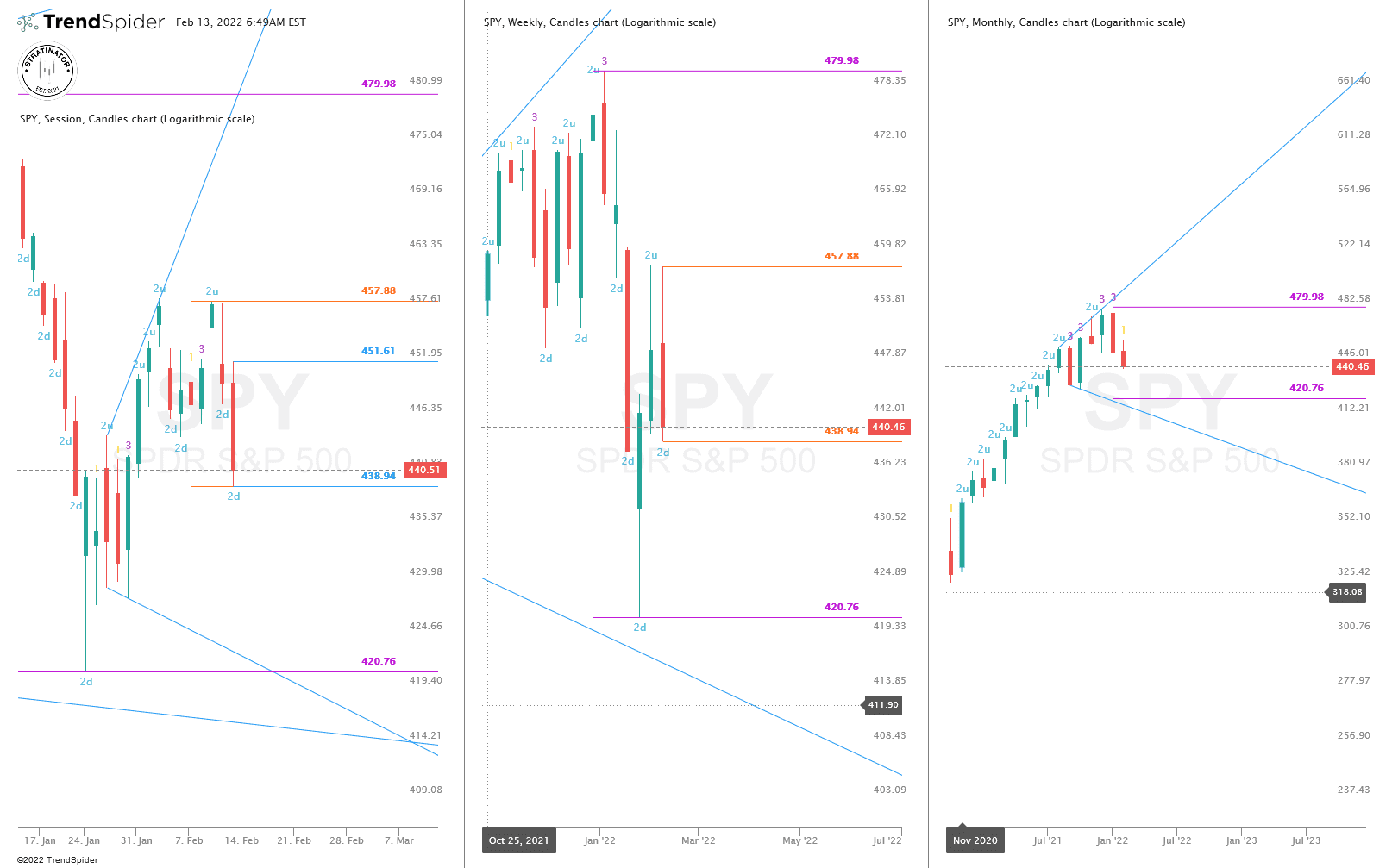

As always lets have a look at $SPY and $QQQ for a rough prediction of what I think the market will do next. Or course it’s just my interpretation, so keep that in mind!

$SPY

As last week, $SPY still is choppy because the month is still inside and no chance to change this anytime soon. It would need 479.98 for a bullish breakout, or 420.76 for the bearish trigger. As of Friday, 440.46 is much closer to the bearish trigger to me. So I have my Bear-pants on and watch the price action every day.

The only short-term target, if we break the low of last weeks 2d 438.94, the next target might be 427.82 from the daily.

$QQQ

Inside month on $QQQ as well but even closer to last months low of 334.15. The week was 2d and read with nearly no lower shadow, so I expect another 2d below 345.80. My projected target short-term would be 337.95 if we break the low.

Profits and Stops

I usually target around 25-40% of profits on those swings and decide during the market hours if I leave a runner on a position or close the entire one.

To view the charts in full detail, click to open them in a new browser window.

As you notice below, I’m going out to the March 18th expiration which gives me ~6 weeks of time if one of the stocks triggers this week and I’m suprised how “cheap” some of the contracts are compared to the tech stocks.

$COP 3/18 100c > 94.33

Strict alphabetical order, beginning with $COP. FTFC is up and $COP caught my attention because of an inside week and an inside day on Friday. The idea here is to get in on the 2-1-2 Bullish Continuation on the weekly above 94.33. I watch the market on Monday and maybe even get an early entry on the 2-1-2u Bullish Continuation Daily above 93.69.

The only thing I’ve to watch for is, that $COP trades at ATH, so there is the risk of exhaustion and I will have set my stops tight when I enter that position on a trigger.

There are no clear targets because of ATH, which is the only difficult thing here to trade, so I will resort to my tried and tested method and target the 30-40% profit and then see what the market does.

Since $COP is not the typical option trade for me, neither it is for Tradytics. I looked the Options Dashboard up for $COP and there is not much information available to get additional information from.

$DVN 3/18 60c > 54.15

Another inside week, $DVN might trigger the 3-2-2u Bullish Continuation above 54.15. First target is 55.44 from last week and then… we do some time traveling here, the next target of 59.80 is back from July 2015! Not a typo and since the energy sector is strong the 60c might go ITM in the next weeks if $DVN still runs with the sector. I don’t really need to mention that $DVN has FTFC to the upside.

$KMI 3/18 18c > 17.63

Slight bend of my rules that I normally don’t trade stocks that are below $20. But $KMI looks so tempting and is still on an inside month which I think will break to the upside and then it is really near to the $20 mark :-)

My entry trigger here is the weekly 1-2-2 Bullish Continuation with lots of targets to the upside, that’s why I think a continuation trade here is very likely and might be successful. The 18.20 as first target also triggers the month 2-2u Continuation. And even if it doesn’t trigger in Februray, the 3/18 contract has time so that a possible 2-1-2u Continuation Monthly for next month is a possibility. The target after 18.20 is 18.76 and then some more, but I’m eyeing on that as my exit. The 18c should be also very profitable if this happens with plenty of time before expiration.

Like $COP above, Tradytics has not much information on $KMI that is worth to show. As of now the 3/18 18c has 28k Open Interest, which is a lot and therefore liquid with only a $0.01 spread.

$SU 3/18 30c > 30.25

The last idea for the upcoming week is another 2-1-2u Bullish Continuation above 30.25, $SU, which has also FTFC up.

Since $SU is not a fast mover, I select the surprisingly cheap ITM 3/18 30c contract, which has plenty of time and my next targets are 30.51, 30.90 and maybe 31.94 as well as 32.48. The last two targets are back from January 2020.

But as you see, the 3/18 expiration has some flow and the 6/17 18c as well. So this would also be a possible contract but is to expensive for me.

That’s it for this weeks #SundaySwing issue. If you found some ideas or learned something from my thoughts, feel free to give me some feedback and share this post to help reach more audience and educate more people trading with #TheStrat.

Have a nice green successful week!