Whatever happens to Twitter, I prepared my Trade journaling Blog to be also available on #Mastodon now.

If you’re interested you can follow/interact via @rene@stratinator.com & @stratinator@mastodon.online

Whatever happens to Twitter, I prepared my Trade journaling Blog to be also available on #Mastodon now.

If you’re interested you can follow/interact via @rene@stratinator.com & @stratinator@mastodon.online

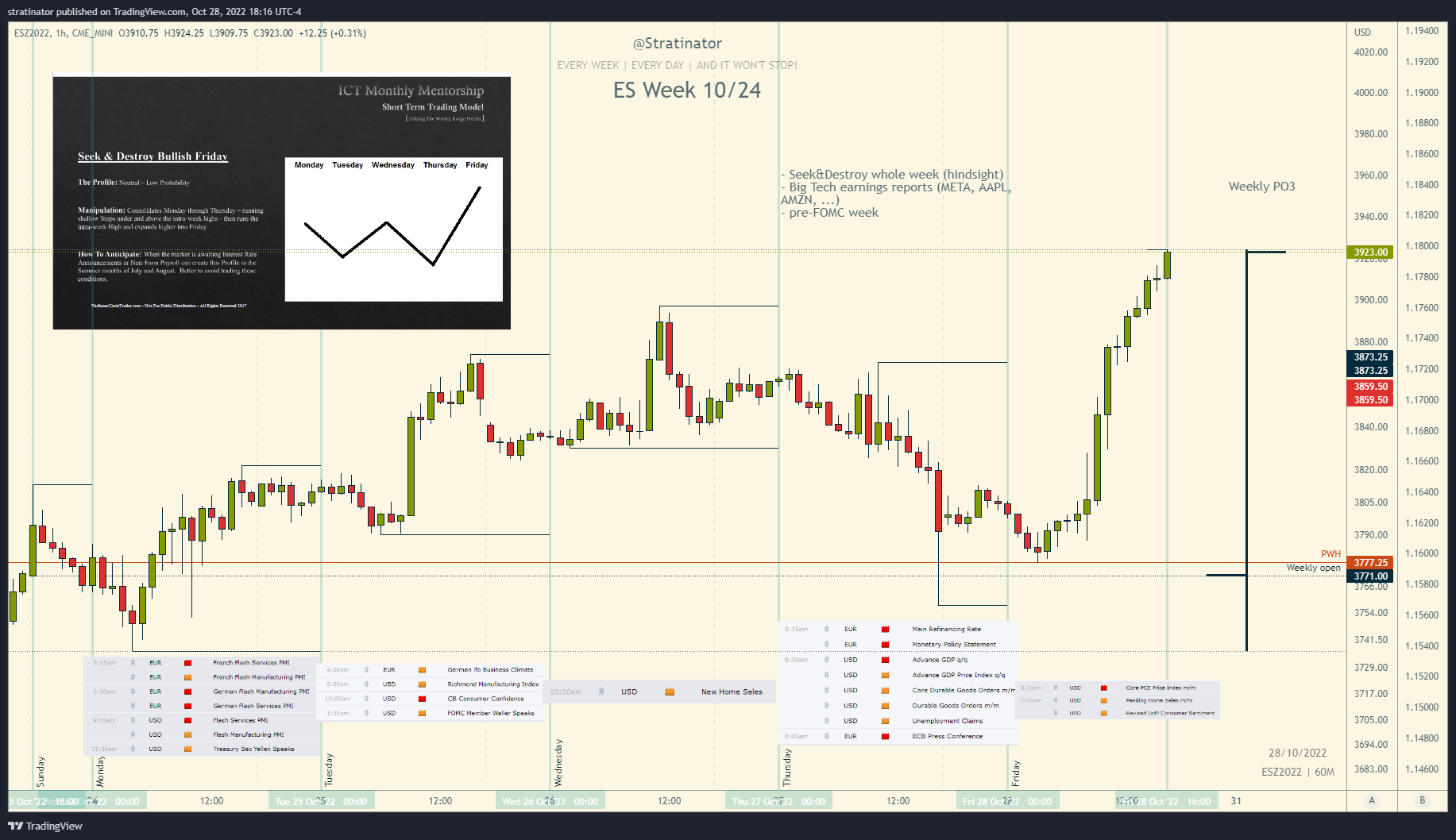

Sharing my end-of-week journal for $ES this time also here in public. This is what I add to my journal book for the overvall week.

All things come to and end, like our vacation in Croatia 🇭🇷 the last couple days/weeks, it was awesome. First visit and definitely not the last one.

Wednesday, September 7, 2022 →

Can’t complain and trust me, there is something like this when you look not at your charts 😉 🇭🇷

Enjoying life 🇭🇷

„Every action you take is a vote for the type of person you wish to become. No single instance will transform your beliefs, but as the votes build up, so does the evidence of your new identity.“ - @JamesClear (Atomic Habits)

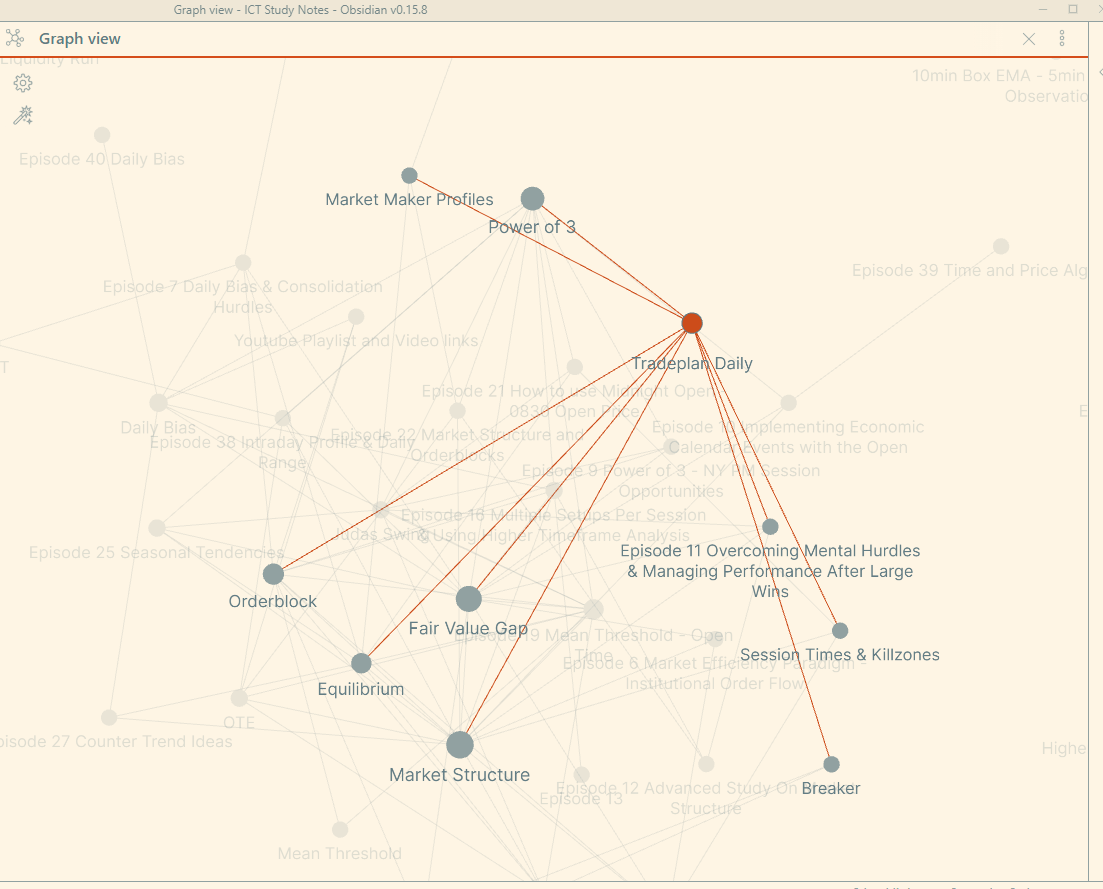

Instead of watching and trading $ES_F in the NY PM session today, I re-watched some #ICT episodes and fine-tuned my trading plan based on the backtests I did this weekend. 🤞 (Not all infos shown in that picture)

Enjoying the weekend with my son 🌴🏟⚽️ ✌️

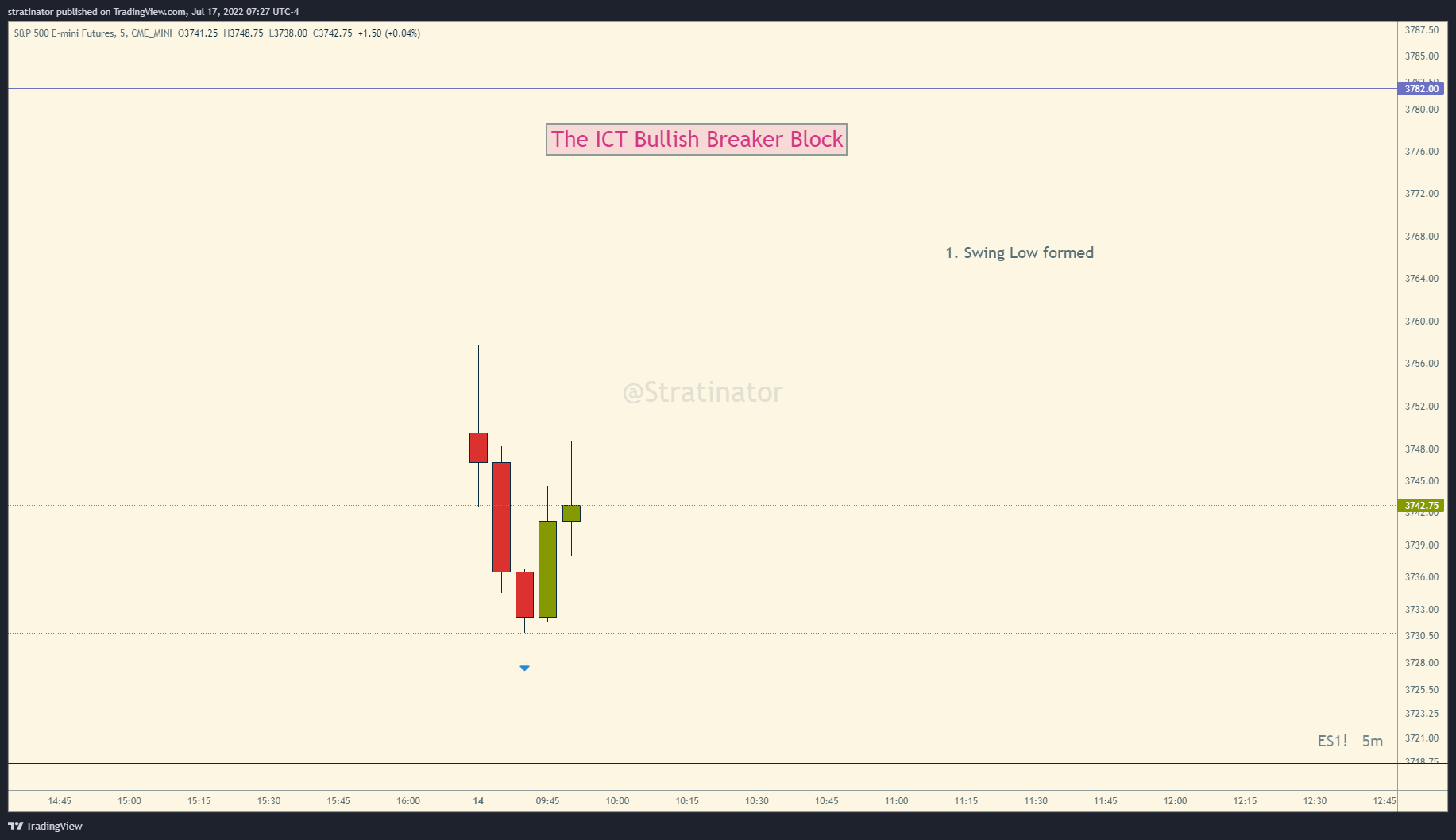

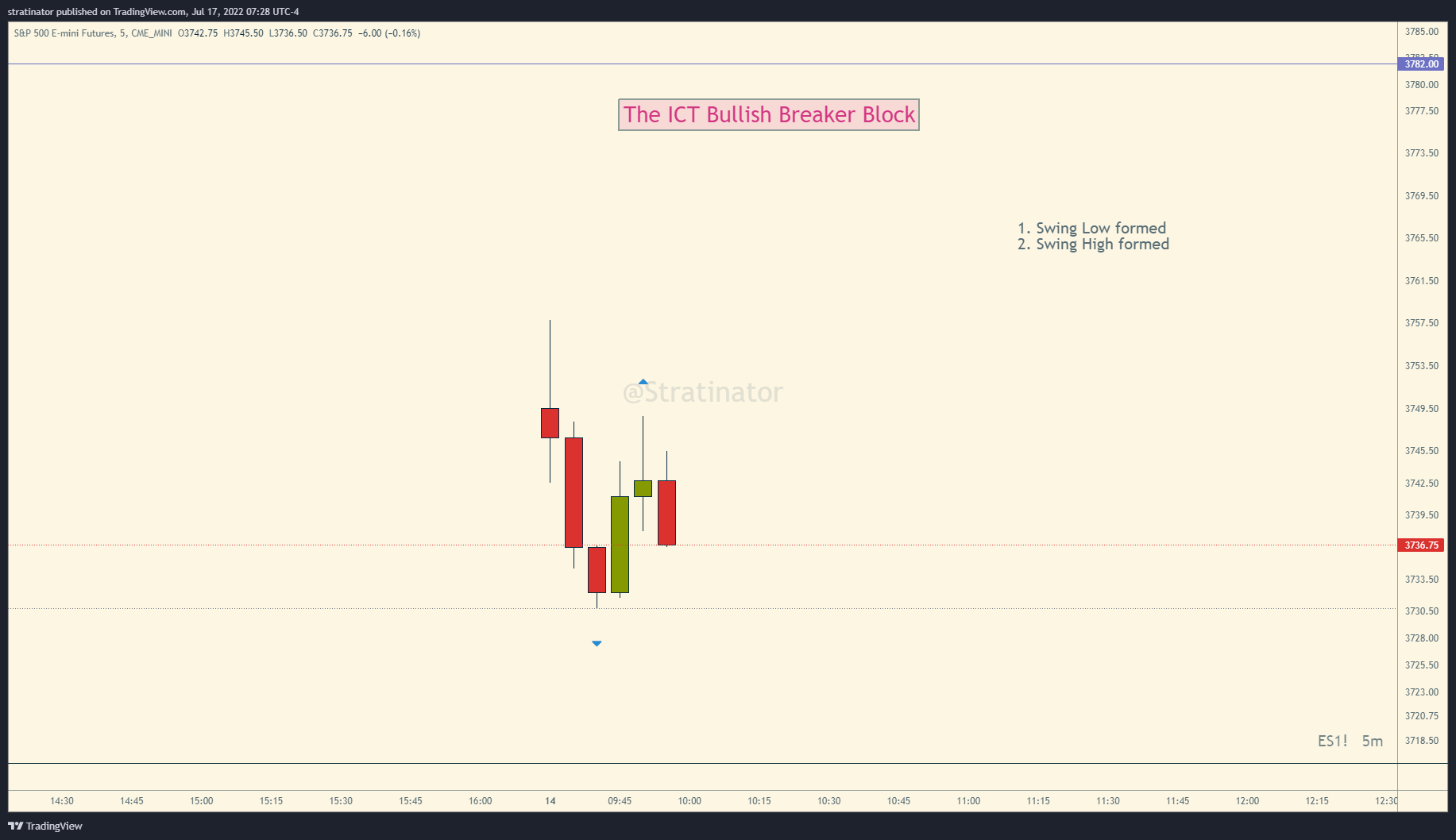

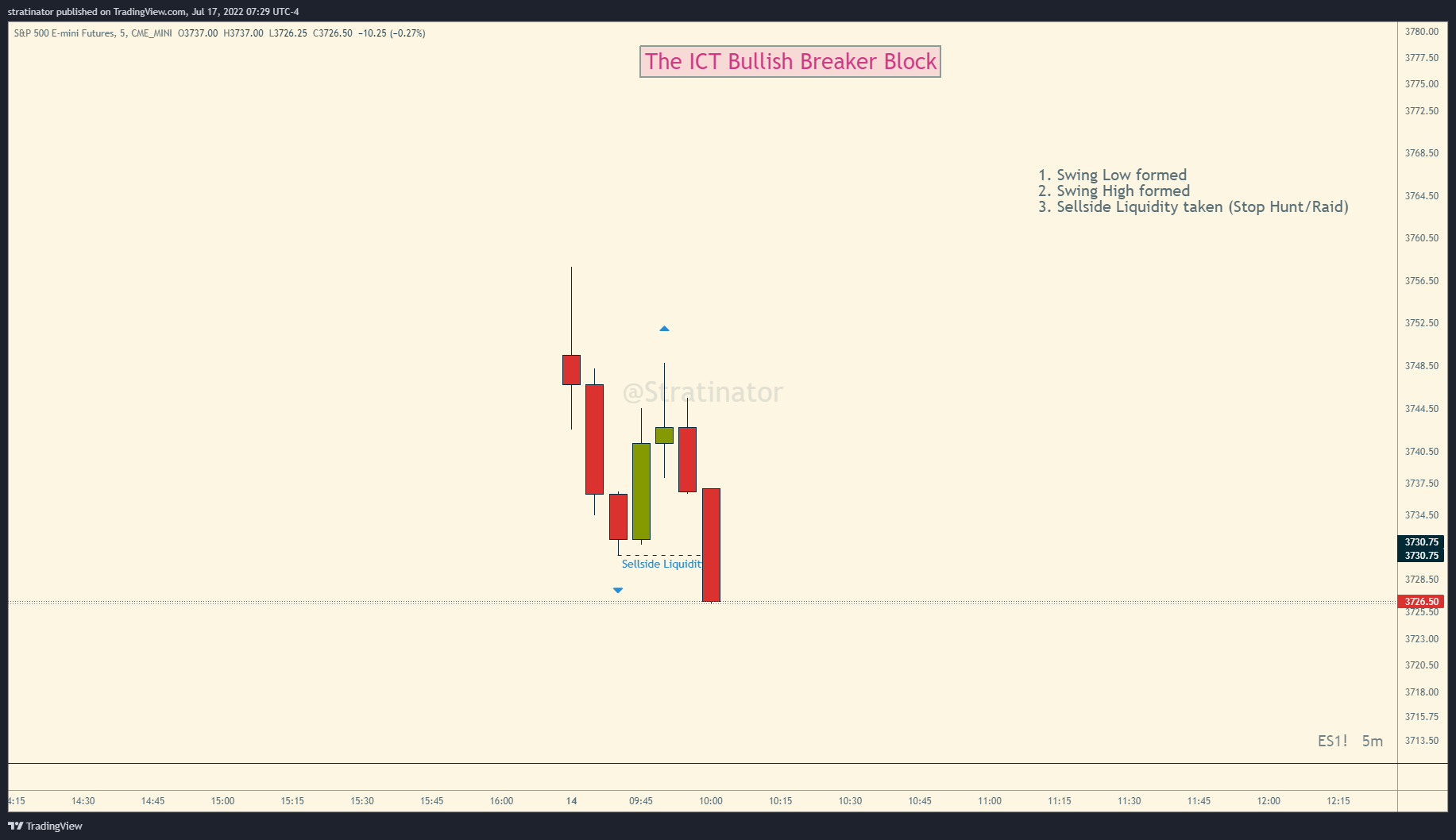

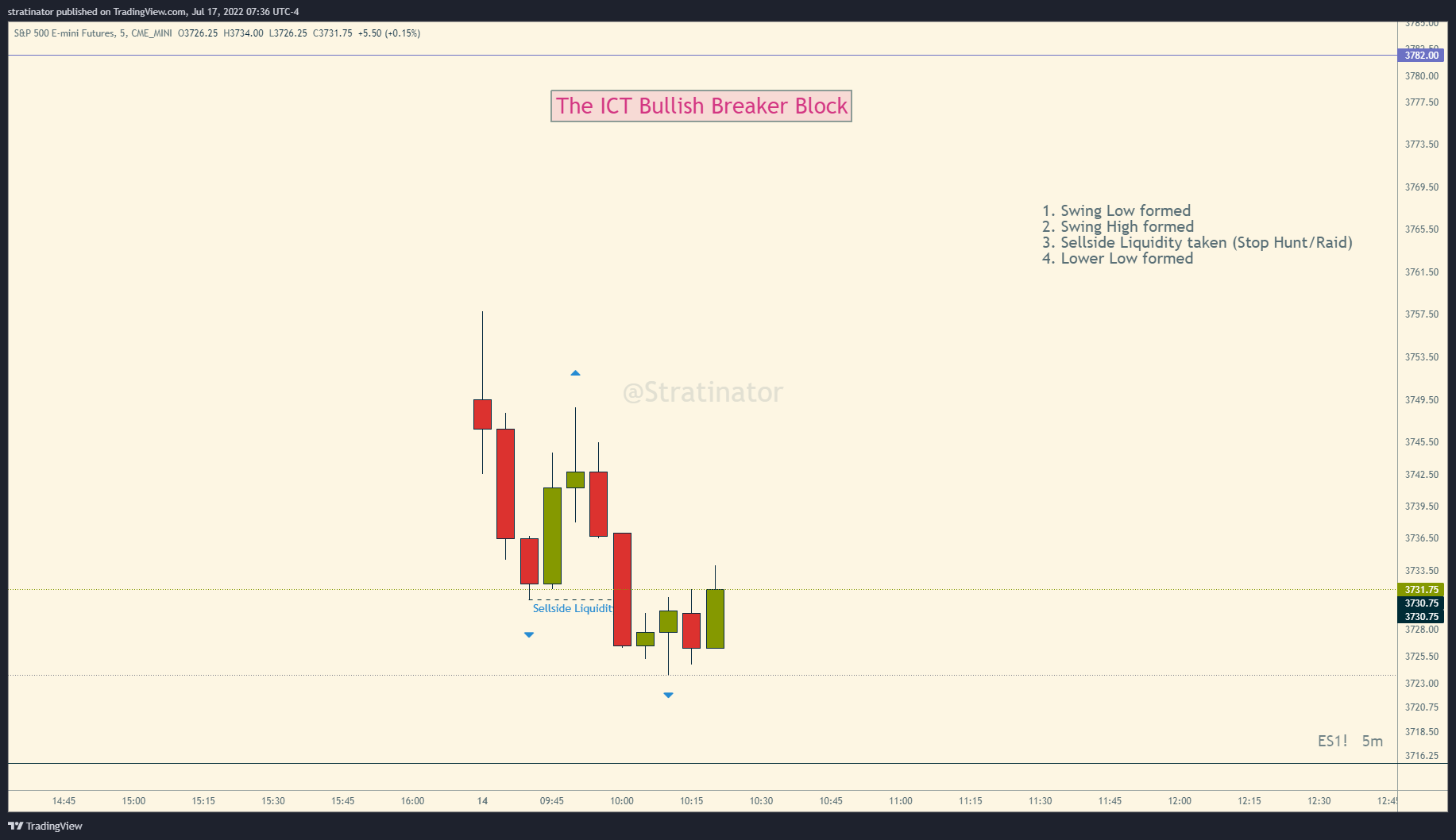

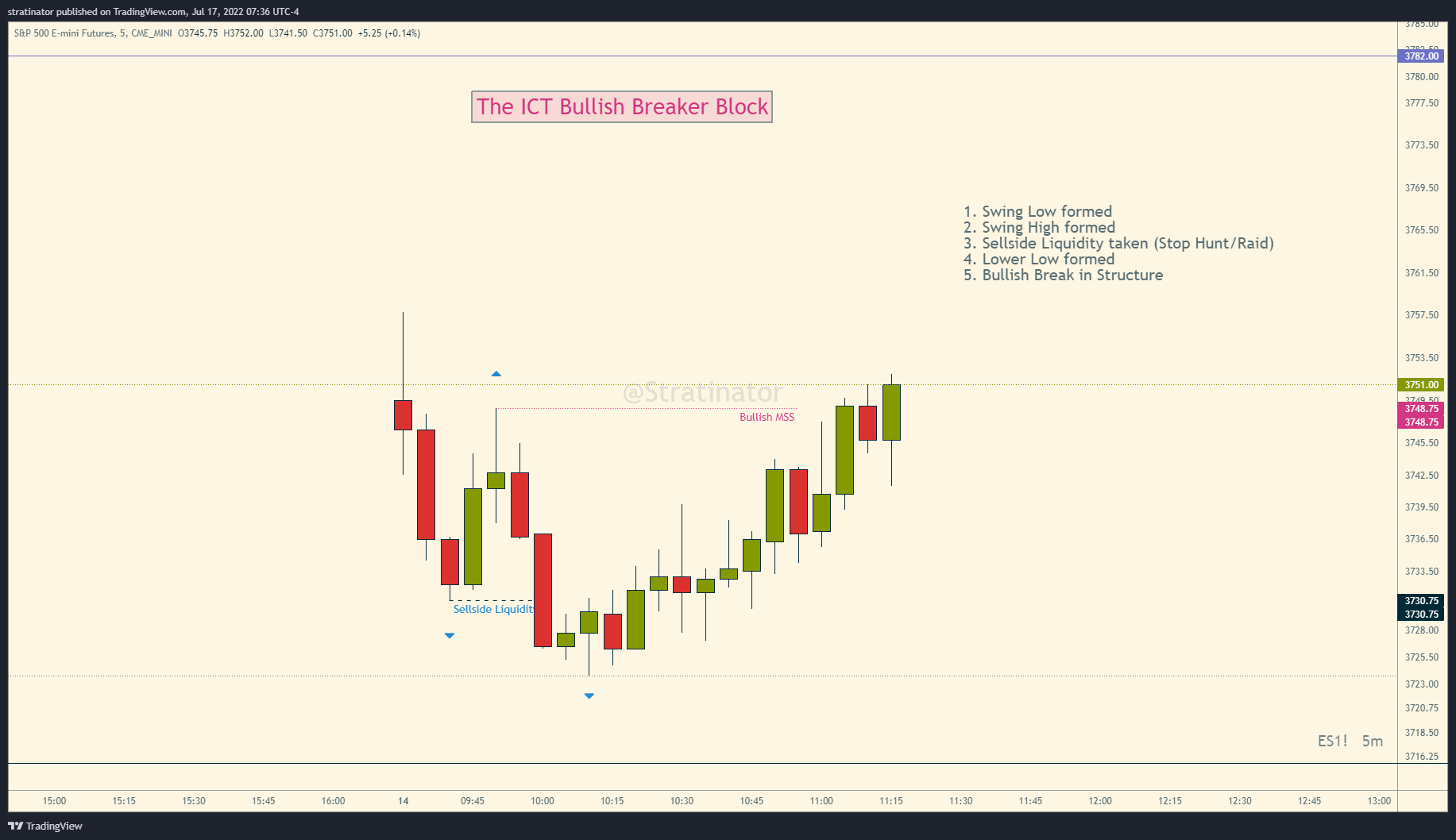

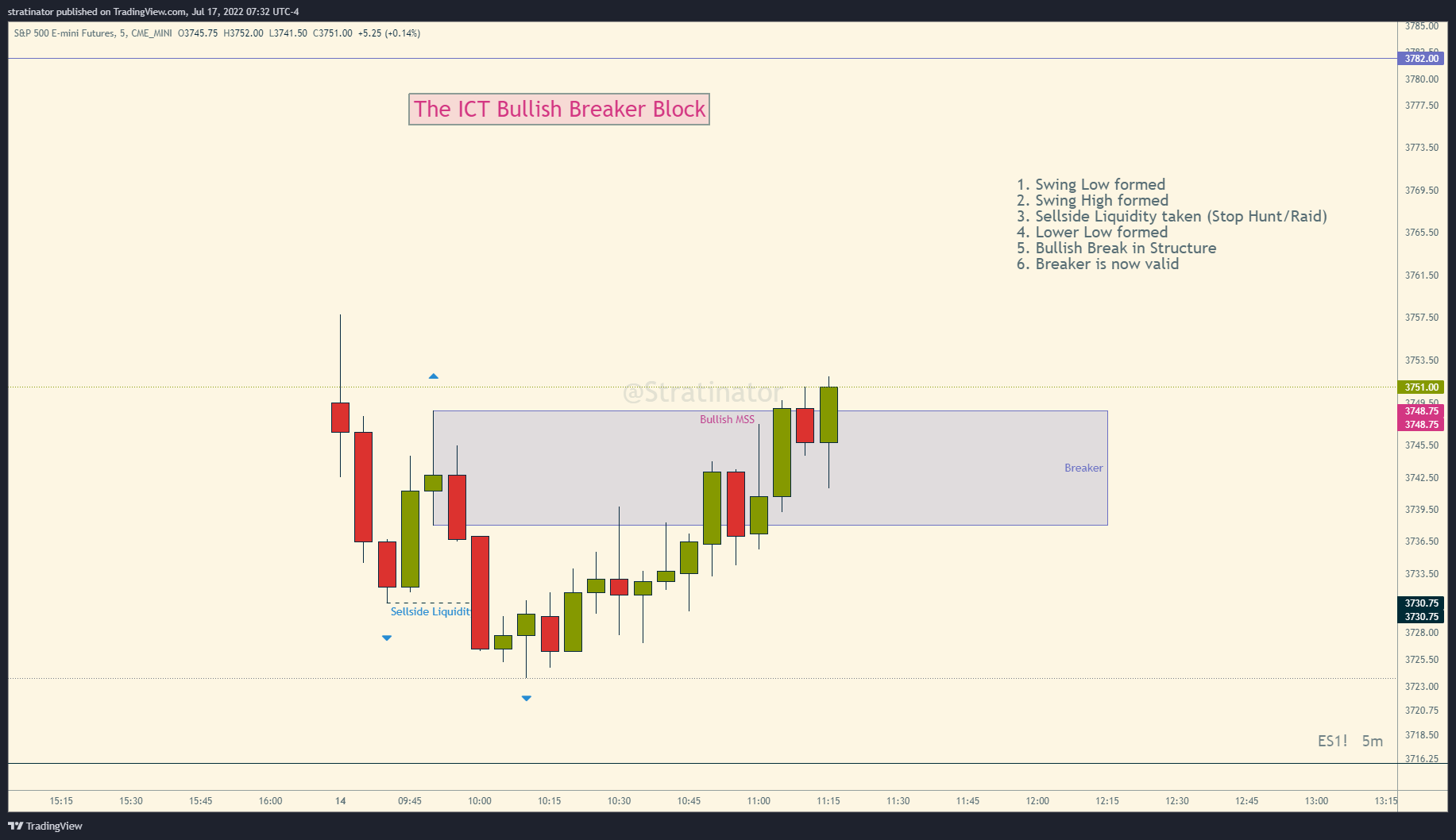

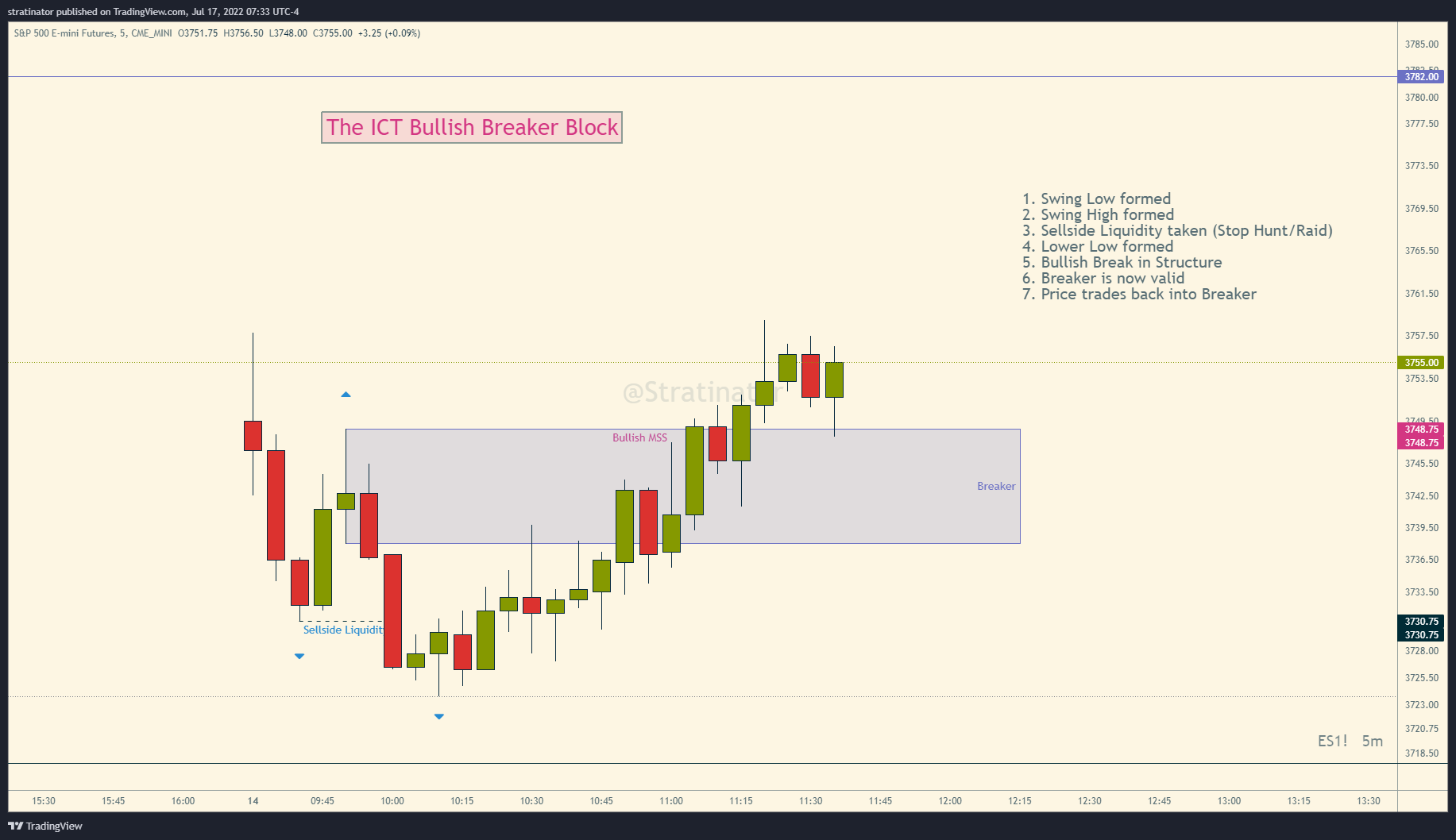

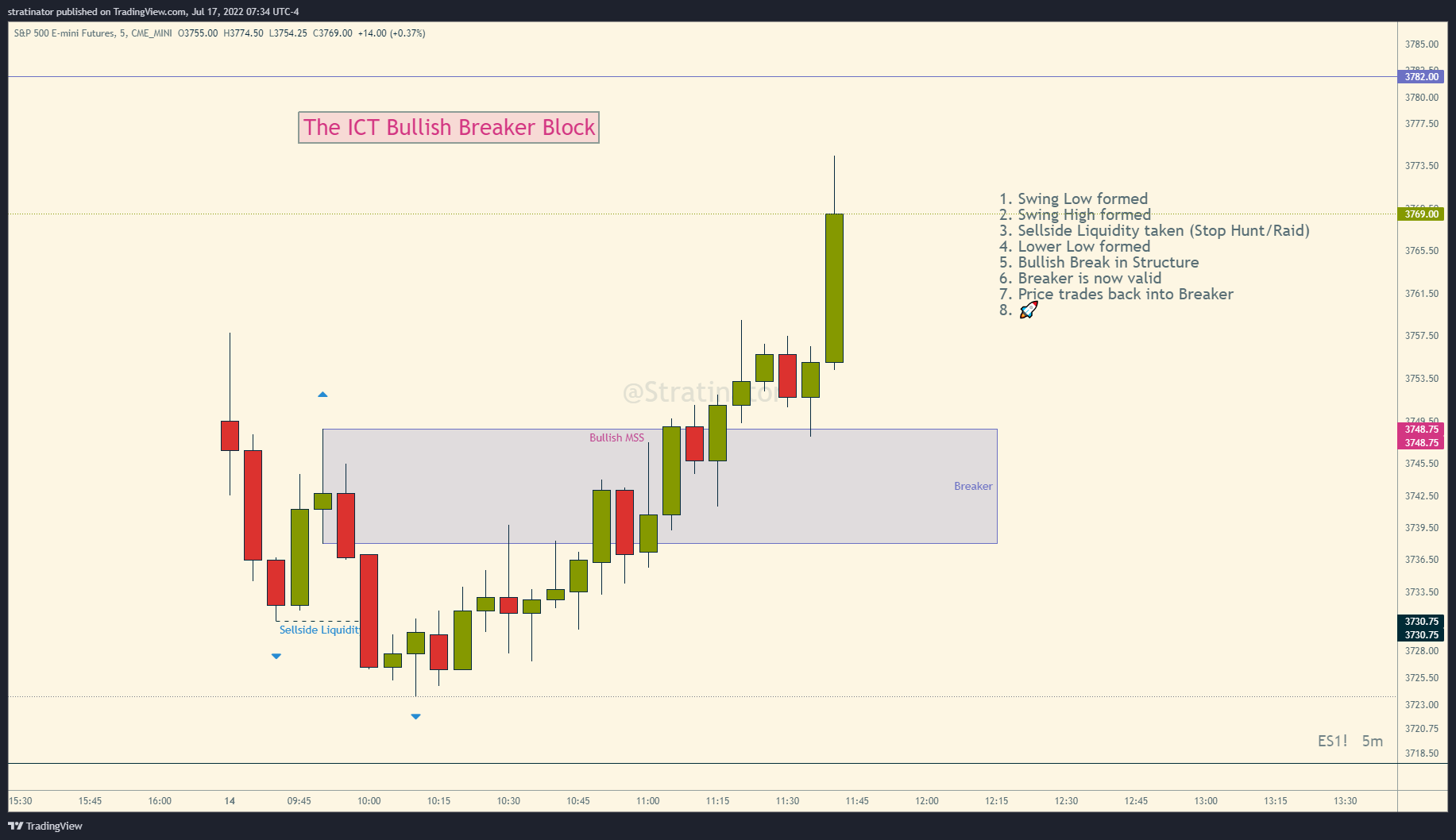

My version of identifying a Bullish Breaker.

Not all Breakers work!. Price can trade through a breaker and fail. Keep that in mind! Stops where invented for that 😉

Have a look at the images for a detailed description of each step.

Enjoying the weekend! I hope you too! 🍻(non-alcoholic for me 😉)

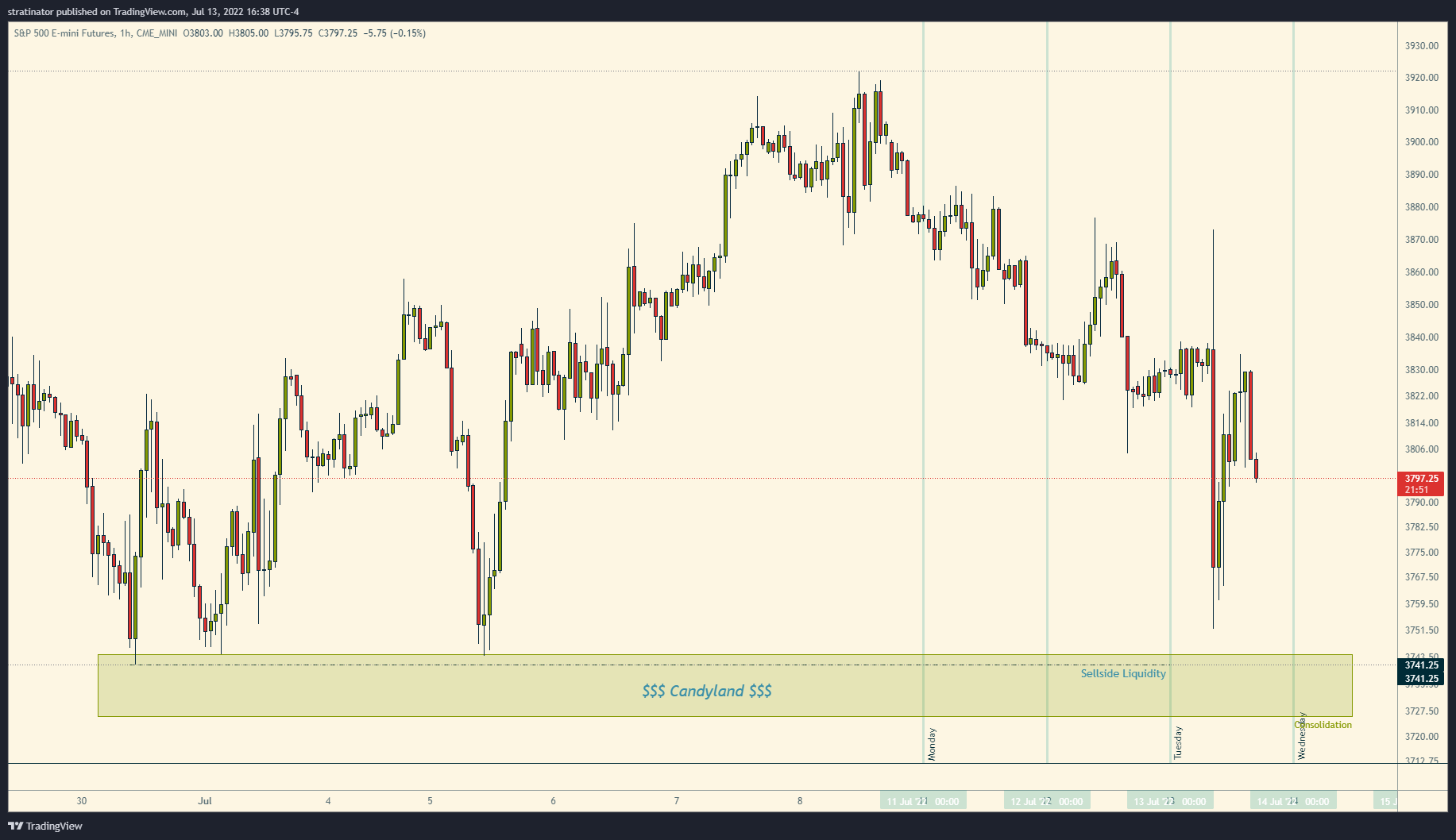

$ES_F 60min chart, there is more down there :-) #ICT

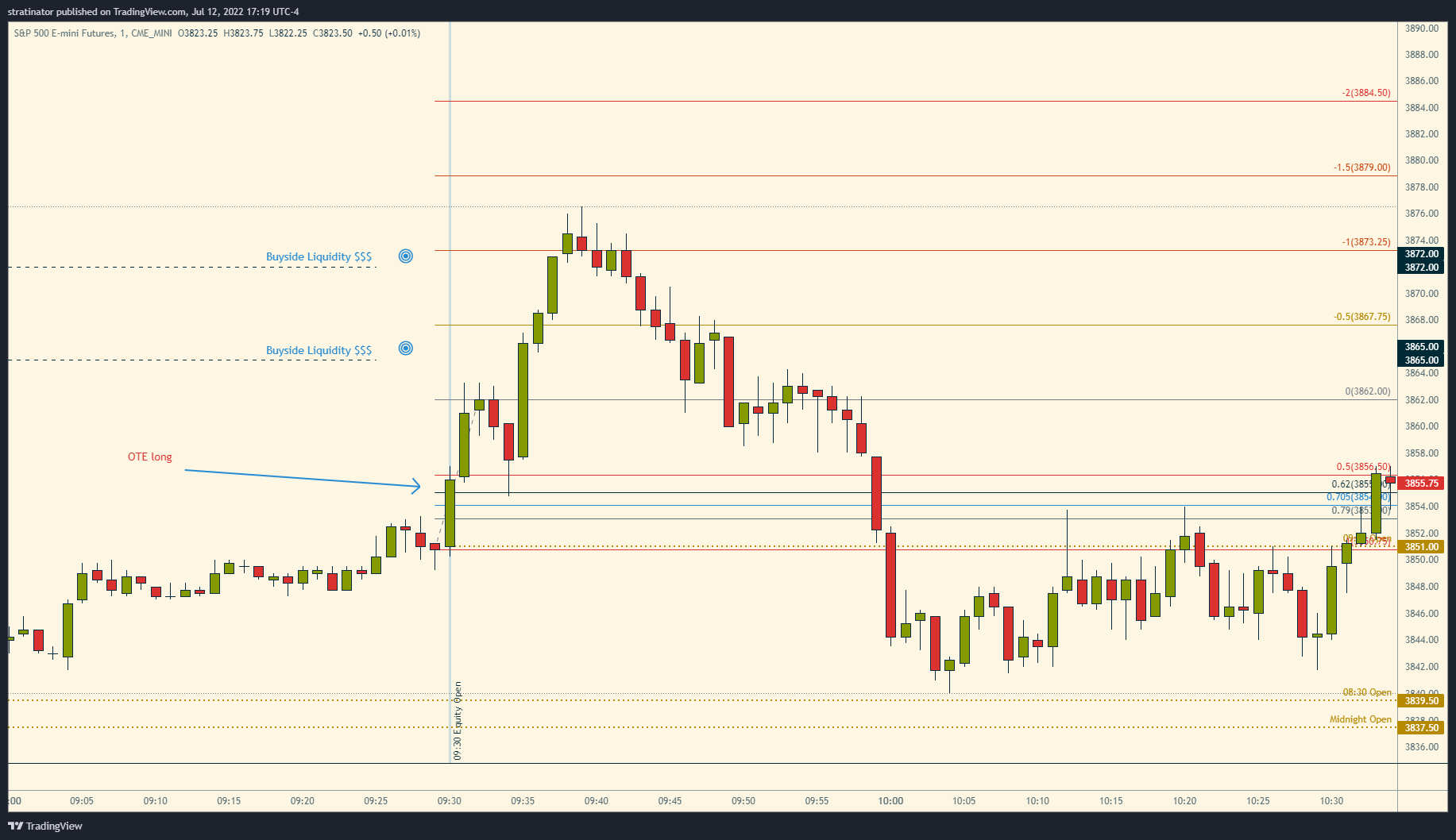

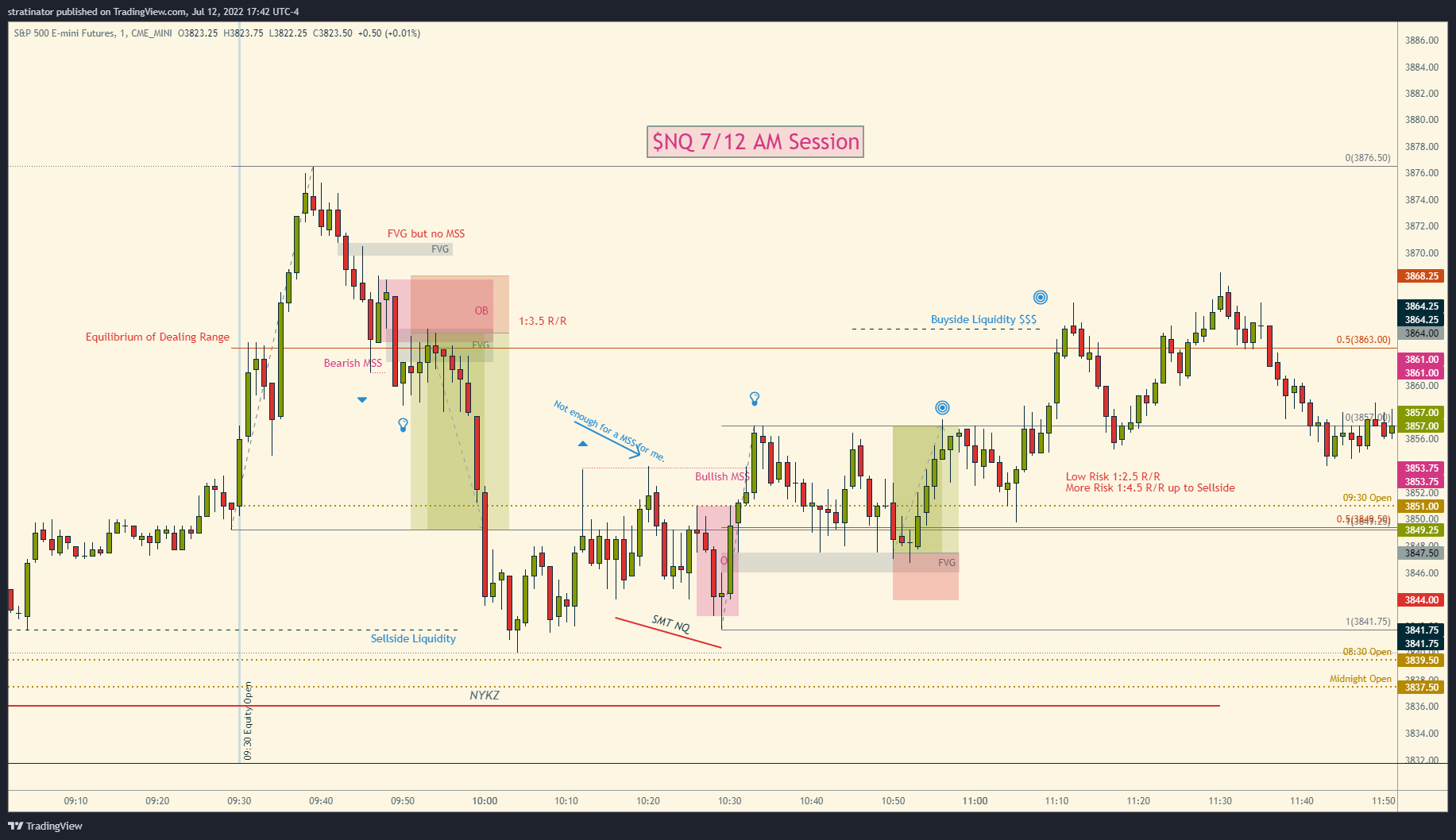

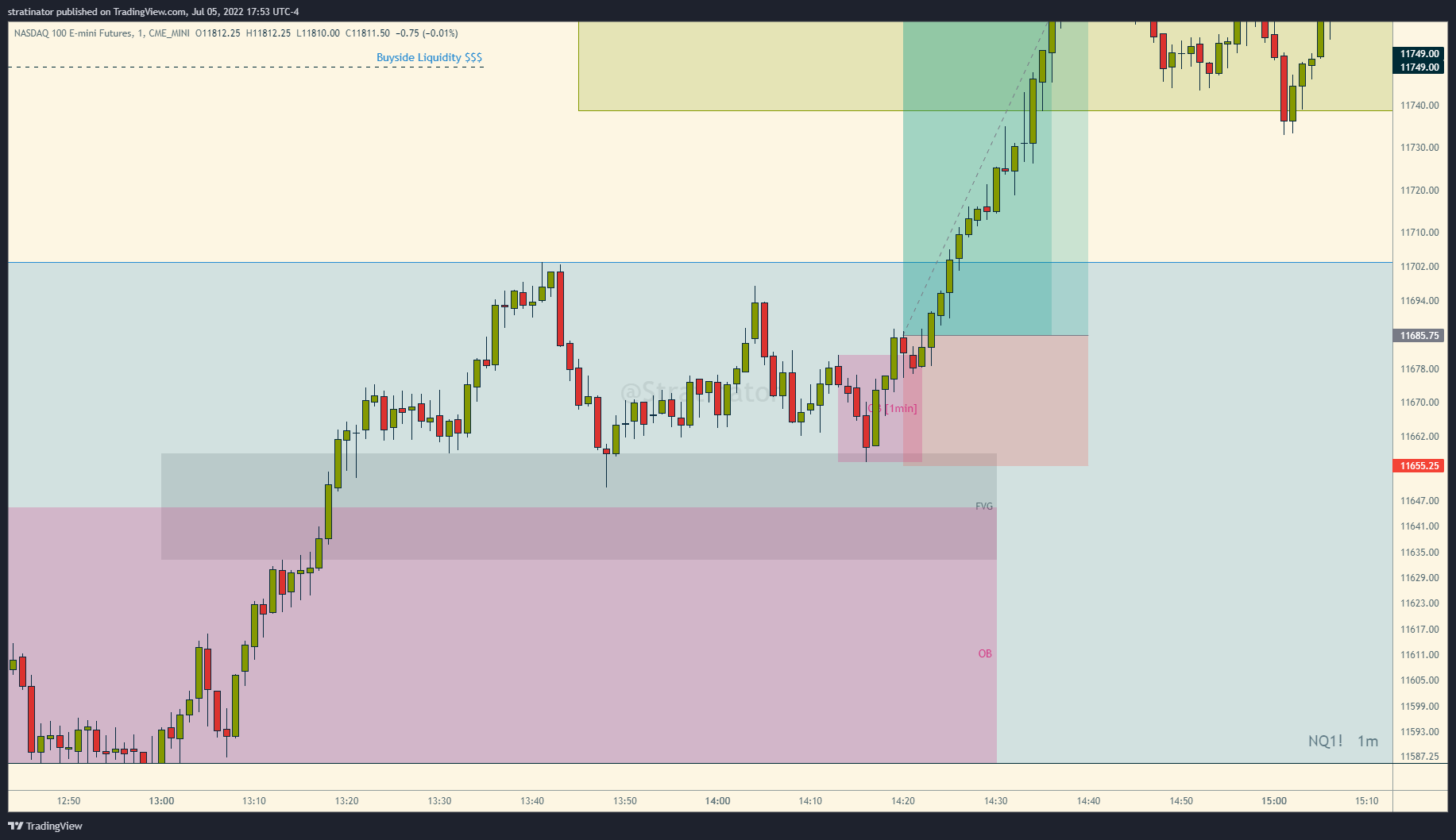

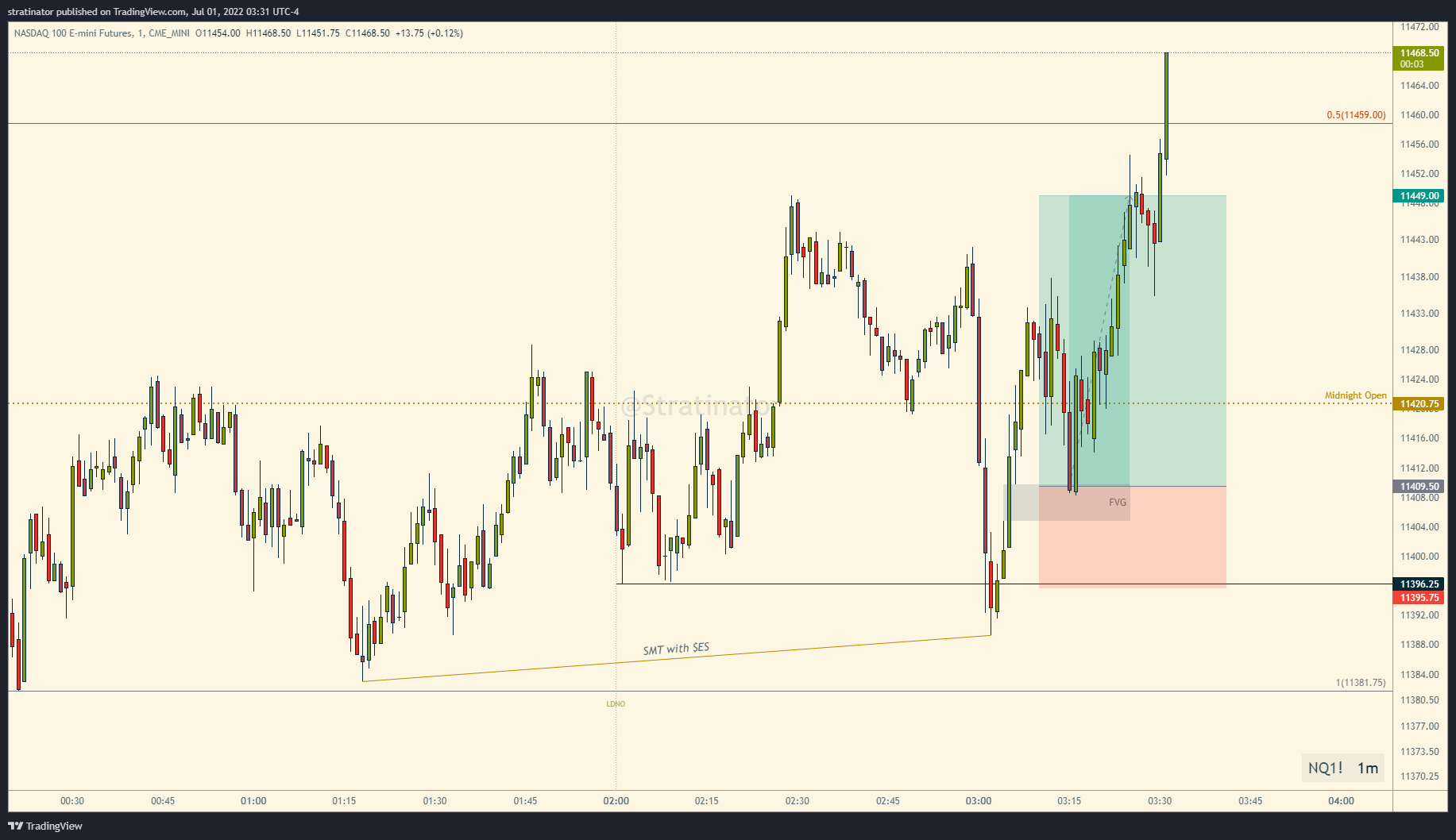

Hindsight $NQ_F AM Session

So many opportunities, I don’t need to take every trade.

1st Chart - OTE Long after EqO, targeting BSL

2nd Chart - Short Judas Swing Possible above Equilibrium & Long after Stop Hunt and SMT with $NQ FVG&OB setup

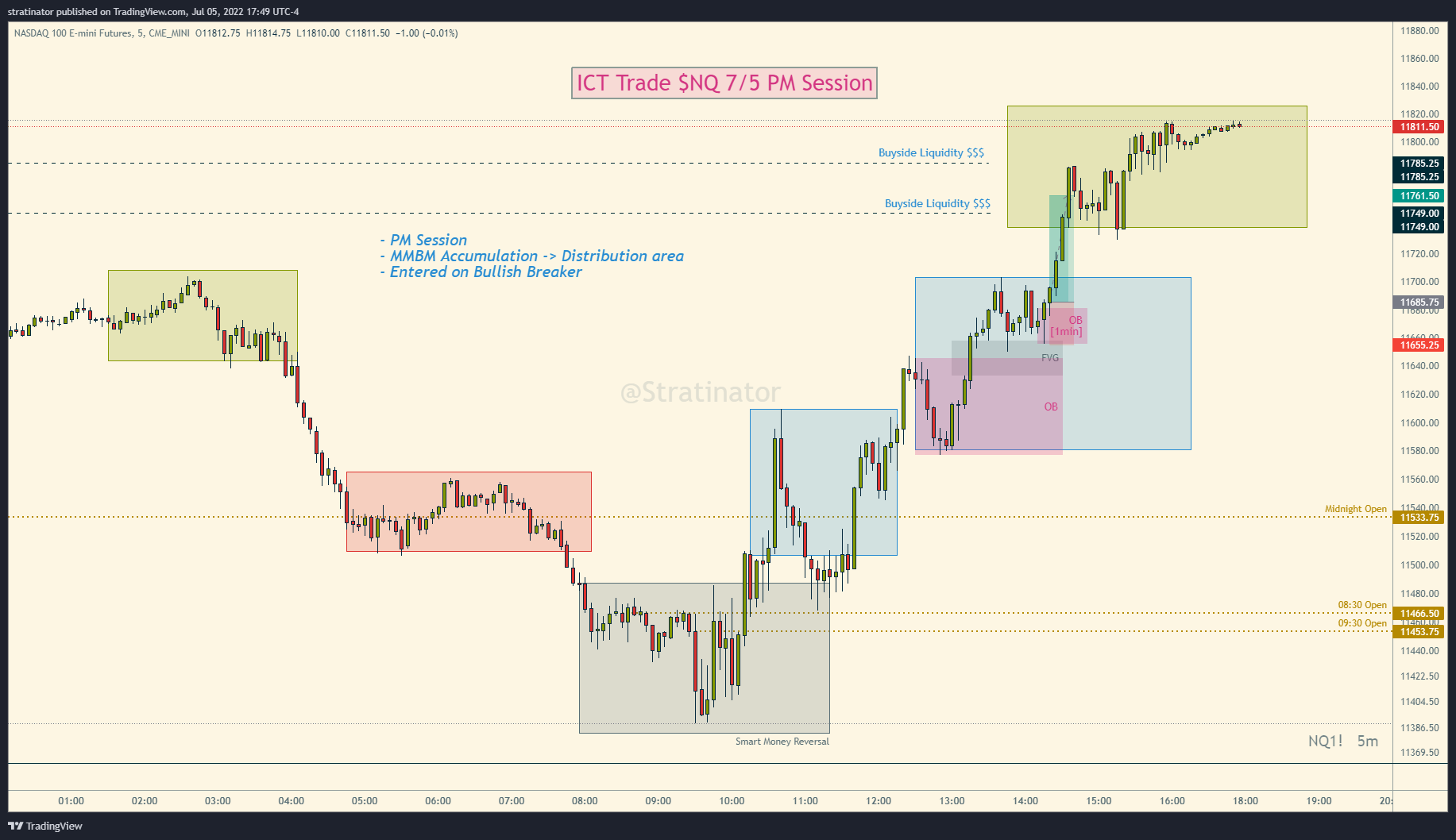

Hindsight $NQ_F PM session trade from #ICT today, annotated for my own study notes.

Tuesday, July 5, 2022

Good Morning, trying something new this month/week, maybe not what you expected but most of you might have seen that I switched to ICT methods and futures trading during the last couple of months. If you subscribed because of #TheStrat ideas and infos, I don’t think that I will and can provide them in the future, but if you’re interested in ICT and futures you can still be subscribed to my newsletter :-)

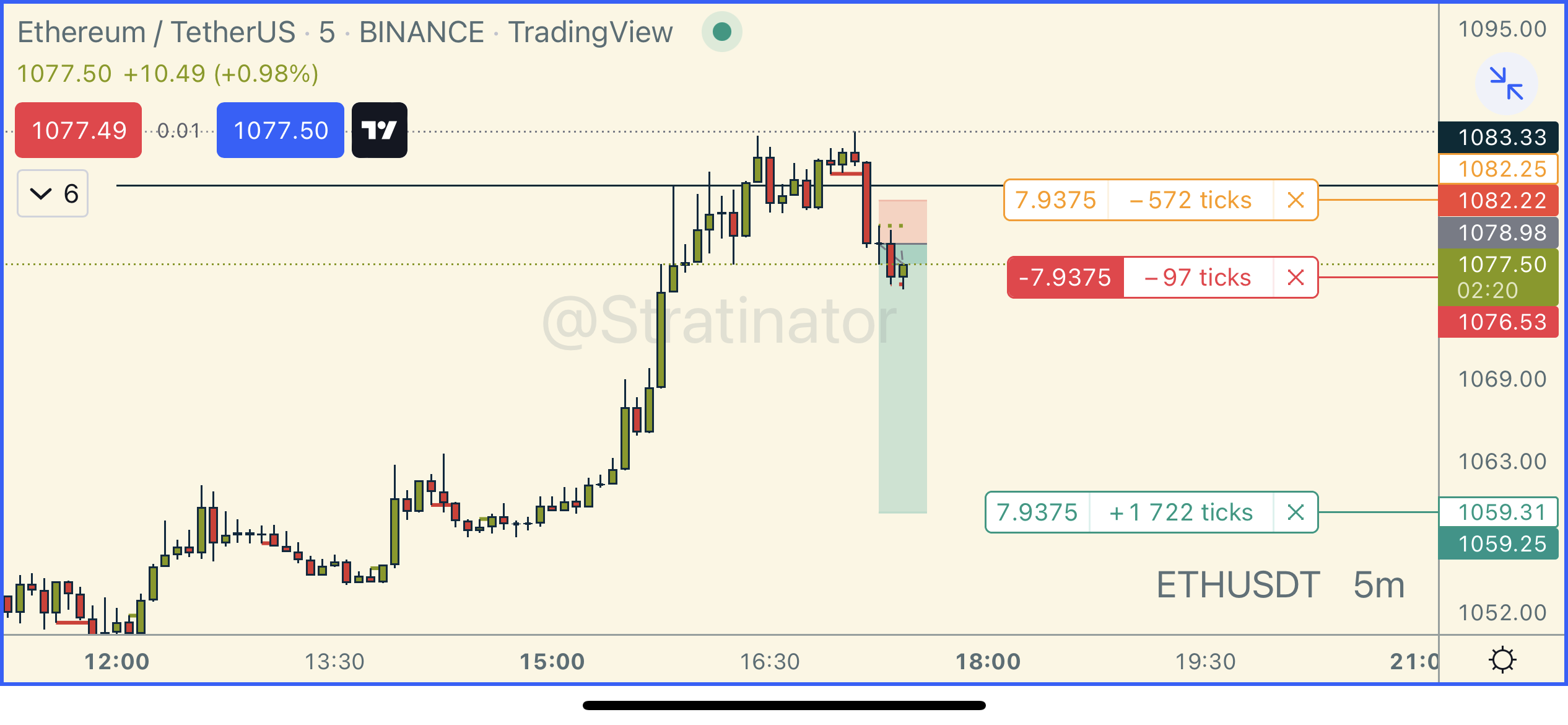

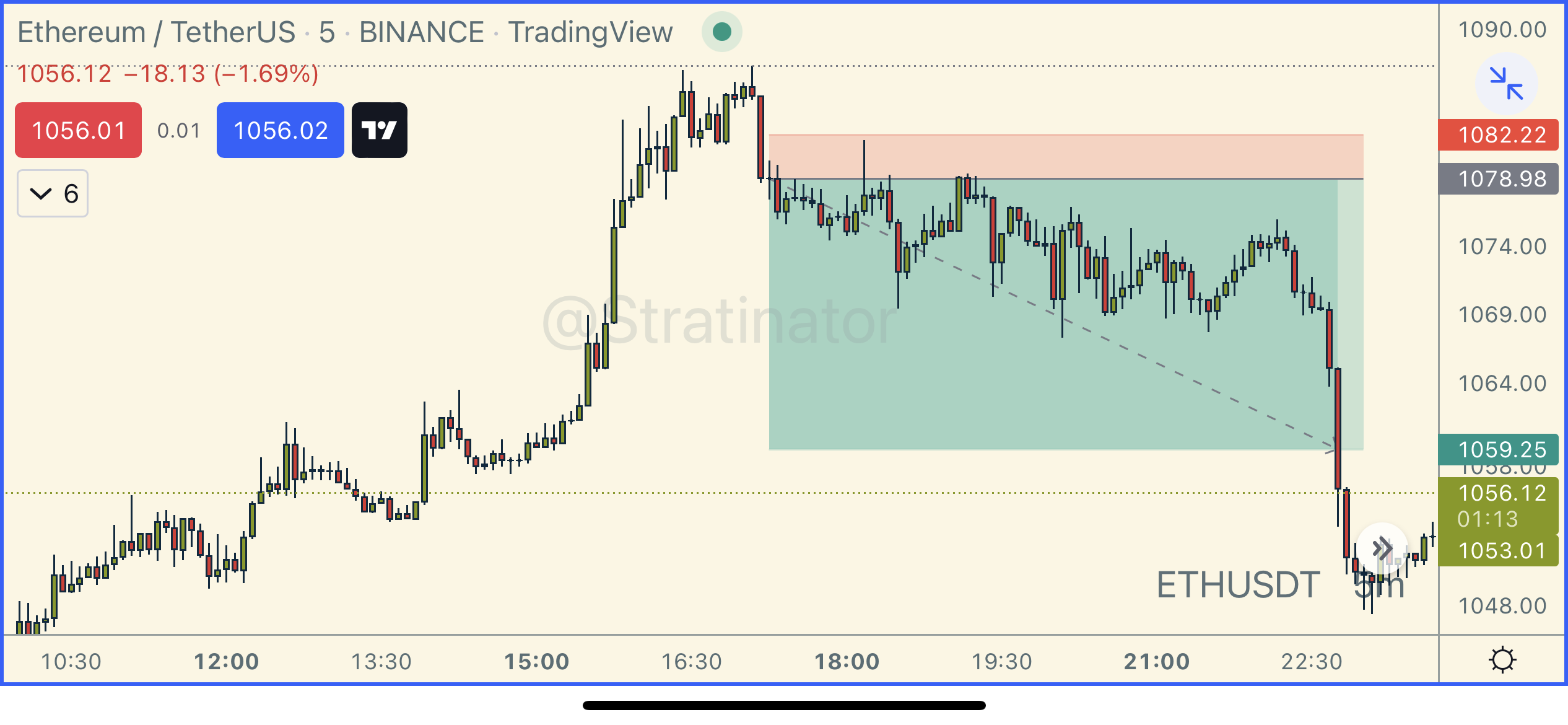

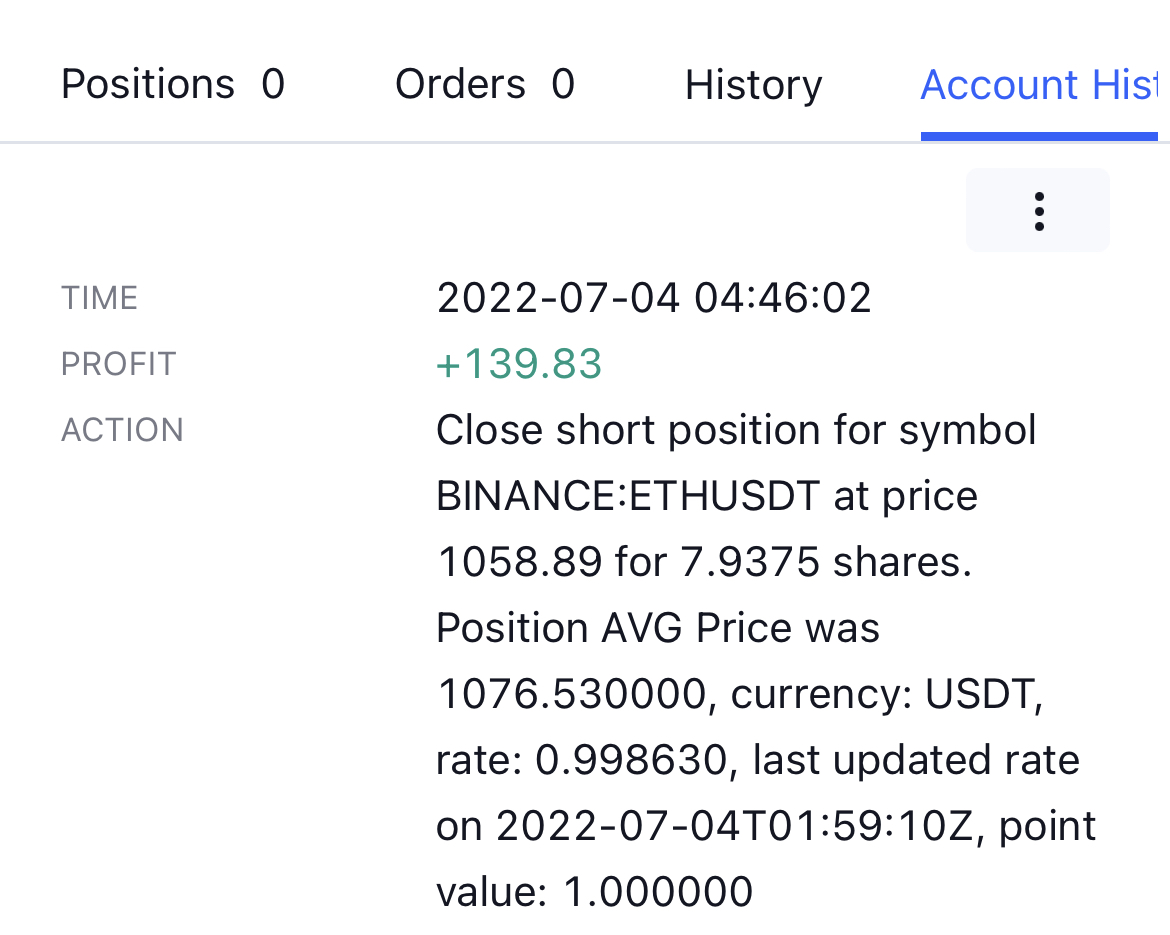

Tape reading practice $ETHUSDT, anticipated a move down, placed a short and went to bed. All on paper, I don’t trade crypts with real money. Woke up and that 1:6 R/R worked out nicely.

Study time! Rewatching Episode 22 and retaking notes today as a start. #ICT

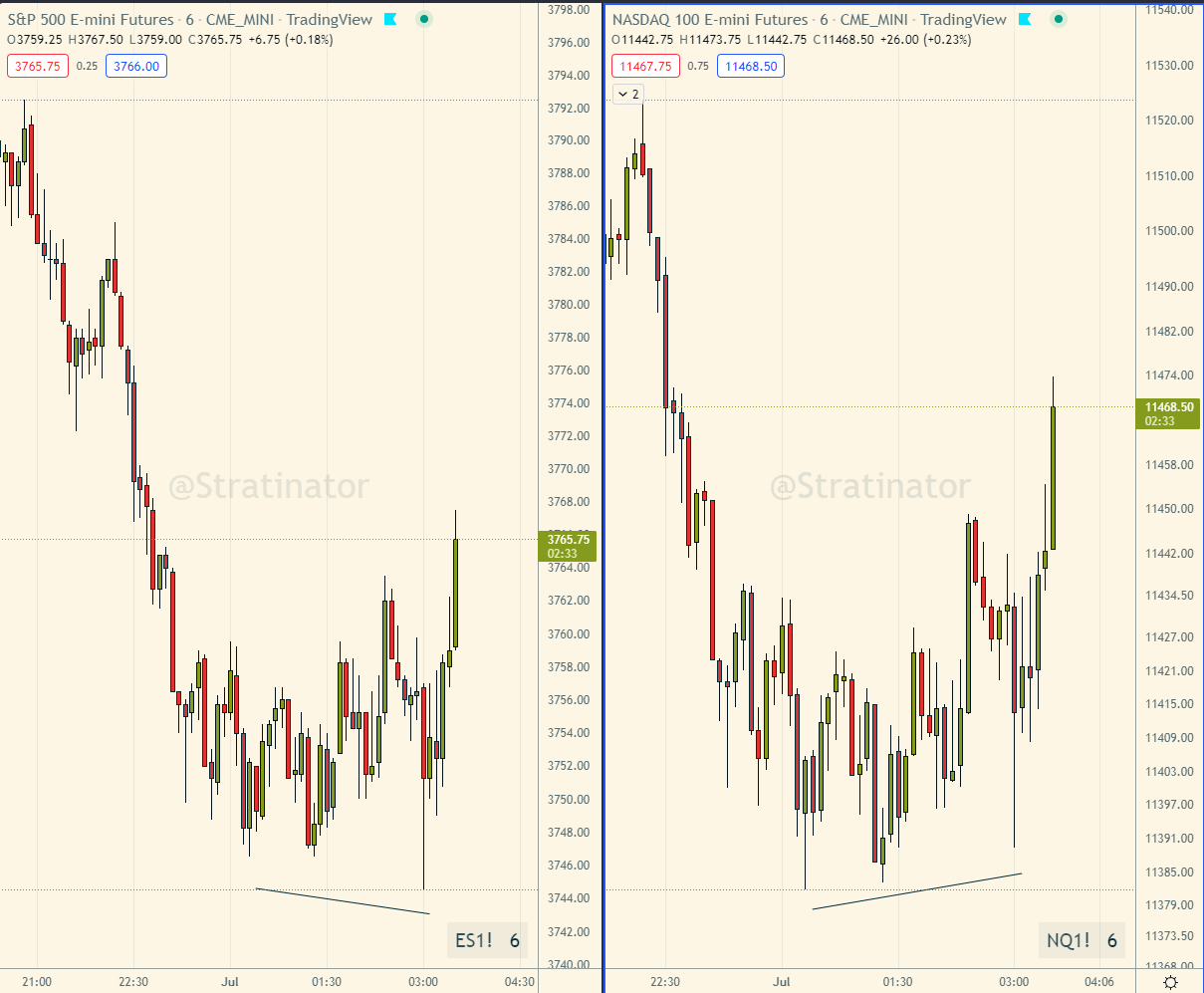

$NQ higher lowes, while $ES_F made lower lows in London session. #SMT, so powerful for getting the stronger index. #ICT

Possible #MMBM on $NQ 1min spotted, still training my eyes to see them before they “finish”. #ICT

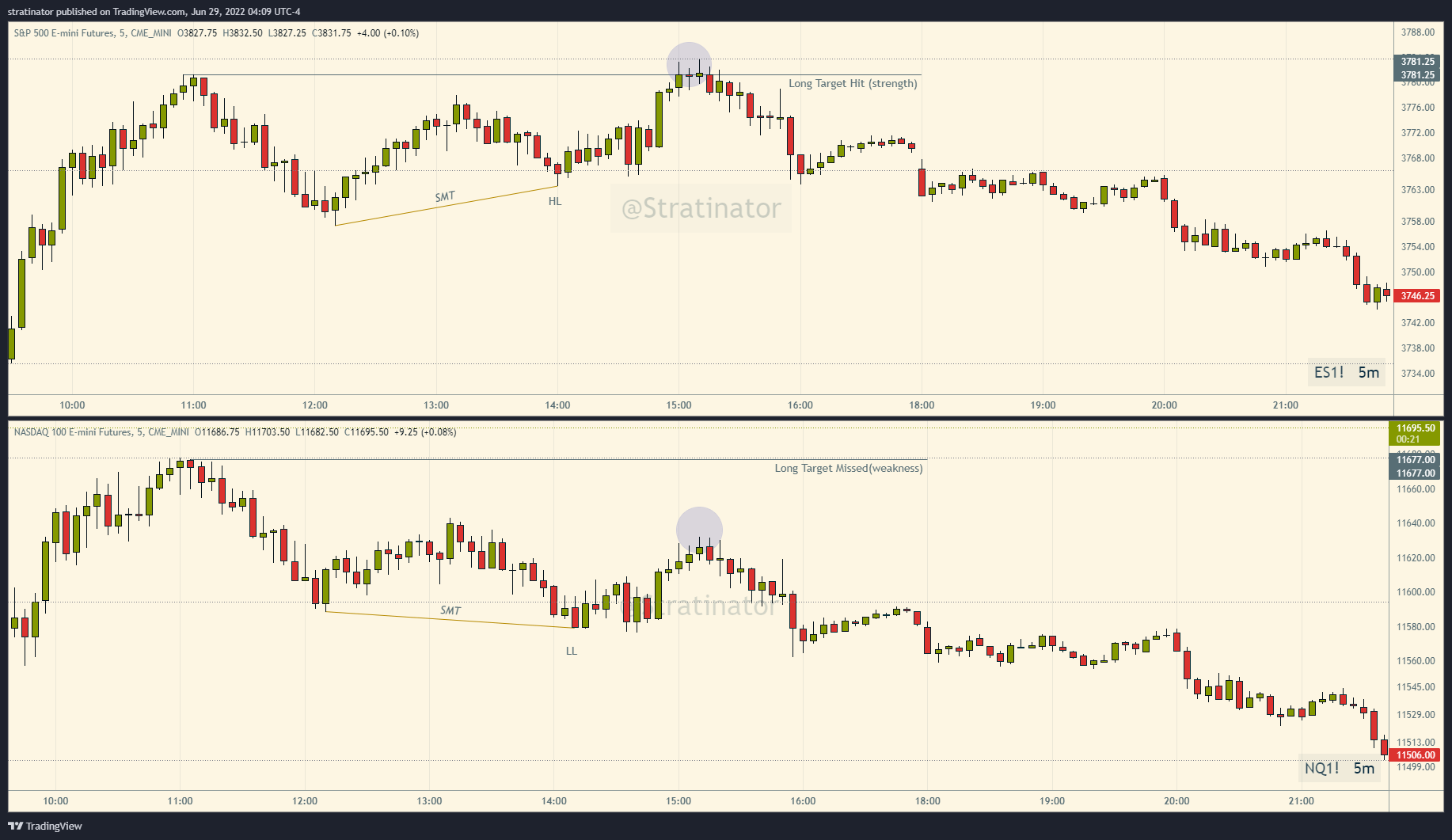

Got some questions about #SMT

Related indexes ($ES, $NQ) trade in sympathy, spotting divergences in price can give advantage.

Looking for long setups on the index showing strength and short setups on an index showing weakness as a confirmation, not as entry!

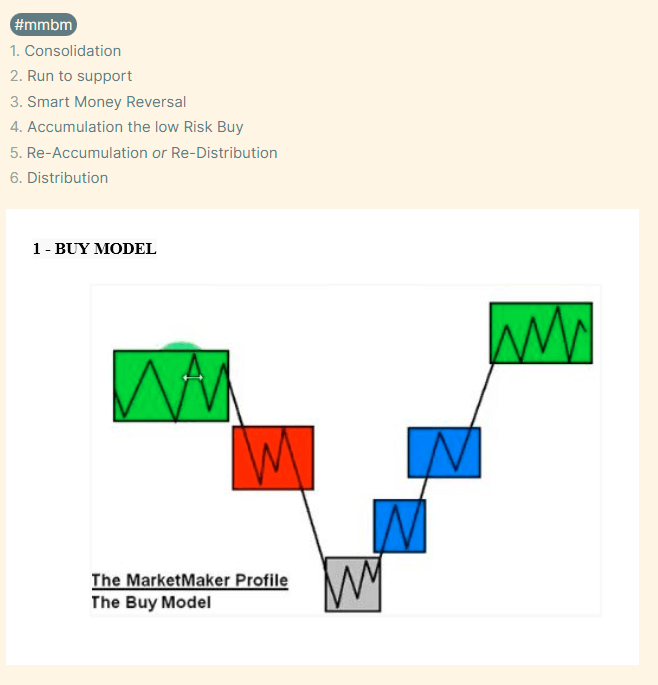

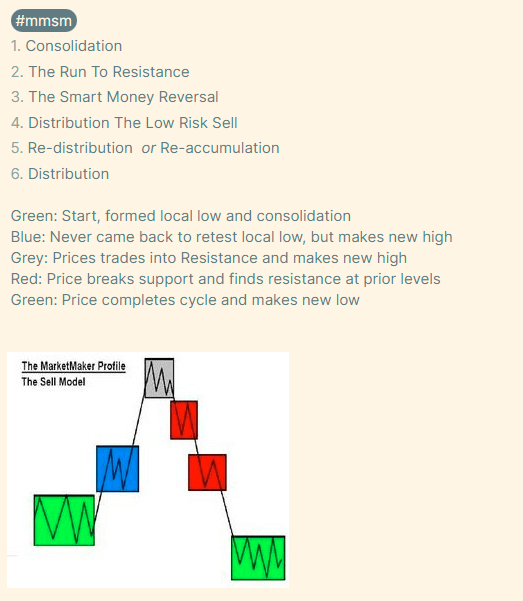

Since I saw that my quick notes to the #mmbm Market Maker Buy Model are floating around. For your convinience here are both together for you in one post. #mmsm Market Maker Sell Model.

Also, the video from #ICT is linked as well.

Happy learning!