Wednesday, February 23, 2022 →

Paper-Traded $MNQ today based on #ICT FVG with bearish bias (obviously 🤷♂️) for some nice profits, but lost some at the end, because I tried to get long again (after that lunch trade), should stick to the rules.

Wednesday, February 23, 2022 →

Paper-Traded $MNQ today based on #ICT FVG with bearish bias (obviously 🤷♂️) for some nice profits, but lost some at the end, because I tried to get long again (after that lunch trade), should stick to the rules.

Wednesday, February 23, 2022 →

$FB - going for the “Biggest Monthly Red Candle” Award 🏆👀 #TheStrat

Wednesday, February 23, 2022 →

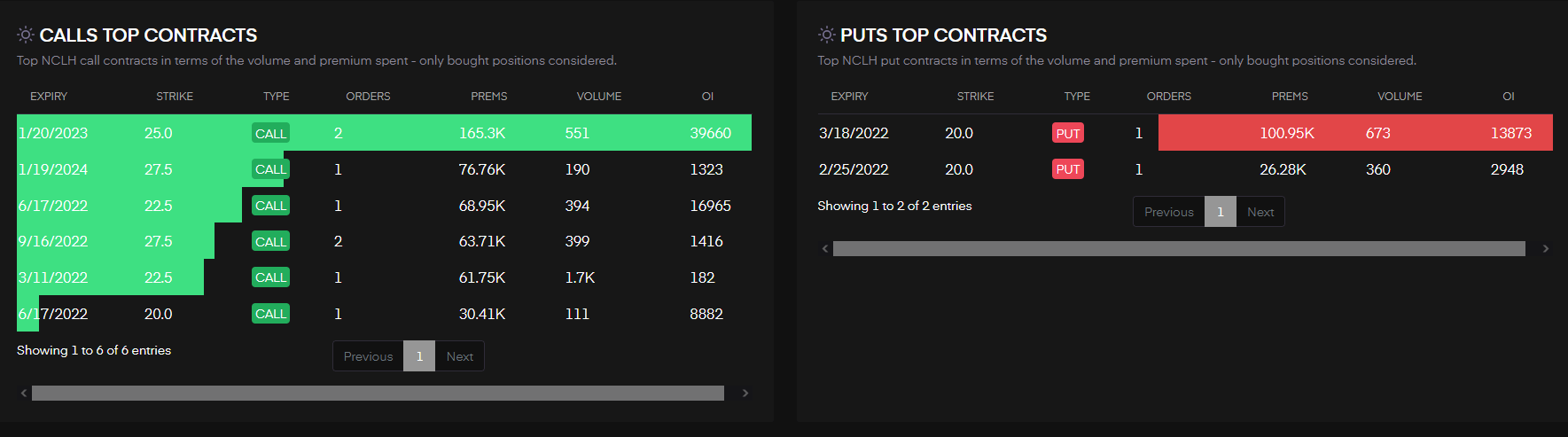

$NCLH - That #SundaySwing alert 3/18 20p triggered and is up 40% for me and ITM! I have overlooked that $NCLH has earnings report 2/24 pre-market! Be cautious!

#TheStrat

Sunday, February 20, 2022

The market is crazy right now, we see movements per day up or down that are bigger than the movements of a whole month 2-3 years ago.

Which makes it difficult to find good #SundaySwing trades, but my scanners worked hard to find possible great setups…

2 trades today and no Friday lottos, which was quite nice and easy. 💰

However, I studied and papertraded $NQ based on #ICT and it was a successful day.

Remember Monday, exchange is closed!

Enjoy your long weekend, have a great one!!

Papertrading #ICT $MNQ today from the NY 09:10 with OTE.

14502.50 -> 14334.00 = 168 handles in 90 minutes 🔥

Getting there, still need to build more confidence before trading it with real money.

Wednesday, February 16, 2022 →

$SBUX possible 3-2u > 95.55 #TheStrat

PT: 96.49, 97.97, 98.42 (swing…)

Wednesday, February 16, 2022 →

$Z possible 2u-1-2u Bullish Continuation > 64.84

PT: 65.56 Risk: R/R not that great, top of a broadening formation #TheStrat

Wednesday, February 16, 2022 →

$SNAP not triggered the long 41.97 today but sets up for a possible 1-2-2u RevStrat tomorrow. #TheStrat

$FDX possible 2u-2d Bearish Reversal Day < 230.01 #TheStrat

$DDOG possible 2-1-2u Bullish Reversal Day > 169.82 #TheStrat

Short swing for me if it triggers.

$SNAP with the triple Inside Day! #TheStrat

$NFLX good candidate for a possible #SSS50PercentRule Week long

Tuesday, February 15, 2022

Good Morning, since Monday was a bit odd, lets have a look if Turnaround Tuesday is worth its name. This issue is also available as a Newsletter in your inbox. Turnaround Tuesday 2/15 The $NQ and $ES futures are bright green since open of the London session, so we might get some nice Bullish Kickers …Instead of posting a #SundaySwing ideas video this week, I decided to switch the format and show you how I find the setups, what tools I use, how my process is to select stocks and so on.

Available in @Youtube now: youtu.be/nYpGzlCfx… #TheStrat

Sunday, February 13, 2022

The volatility we had the last couple of weeks are wonderful to trade, but also make it hard to collect a #SundaySwing list of trade ideas for a longer time frame.

Growth is driven by compounding, which always takes time. Destruction is driven by single points of failure, which can happen in seconds, and loss of confidence, which can happen in an instant. - Morgan Housel

From the book “The Psychology of Money”

$ZM possible 2-2d Reversal Daily < 144.29

Week flips red < 144.59 for FTFC down (Month inside and red)

PT: 143.19, 139.78, 137.28 #TheStrat

Update of #TheStrat

On watch for today:

Tuesday, February 8, 2022

Good Morning,

If I write such a post, I will quickly glance at $SPY and $QQQ and some tickers that I will watch today for a possible day trade from a #TheStrat-View as well as some Tradytics unusual flows caught my eyes.

The $LVS 2/25 45c from my @Tradytics flow idea post is up 30% today 🔥

$HP 3/18 35c were down this morning and pretty cheap, plenty of time left on these. 🤞

Sunday, February 6, 2022

In addition to my #SundaySwing ideas, I had some time and passion to dive into some of the @Tradytics tools. It’s such a powerful website that I use since a few months and still have a lot to learn.

So here are some flows I found looking at it.

Doing a deep dive into some of @Tradytics powerful tools. Found some great looking flow-based ideas. If interested I can share some flow-based ideas as well!

Sunday, February 6, 2022

You asked for a newsletter in addition to my blog, so you get one. @Buttondown is the service.

You can subscribe on the Newsletter page.

Read on if you want to know a bit more; if you’re interested in the details.

Sunday, February 6, 2022

Another crazy week, and I think we will get some more, since #TheStrat loves volatility, I’m having a good time trading short-term swings and otherwise scalping SPY and QQQ during the day.

$GILD possible 3-1-2u Daily > 68.85 Target: 69.37

Inside week after 2d, possible 2-2u weekly above 69.37 #TheStrat

Tuesday, February 1, 2022

PSA: I know the intersection is small, but I wanted to share this anyway. Since I started using Tradytics more for extra confidence when finding posible #TheStrat setups, with more targets to chose the “better” contract expiration or strike, i created a Alfred-Workflow to use the …Sunday, January 30, 2022

Since the high volatility and video production takes lot of my free time, I decided to not post a video to the ideas this week, so you have to read on if you are interested in this weeks #SundaySwing ideas.