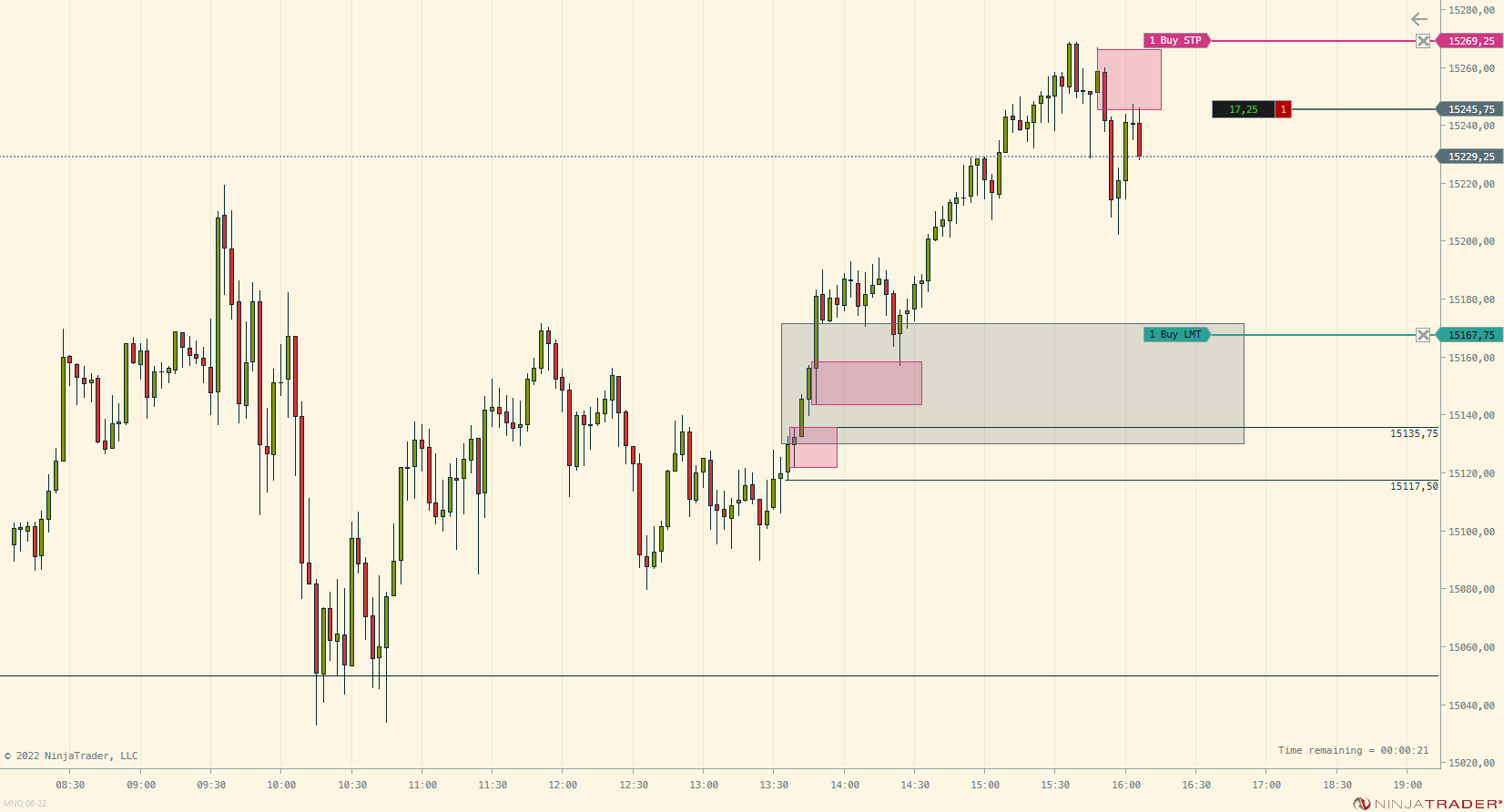

$MNQ_F 3min at high of day, took the short (paper!) because of an imbalance. Tight stops and overnight session is lower volatility, so lets see how this works out. #ICT

$MNQ_F 3min at high of day, took the short (paper!) because of an imbalance. Tight stops and overnight session is lower volatility, so lets see how this works out. #ICT

Possible 2d-2u Bullish Reversals tomorrow #TheStrat

All have FTFC up!

$IWM - possible 2d-2u Bullish Reversal Daily > 206.21

PT: 207.20, 208.79 (3-2u-2u Week), 209.05 (Month 2d-2u) #TheStrat

Sunday, March 27, 2022

Another green week in the books for the market. After the last couple of red weeks, the market ran back above some important levels with no stops in sight.

I wrote last week, that I wasn’t sure if the week was green becaue of OPEX or not, but I would say OPEX didn’t play a role at all, …

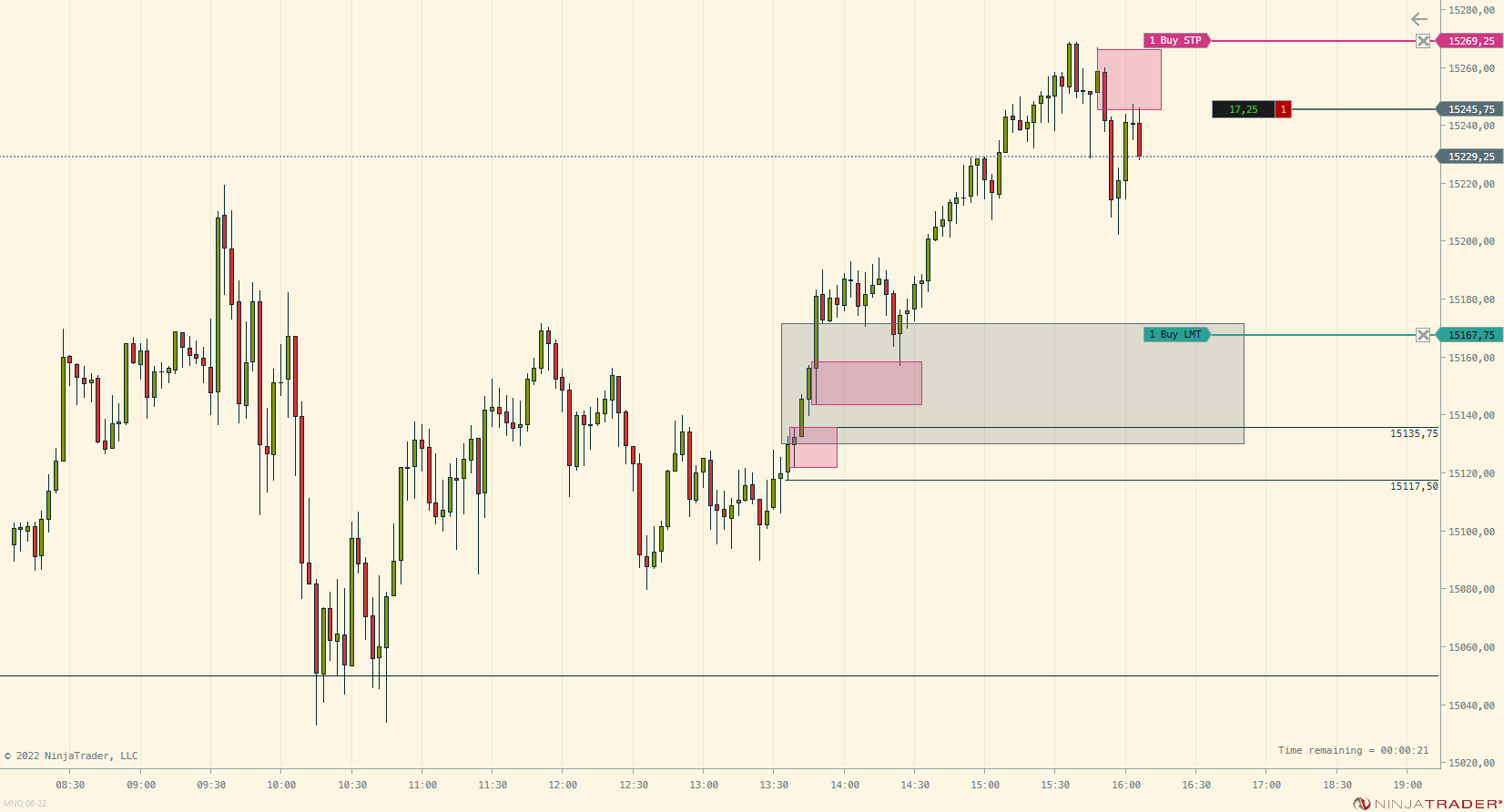

$ES_F #ICT Pre-market 1:3 papertrade in 14 minutes :-)

When you spot this all live and it works out, feels so great! :-) @AlexsOptions

Science: 15min -> 5min -> 1min

Still paper, but I’m getting there 🤞 Sticked to the 1:3 R/R and not getting to greedy.

No #SSS50PercentRule Weekly long setups for tomorrow on my #TheStrat scanners.

But, these are some possible 50% Rule outside Month tickers if we stay bullish:

$MNQ_F - 60min Broadening Formations - 2 possible ones drawn.

The inner BF would be a nice run up to ~14700 🤞🐂 #TheStrat

$NIO - Possible Outside Month #SSS50PercentRule #TheStrat 👀

Wednesday, March 23, 2022

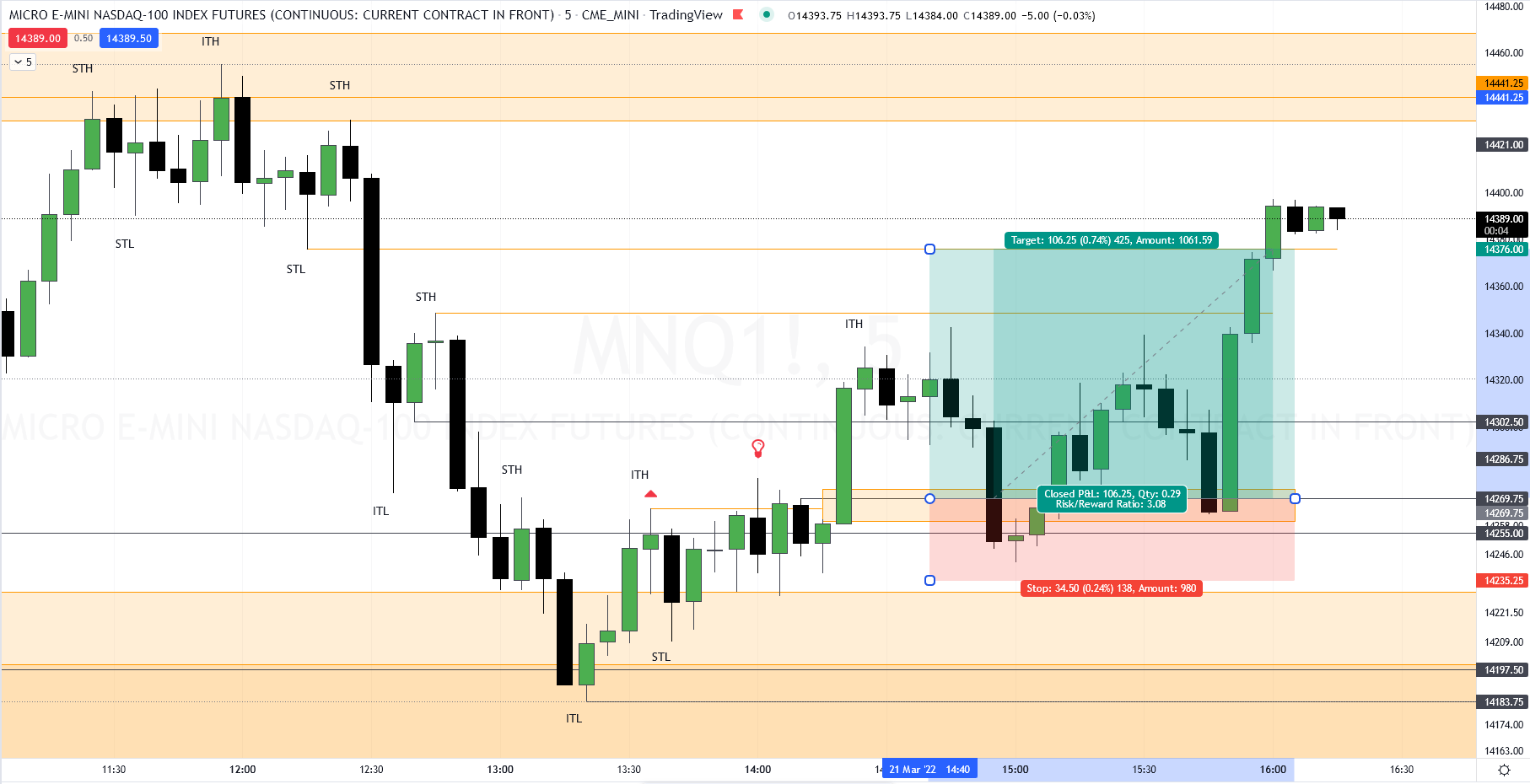

I couldn’t figure out yesterday why $NQ and $ES pumped so hard from the open and yesterday and thought it was just “bullish”.

That reason didn’t give me any peace. Here is the science of this setup with a 9.6:1 risk/reward and why it really worked out.

$NVDA - 2u-2d Bearish Reversal Day < 260.72 ? #TheStrat

Bear pants back on 🐻

PT: 256.64, 246.24

No trigger, no trade!

$SPY - nearing at a top of an inner 60min Broadening Formation #TheStrat

Price Expansion or back down?

$SBUX - Double Inside Day setup! #TheStrat

PT: 84.98, gap 83.44

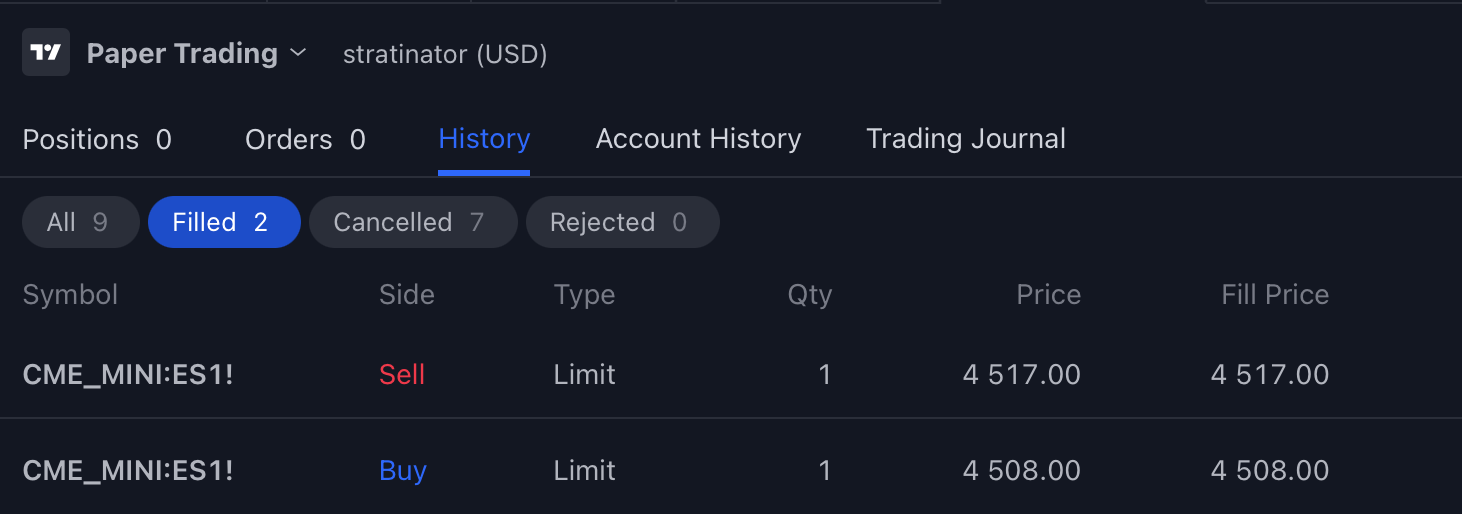

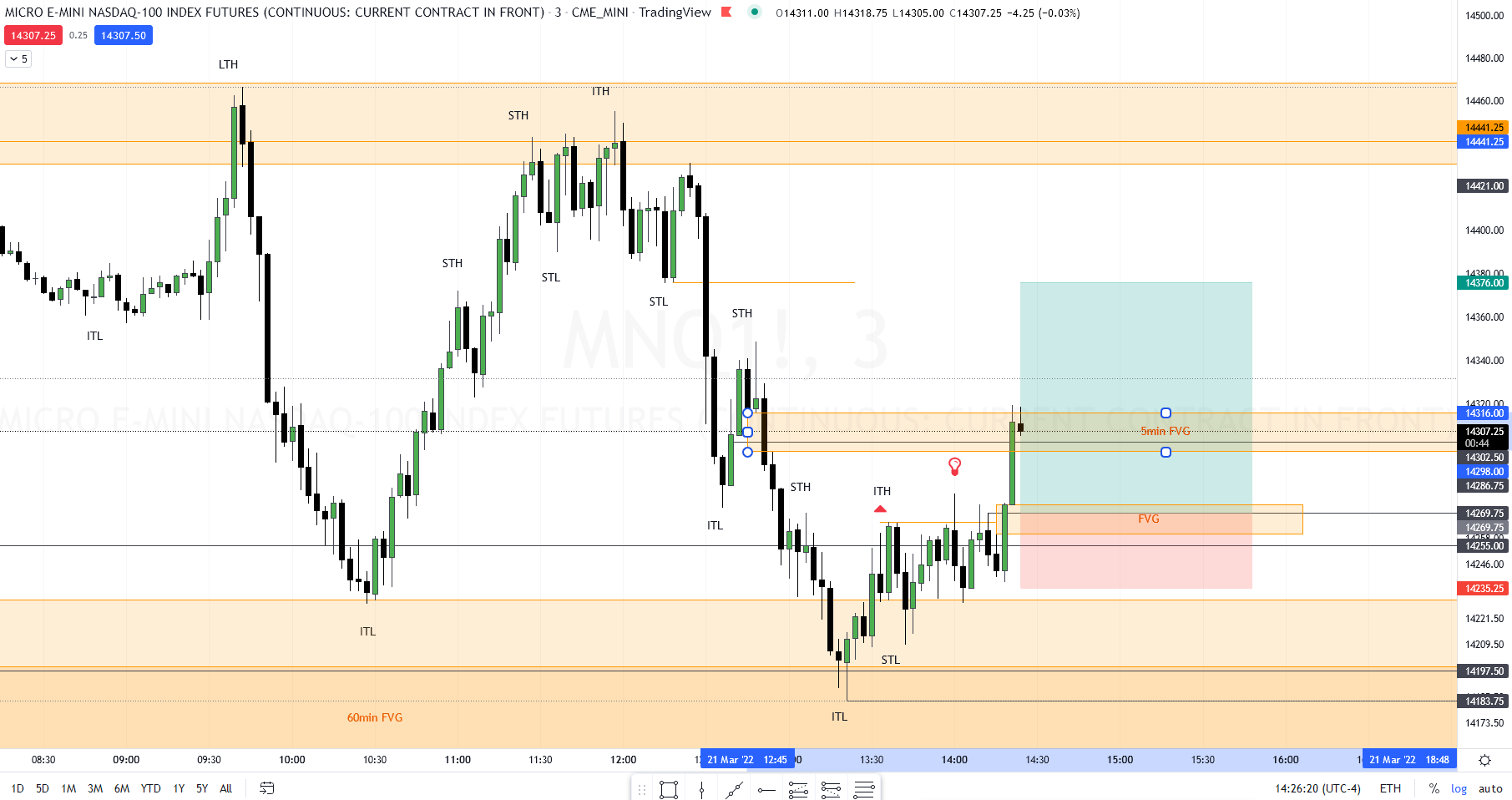

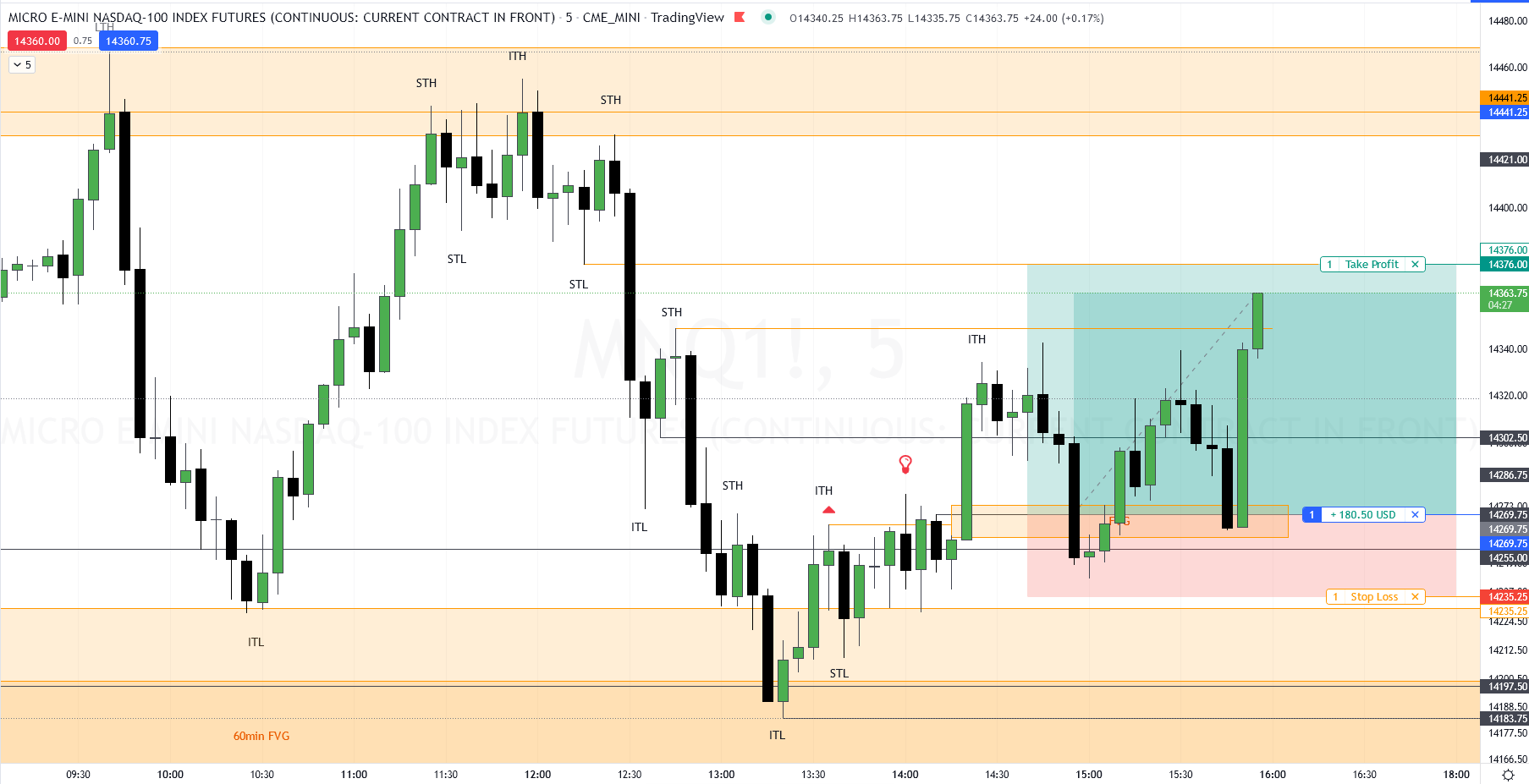

Only papertraded $MNQ_F #ICT-style today, slowly getting it all right.

Last trade was just what I needed for my mindset, hit 14376 right after close :)

3min & 5min annotated chart of my thought process…

Sunday, March 20, 2022

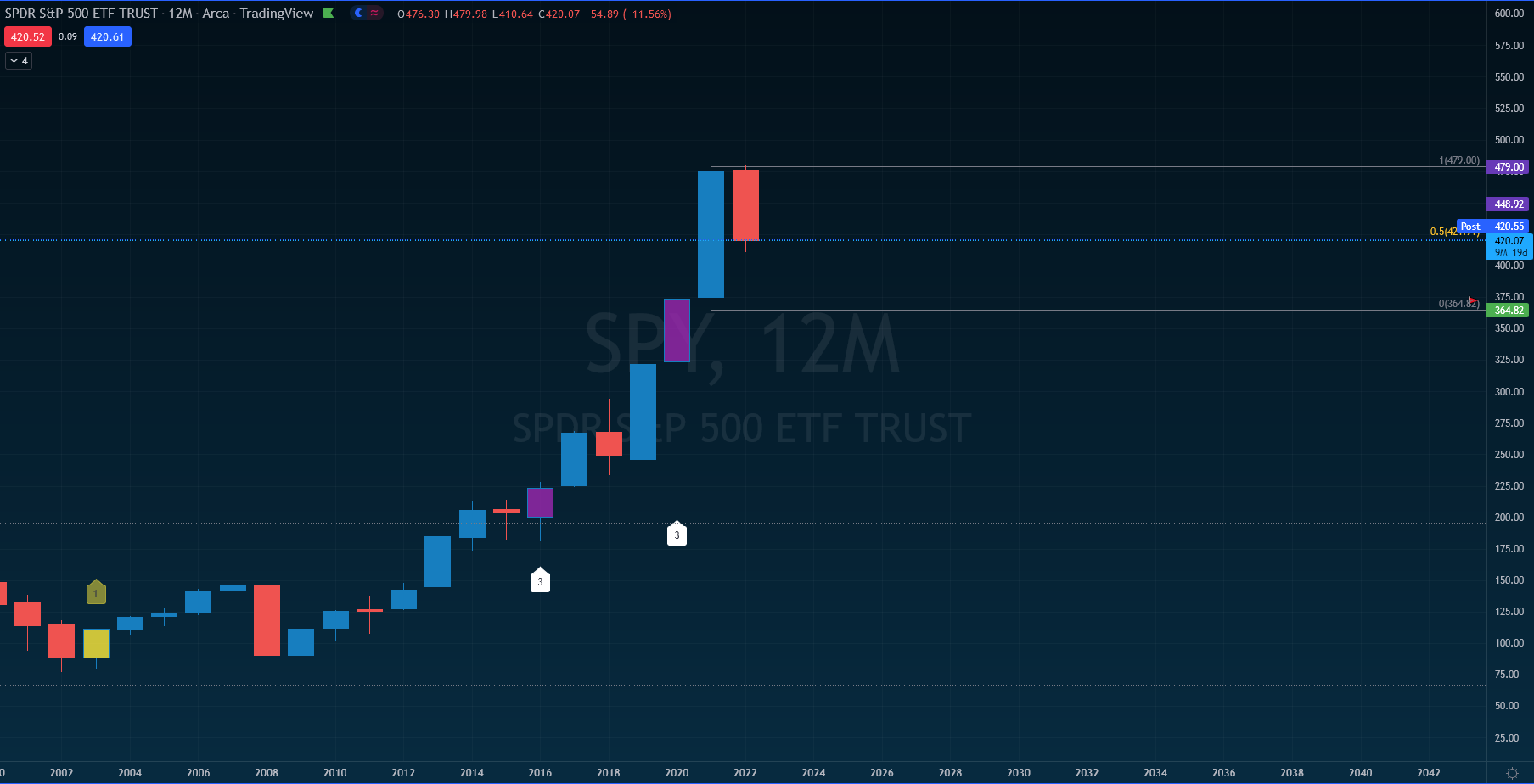

I’m still unsure if last week was a bull run because of OPEX and Quad-Witch-Week or what caused this 4 massive green days in a row. Nearly 30 points straight up for SPY without a pause. Crazy!

Back to the drawing board tonight to get better with the #ICT Mentorship stuff. Got some eye-opening moments yesterday thanks to @AlexsOptions regarding Market Structure shifts. Episode 12 & 13 make much more sense now!

$MES_F 15min #ICT OTE pre-market low->high perfection

$KR - possible 3-1-2u Bullish Reversal Day #TheStrat

$WMT - possible 3-2-2u Bullish Reversal Day #TheStrat

$MNQ - a possible outlook into the overnight session, just my novice prediction learning #ICT FVG stuff

Lets see how things really develop, I do not trade this, just watching and learning!

So many possible #SSS50PercentRule weekly long tickers into Friday:

$ZM $ROKU $ETSY $BLNK $TDOC $DKNG $NIO $JMIA $AAPL $PINS $DDOG $DIS $APPS $MU

Will have to narrow this list down and provide some charts later. $PINS, I already posted today. #TheStrat

$PINS - If market continues higher today, the #SSS50PercentRule Weekly might hit. #TheStrat

My annotated $ES 1min chart #ICT on todays rally. Sure FOMC was the catalyst, but worked that way.

@AlexsOptions is this MSS what ICT also calls a “Breaker”? Would love to get some feedback on it 🙏

$MNQ - 60min Broadening Formation from this morning. Stopped the pump right at the top. Price expansion or rerversal down? #TheStrat

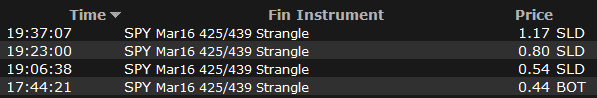

$SPY - on days like today with FOMC and how the market reacts, that Strangle 425p/439c 0dte worked great…

No Strat setup, no flow, just both directions, only issue is when market stays flat.

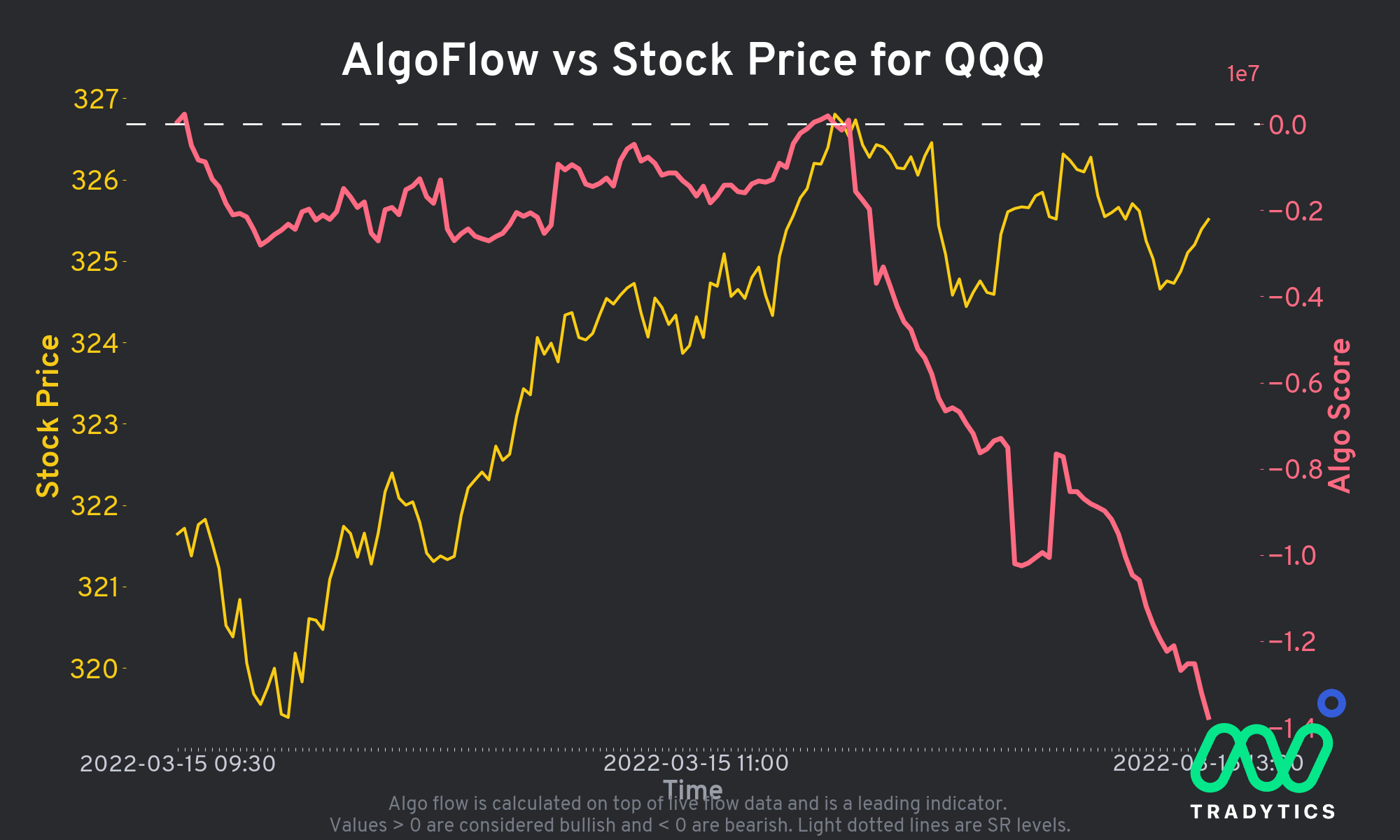

$QQQ - @Tradytics Algoflow is overall bearish on it intraday now 👀 🐻

Sunday, March 13, 2022

Since I have some outside DIY projects running on my house and weather gets better, my free time is shifting into that projects and therefore fewer time on the weekend for my trading hobby.

Enjoy reading this – shorter than usual – weeks issue!

With the weather finally turning spring-like here, I’m starting my solar carport DYI project this weekend.

So it is very likely that there will be no #SundaySwing post from me this weekend.

Have a great weekend!

$MNQ – #ICT 3/11 Morning session – annotated chart 5min.

You don’t need to go down to a lower timeframe, 5min also showed it’s hands.

Note: I painted this in hindsight, to train my eyes, I have not traded it, not even in paper.

$SPY - triggered #SSS50PercentRule for possible outside year, again #TheStrat

$QQQ - triggered a possible outside day #SSS50PercentRule 👀 #TheStrat