My most used „tools“ while reading price action, helps me to stay patient. 🤷♂️

My most used „tools“ while reading price action, helps me to stay patient. 🤷♂️

Thursday, February 23, 2023

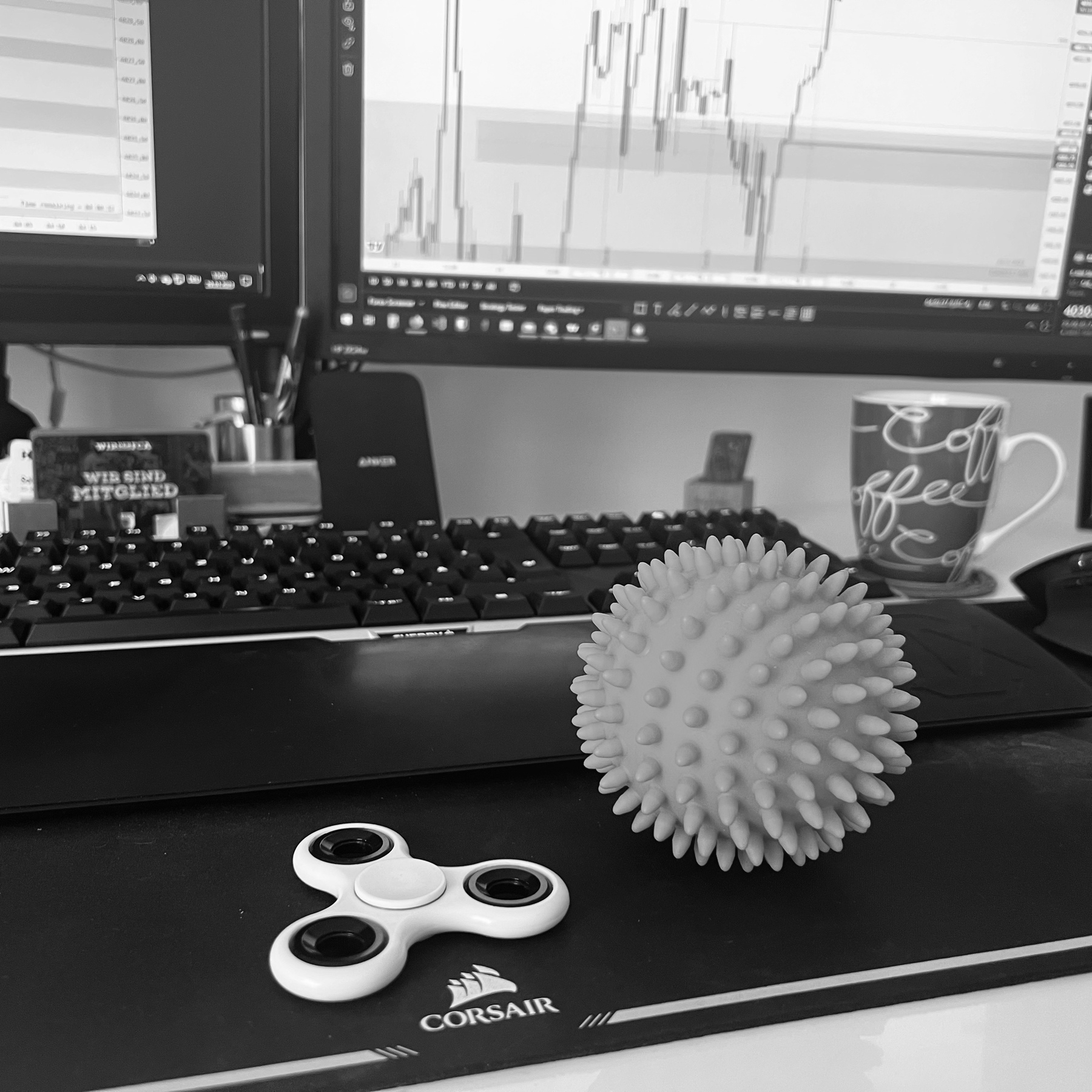

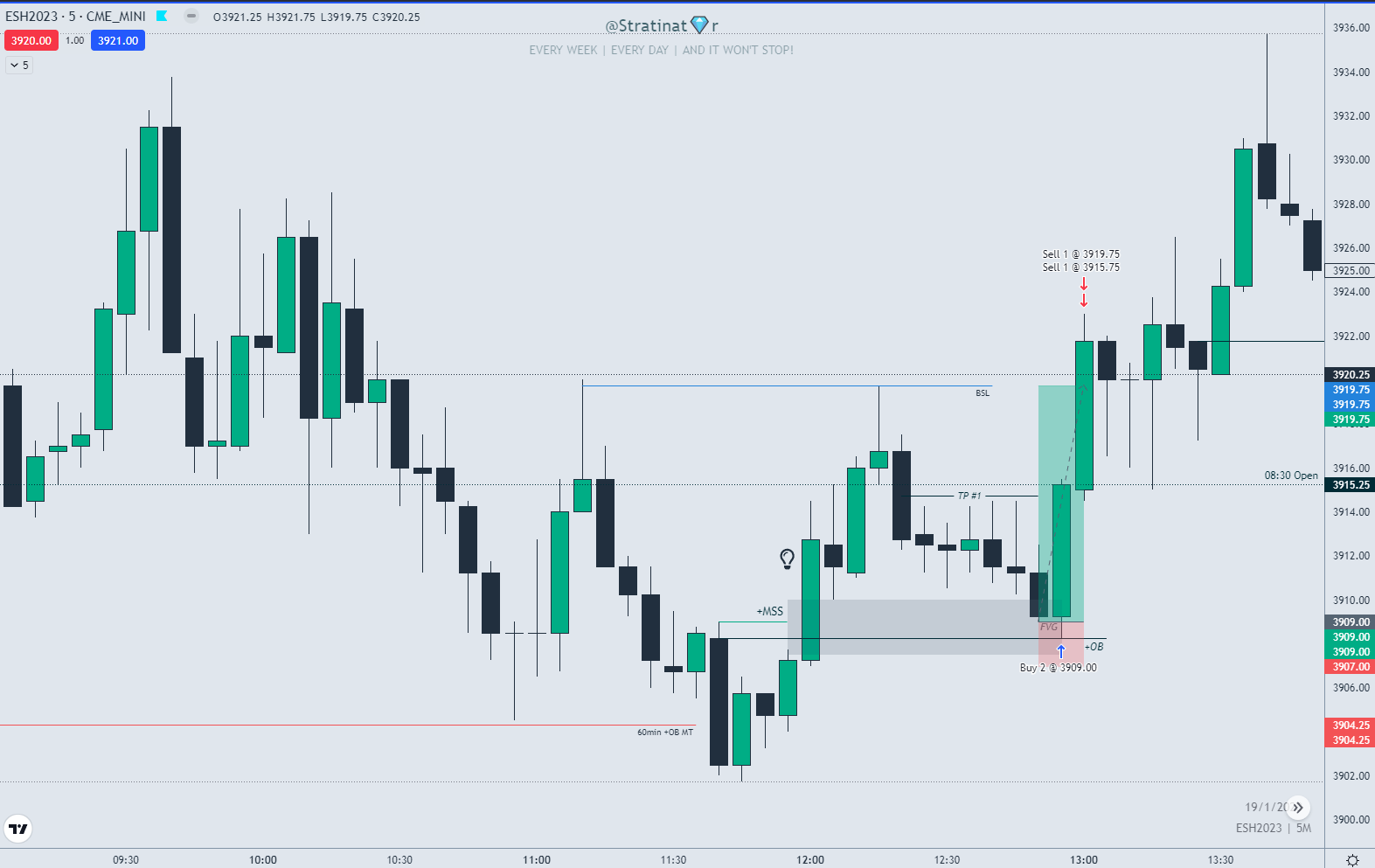

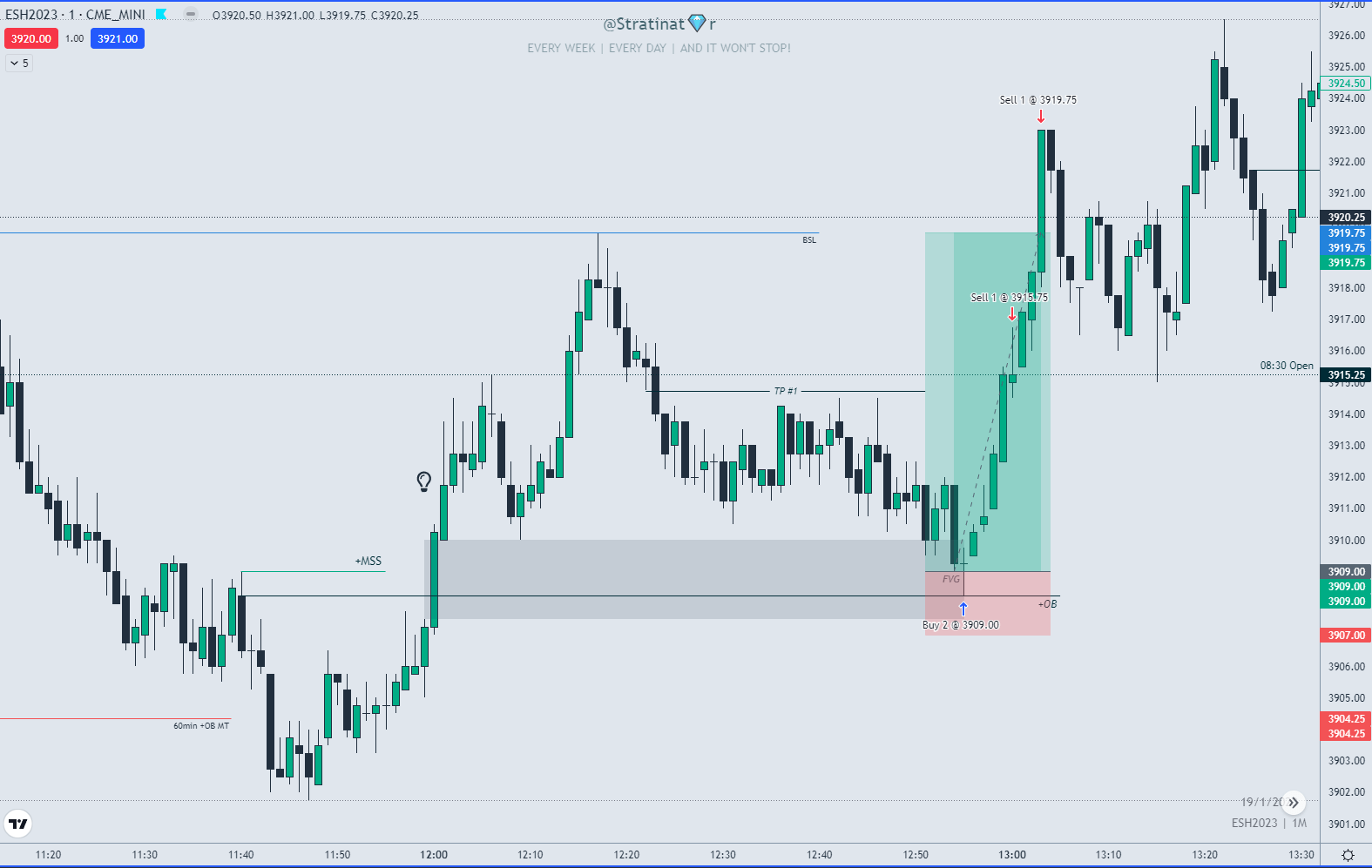

Introducing the Mellow Market @TradingView color scheme - a soothing and eye-strain free palette perfect for charts. With the help of AI, I created a beautiful combination of colors that enhance readability and reduce fatigue. Mellow Market is a calm and soothing color scheme for charts, designed to …You can clearly see, the rare occurence when the unicorn appears where price is supported! That’s it’s called the 🦄 model (BRK + FVG) $ES 5min Example ;-)

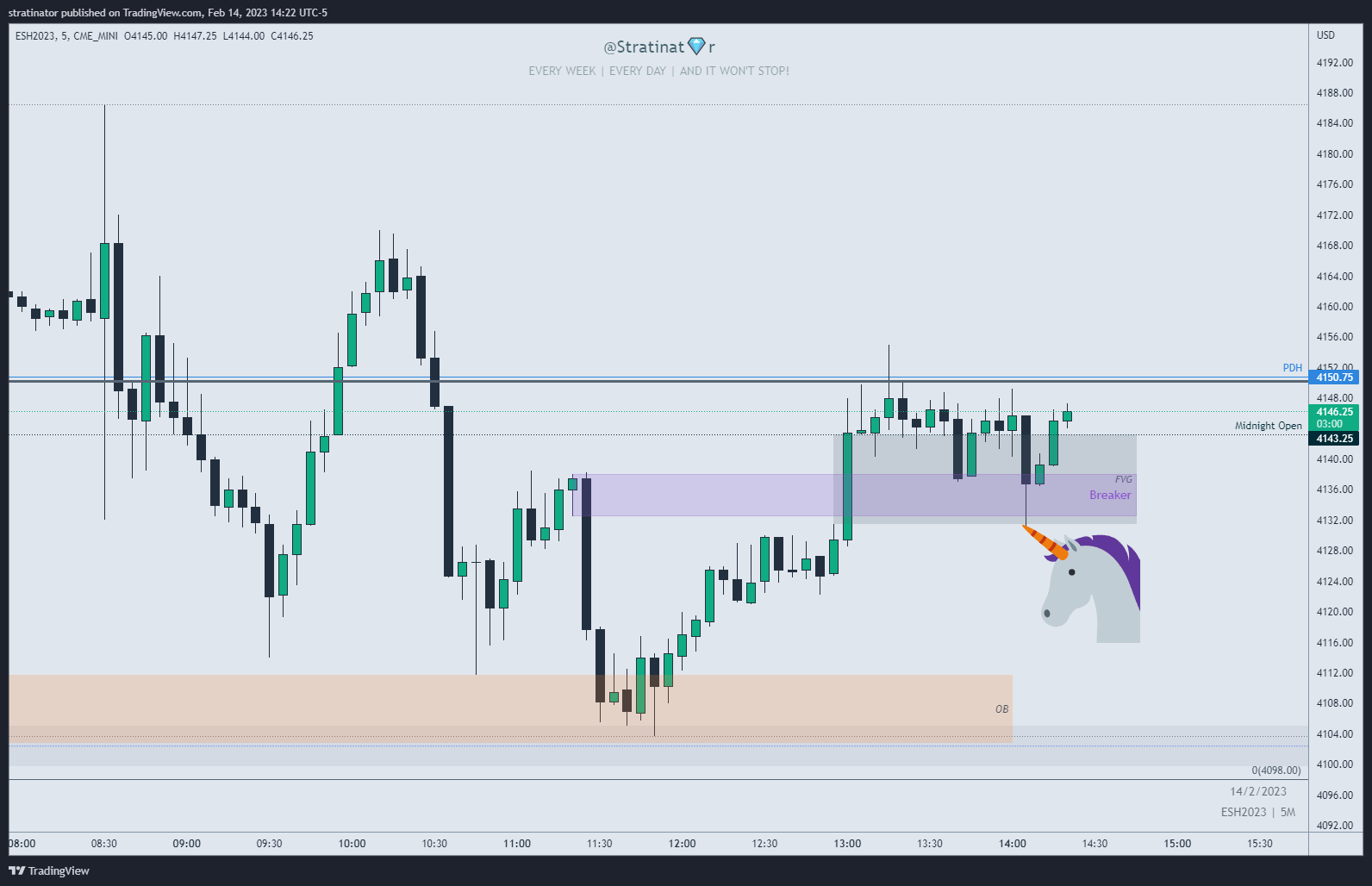

Had fun with MindMaps this weekend and the @I_Am_The_ICT Bridge Builder video. I love MindMaps and used them years ago very successful, so trying to implement them more in my learning process.

If you search for a Futures Prop-Firm (no CFD) have a look at APEX.

This promo is interesting because 50% is also valid for recurring months (eval). No time limit. Trade Copiers allowed.

Code: IZUCSMVN

$ES Entry Model Long 1min…

Can’t be unseen, once it’s burned in.

5 min & 1min chart on #TradingView

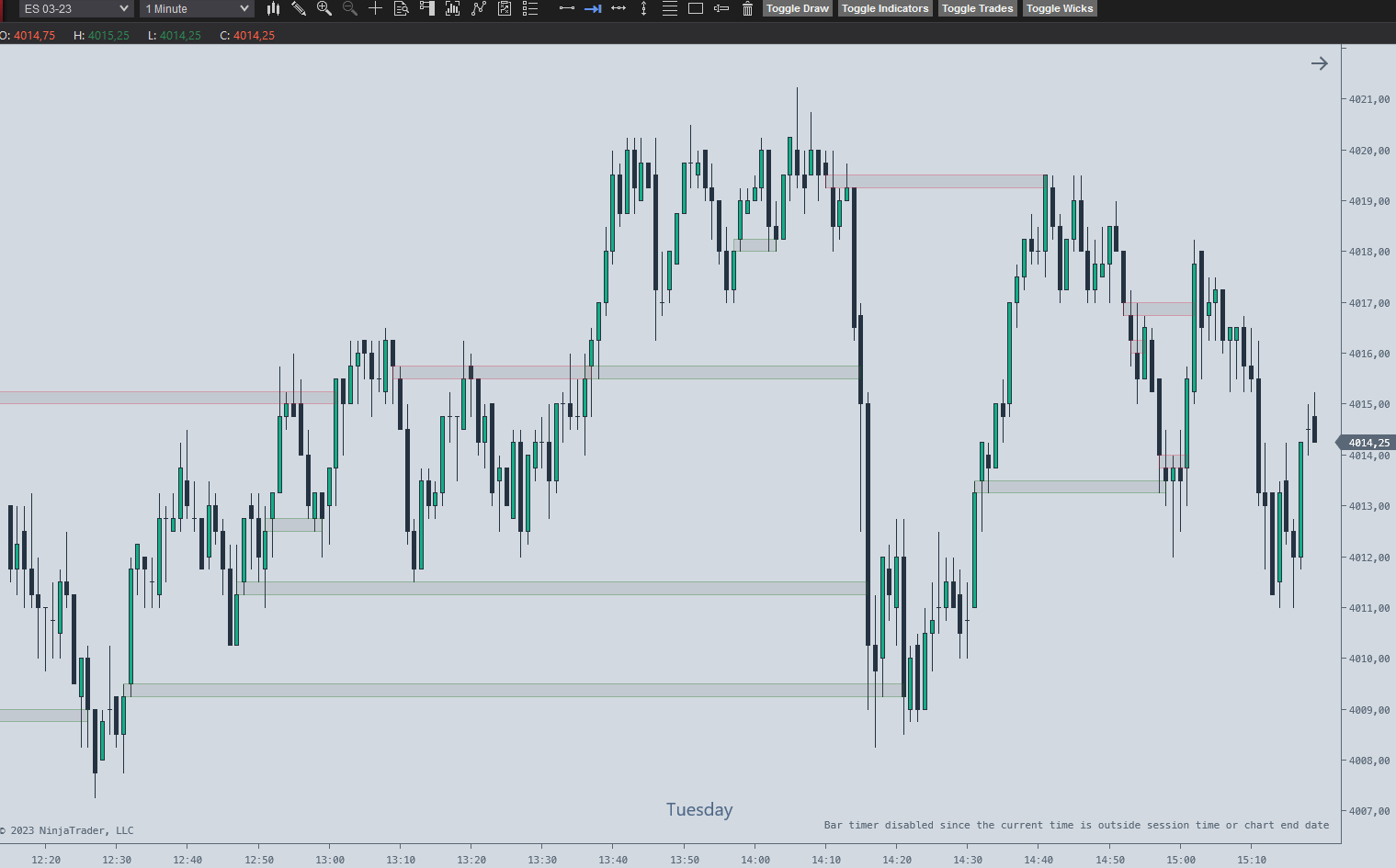

There seems no VolumeImbalance indicator available for #Ninjatrader 👀

Still in early beta, but this is fun :-) 🤓 (First NT code ever for me!)

Thanks for the inspiration @28_trader and @IamMas7er

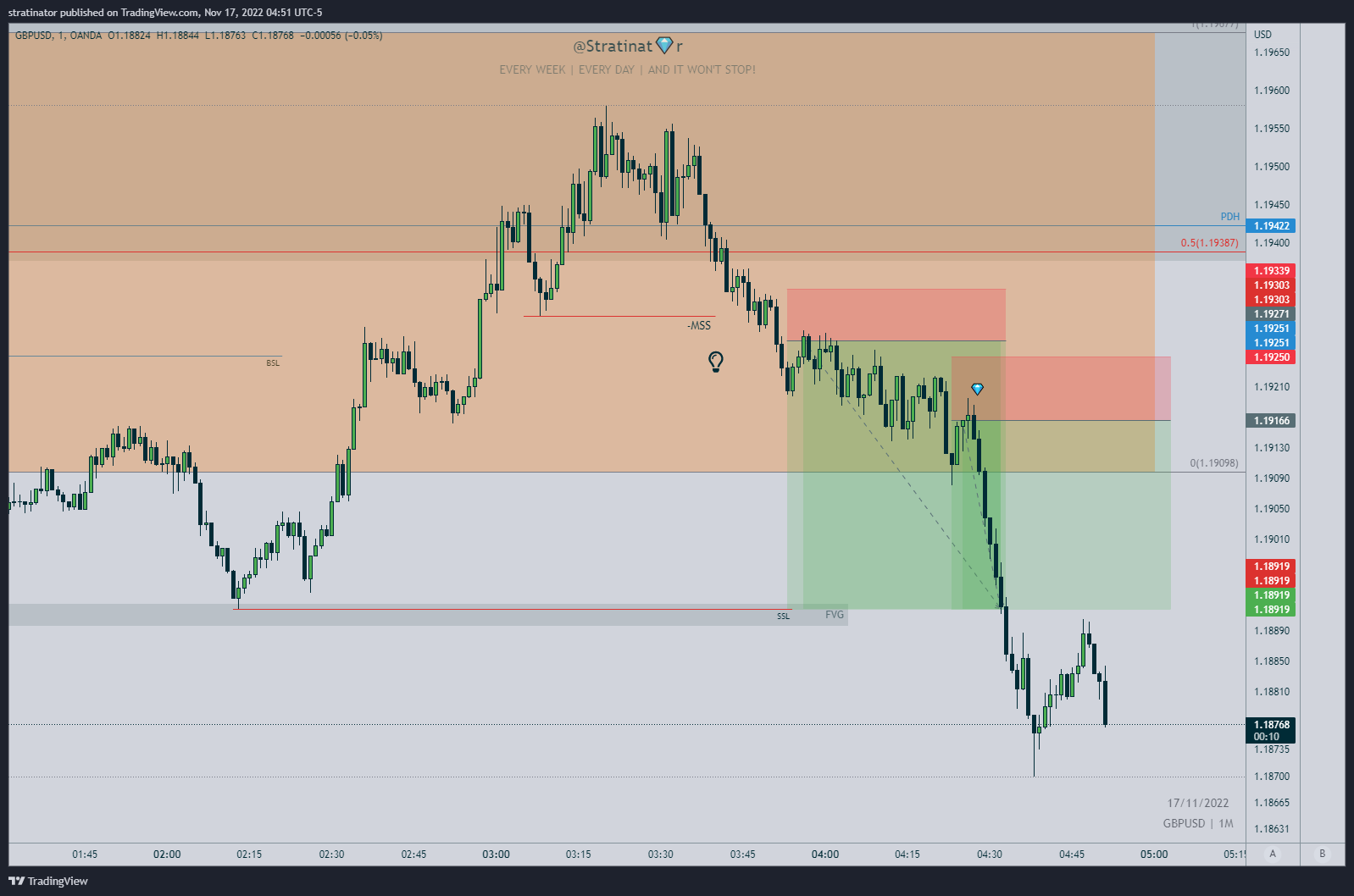

$GBPUSD

Enjoying a perfect autumn day and started reading this great book again. Can you guess it?😀

Have a great Sunday!

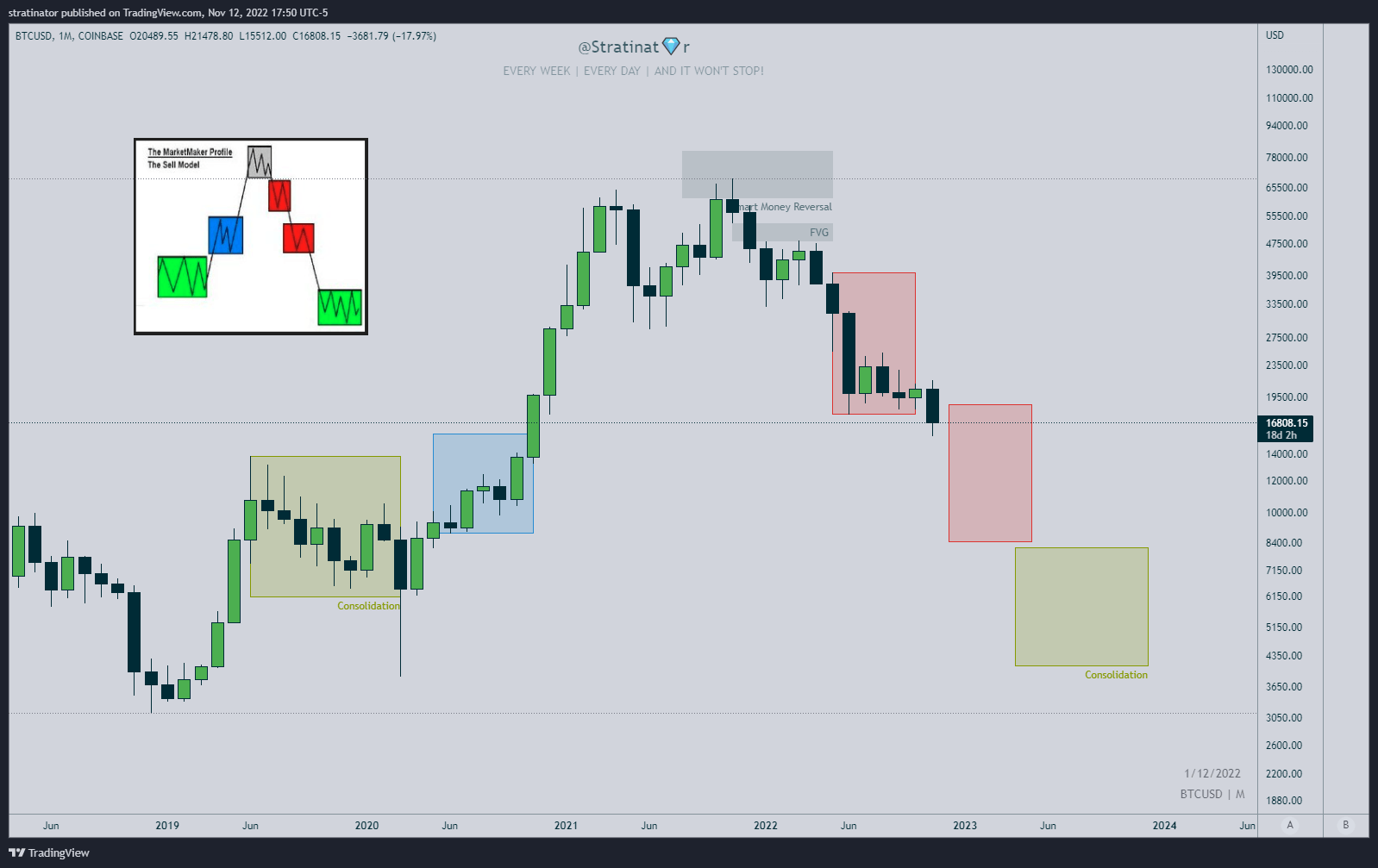

Listened to @I_Am_The_ICT Twitter Space today and afterward had a quick look at #BTCUSD. Since I haven’t looked at it for a while and not trade it…

Monthly chart. you see it? #MMSM could be totally wrong, beause it’s crypto ;-)

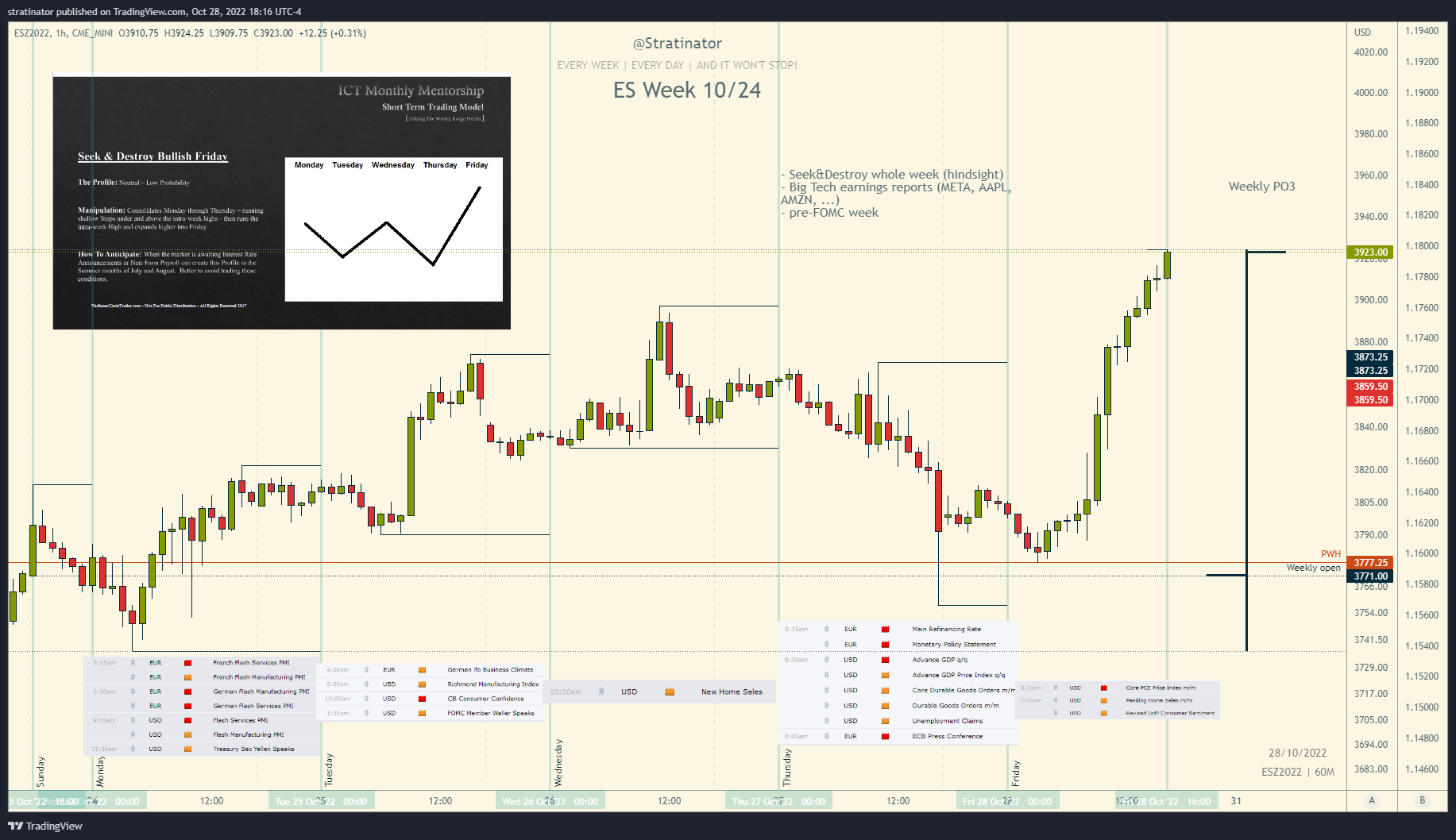

Sharing my end-of-week journal for $ES this time also here in public. This is what I add to my journal book for the overvall week.

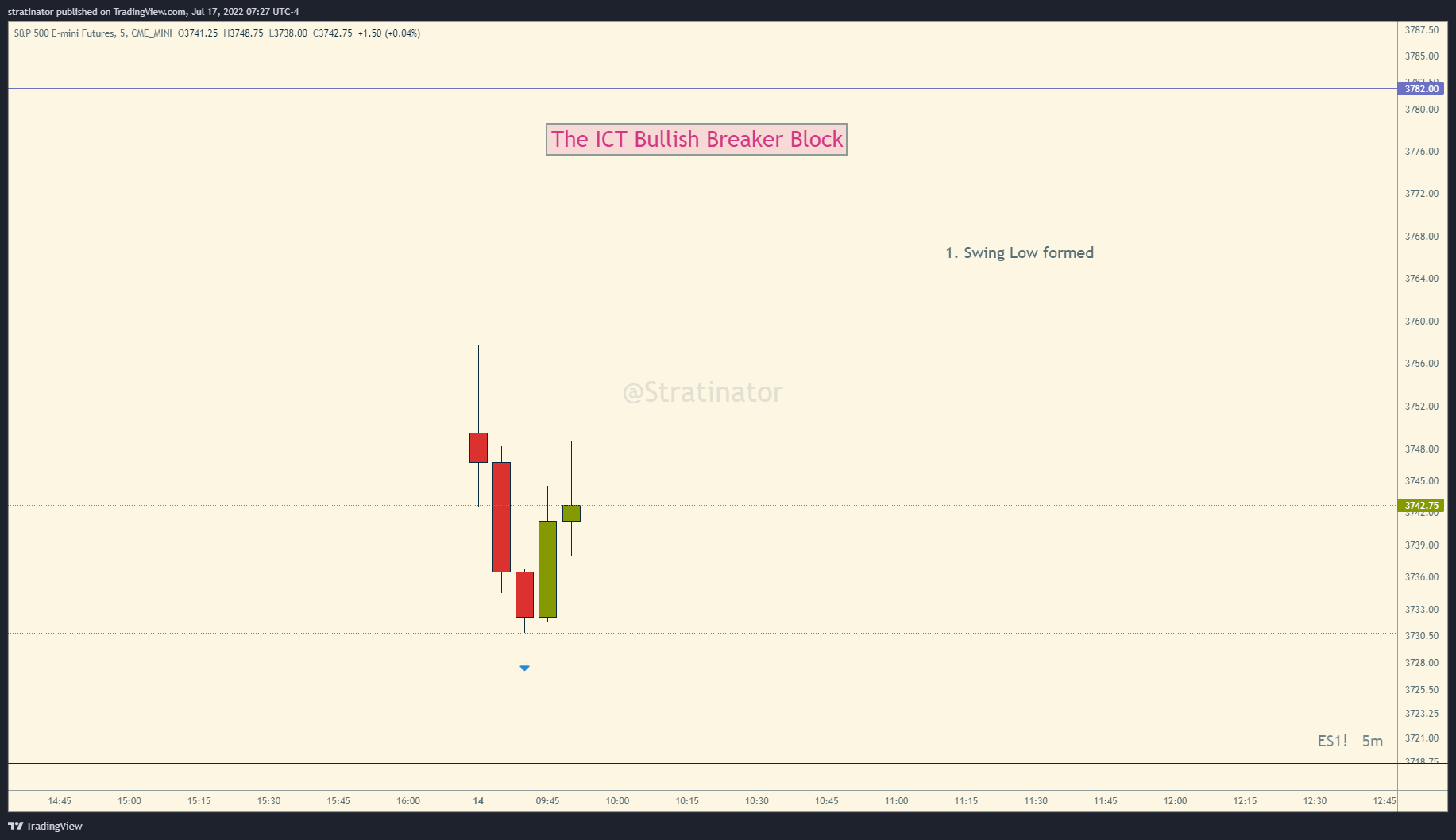

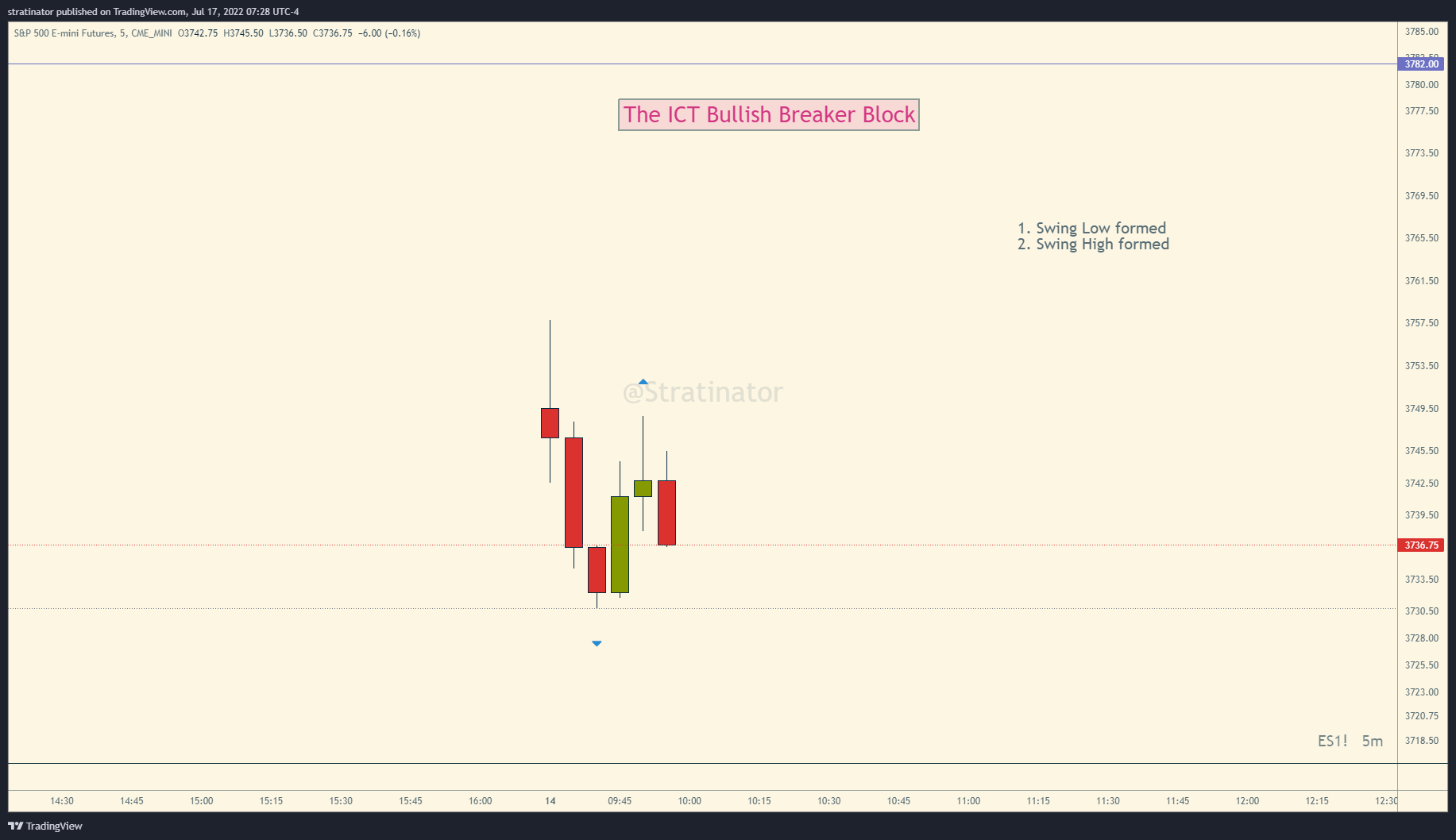

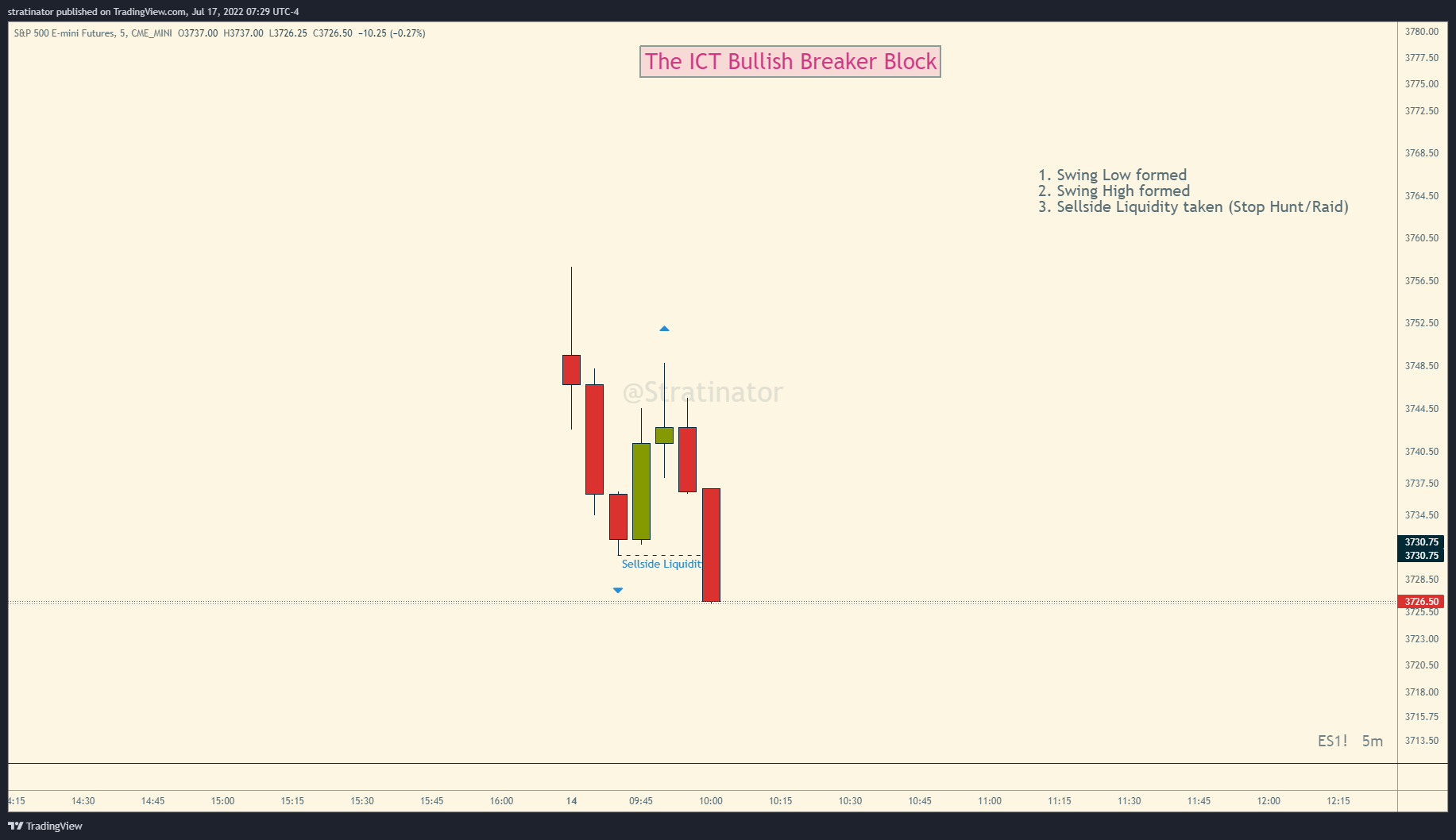

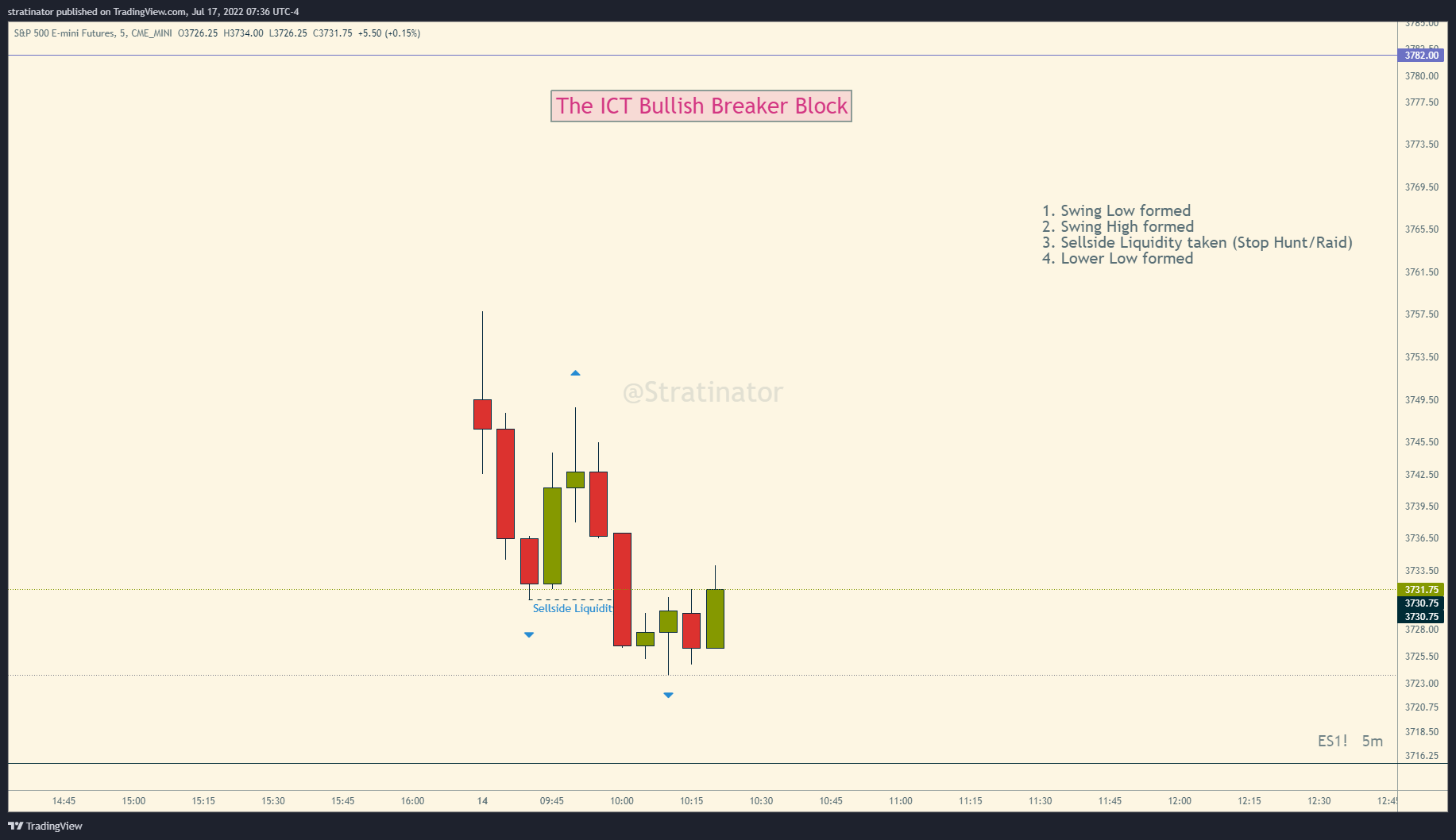

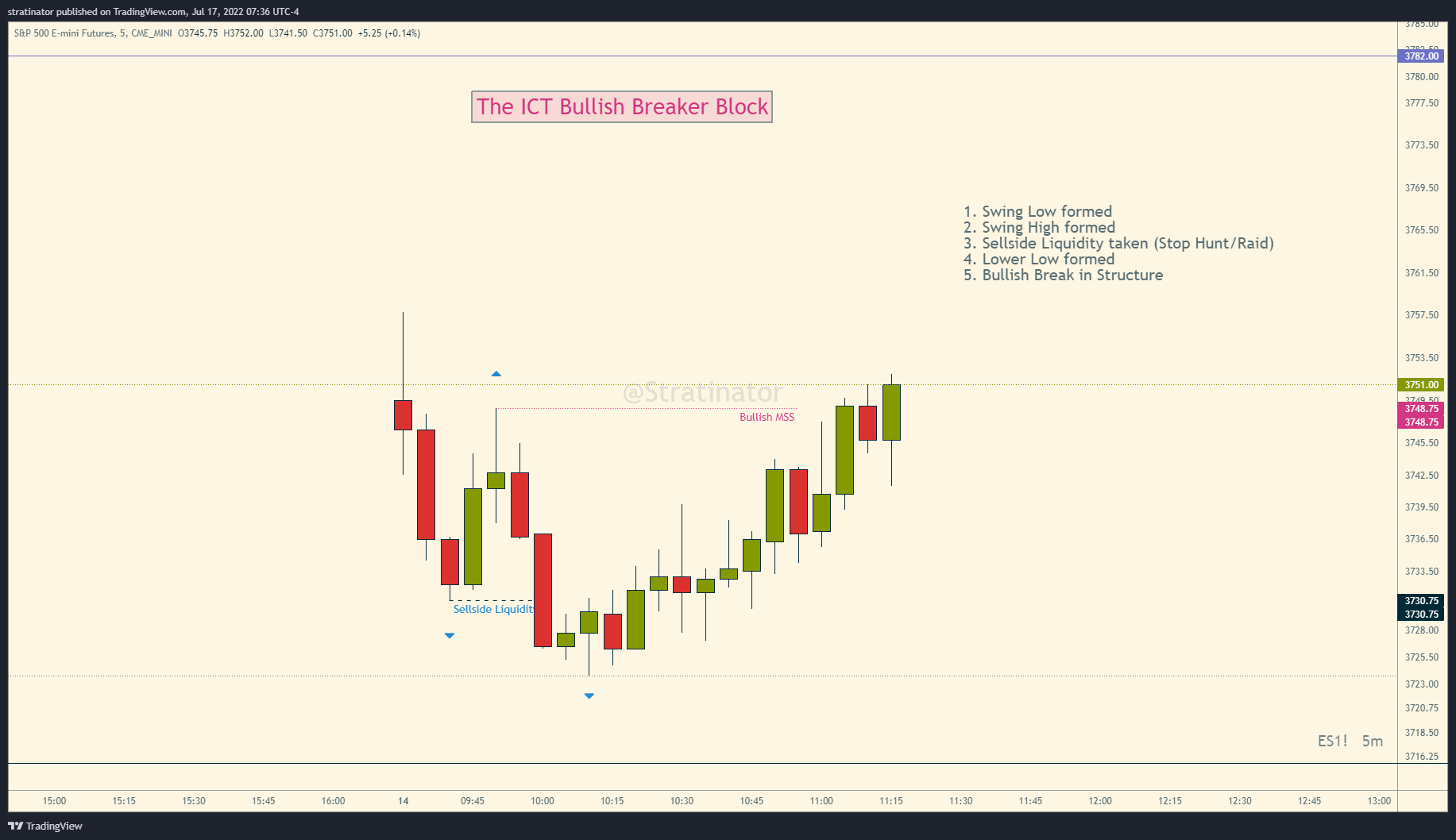

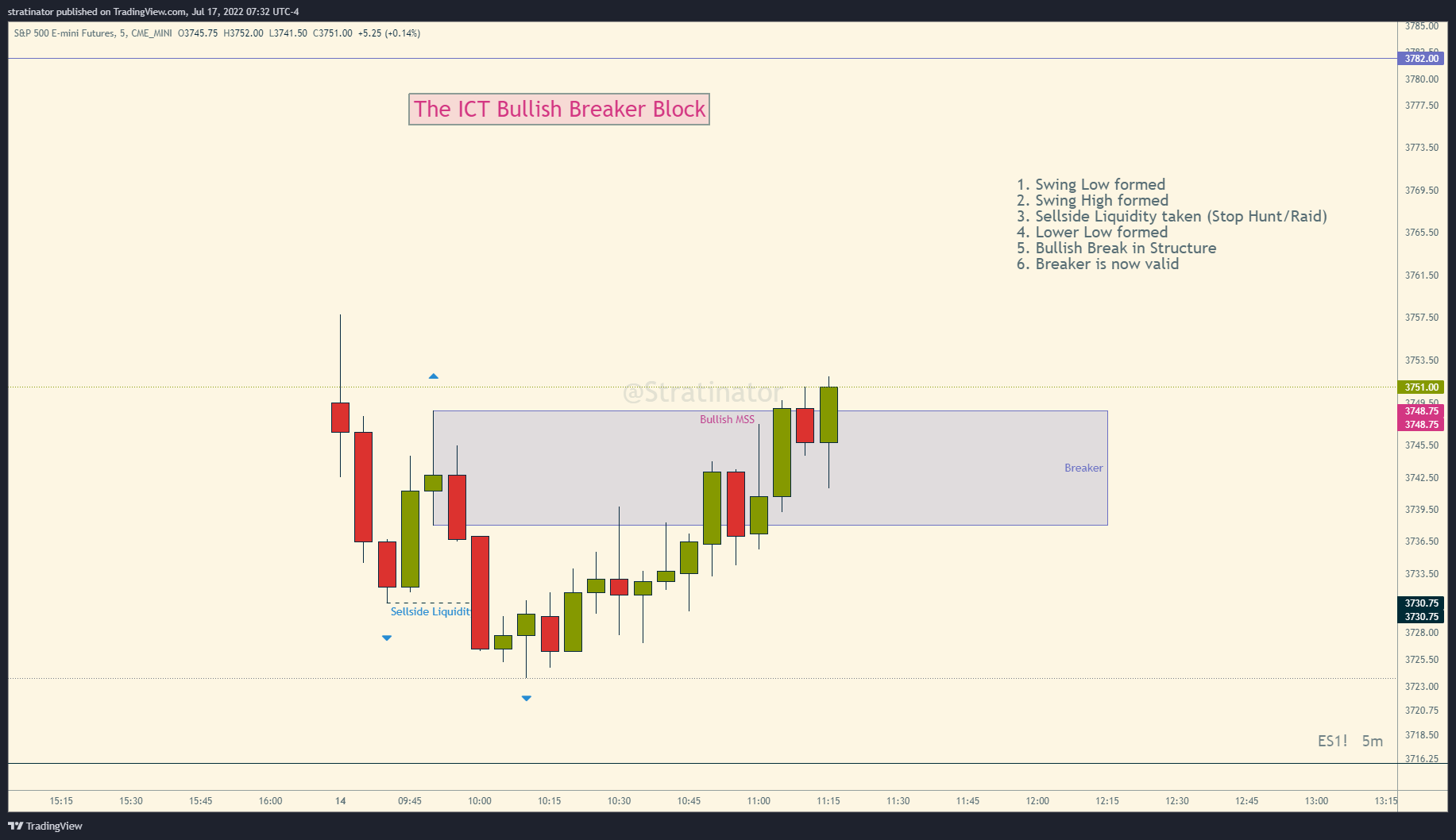

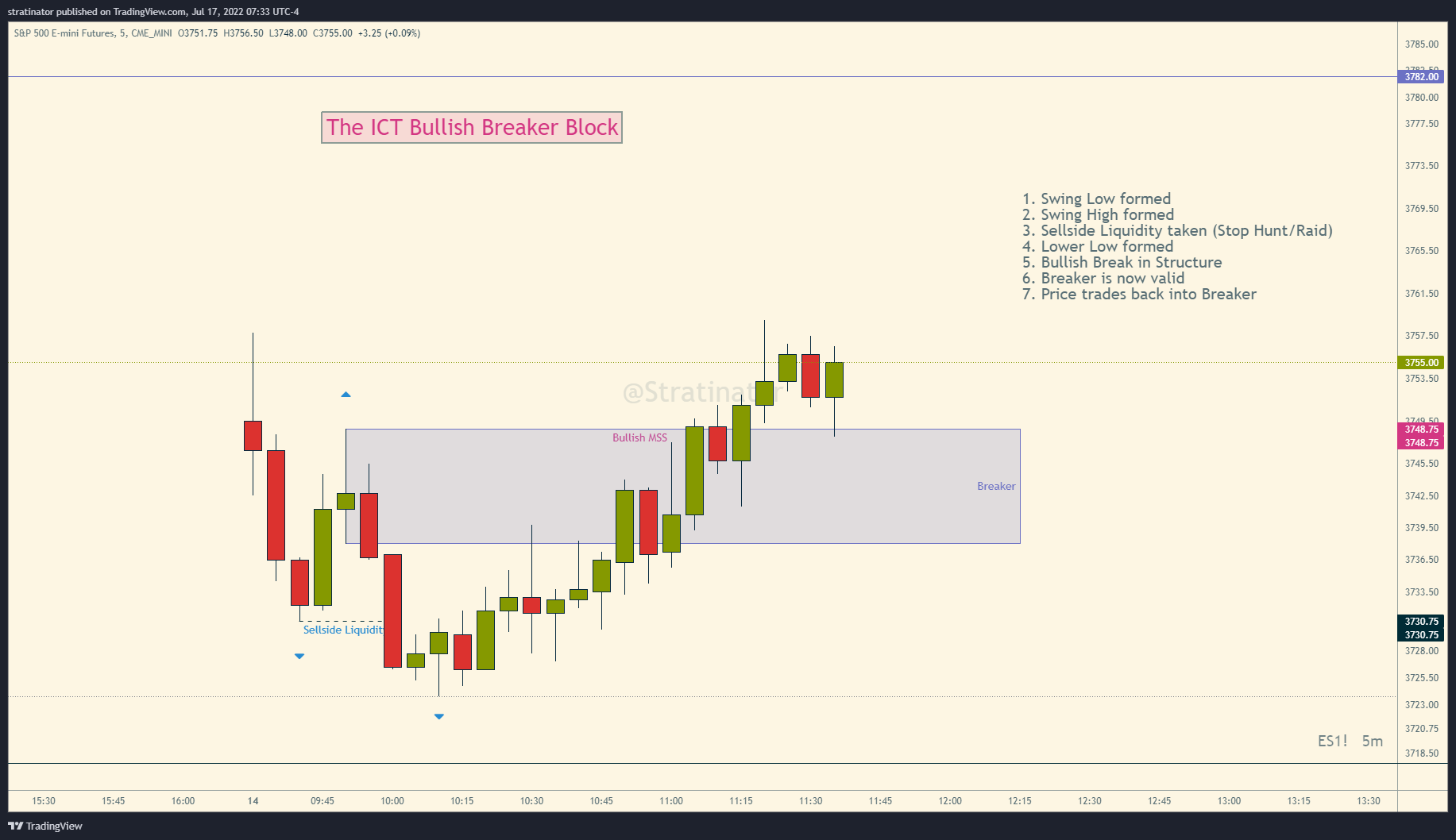

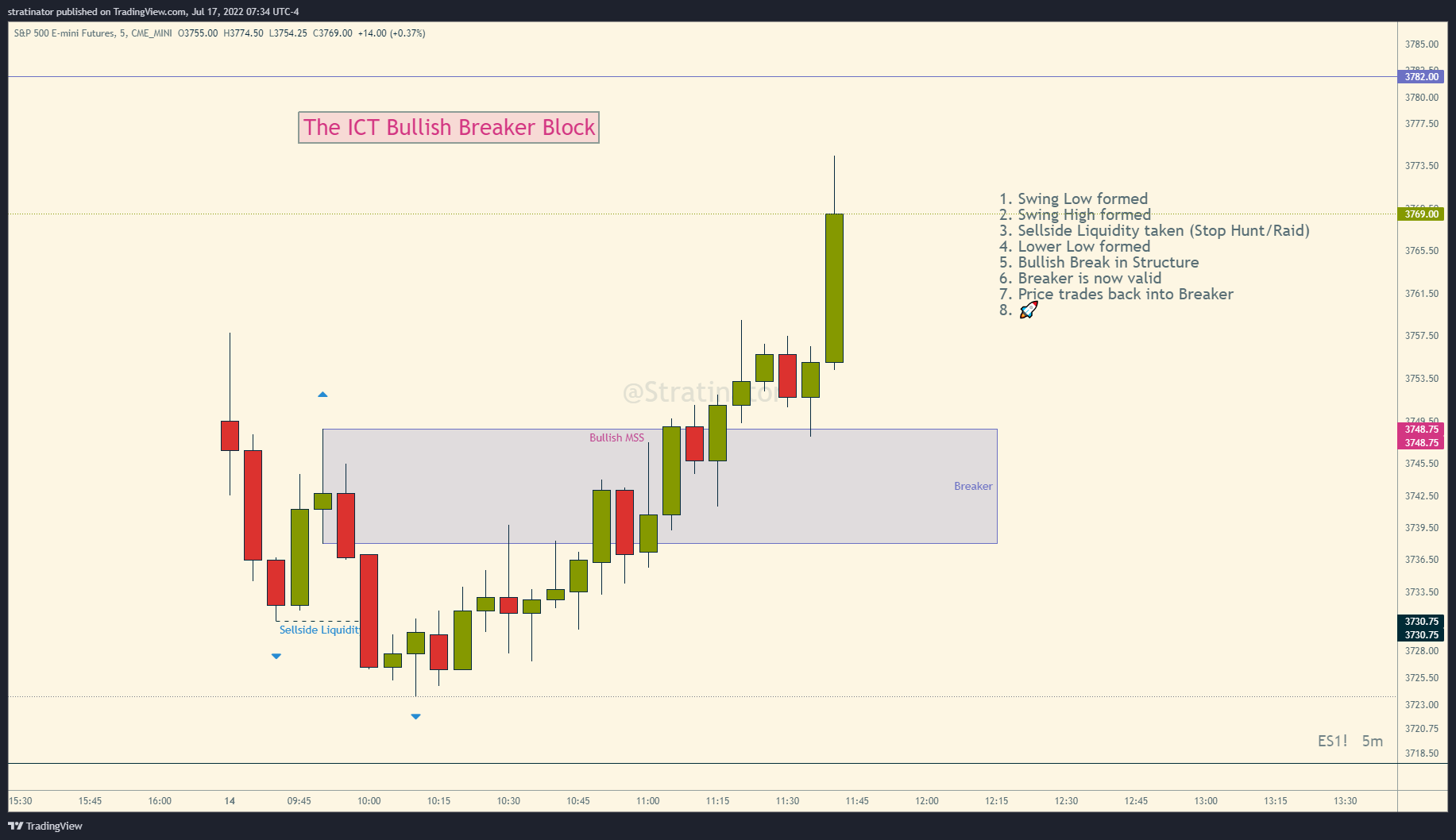

My version of identifying a Bullish Breaker.

Not all Breakers work!. Price can trade through a breaker and fail. Keep that in mind! Stops where invented for that 😉

Have a look at the images for a detailed description of each step.

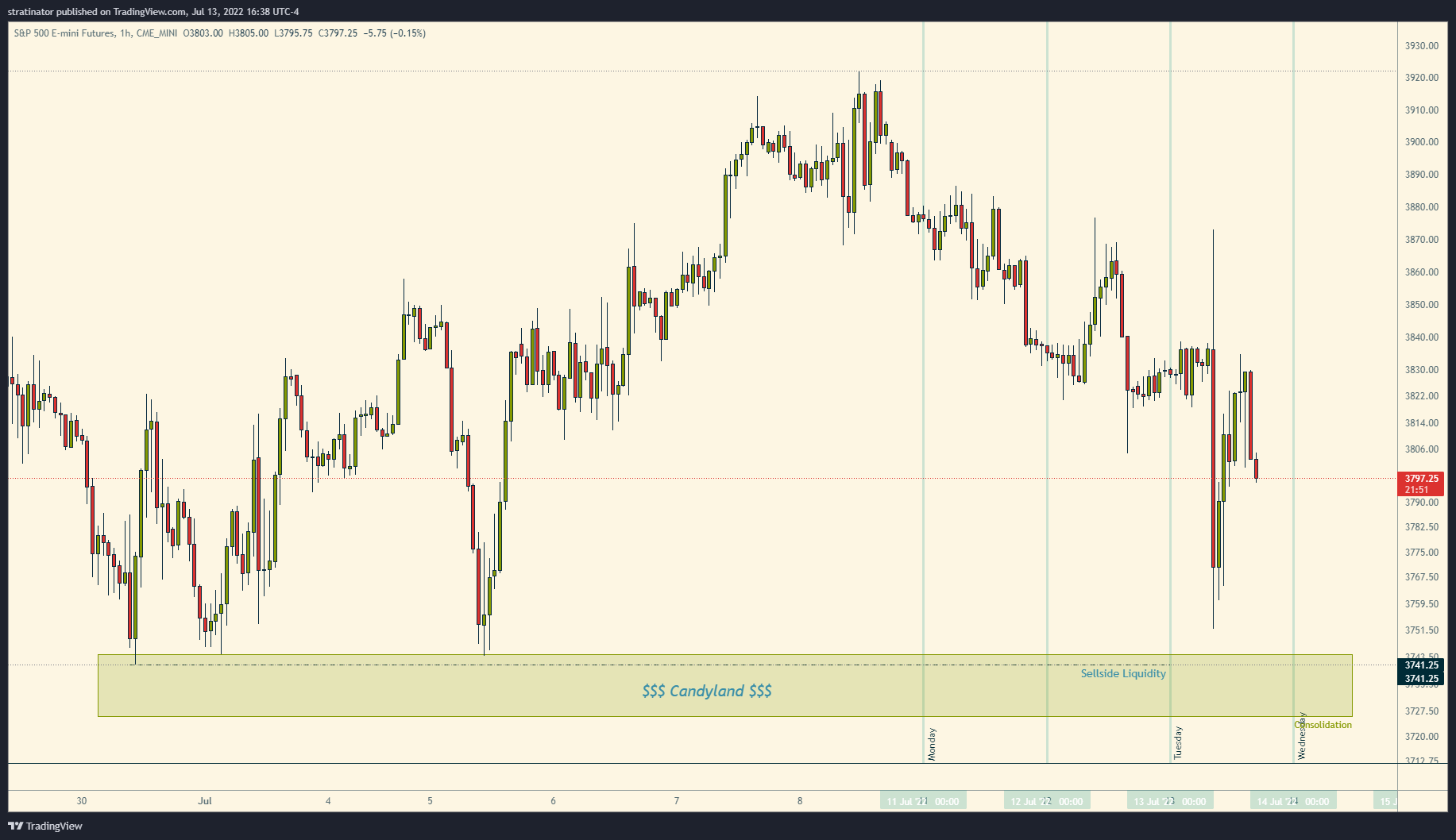

$ES_F 60min chart, there is more down there :-) #ICT

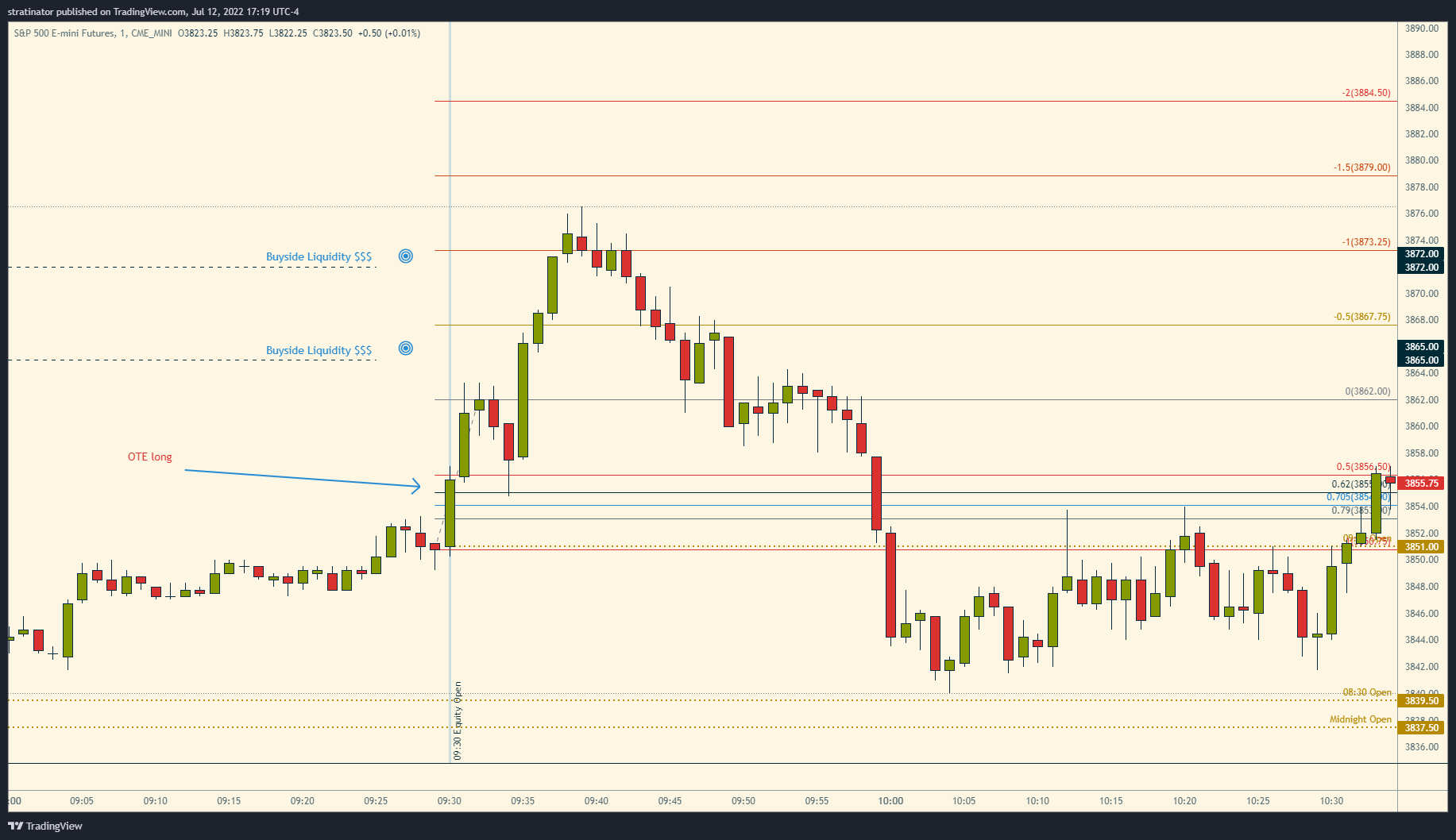

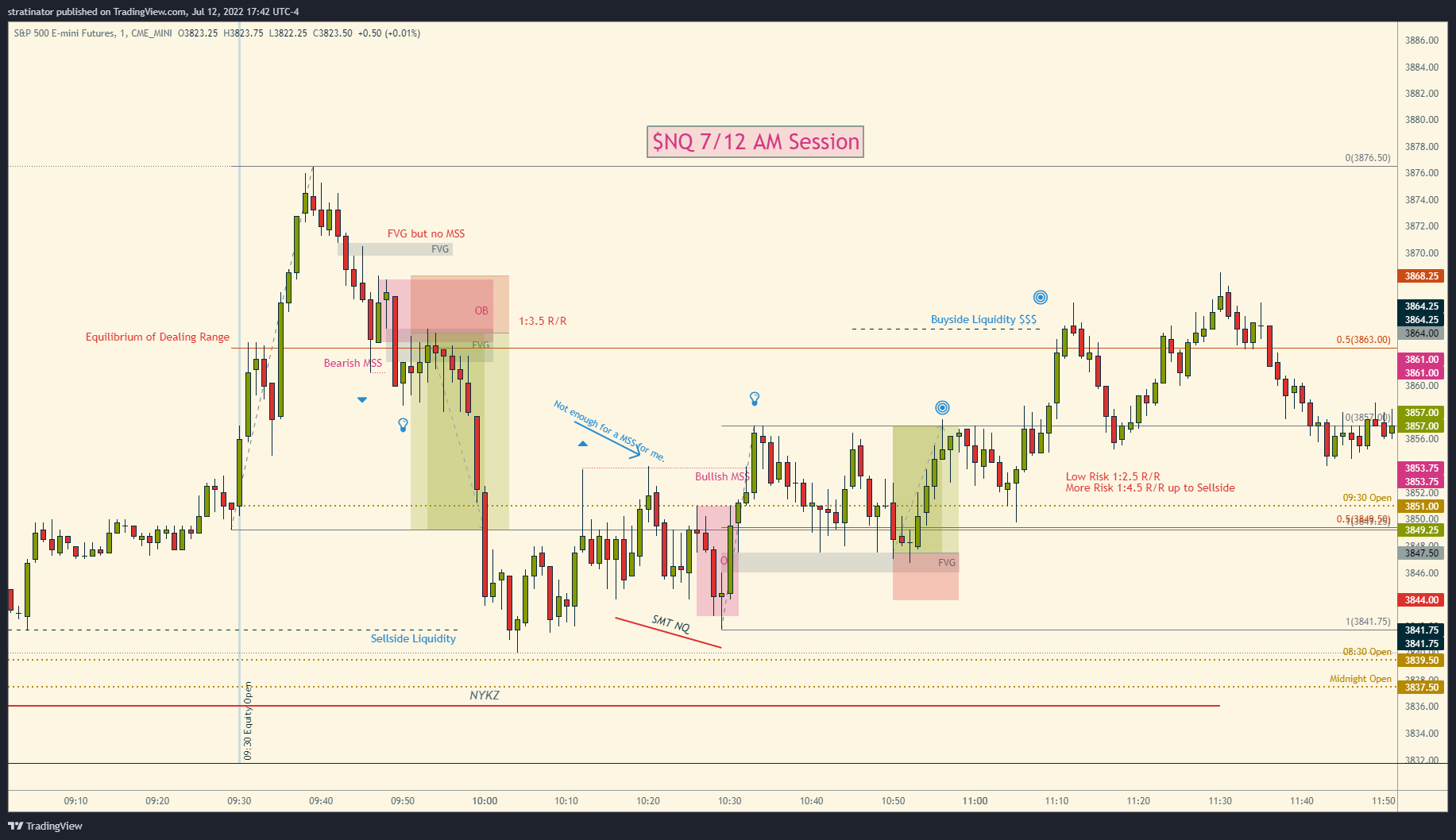

Hindsight $NQ_F AM Session

So many opportunities, I don’t need to take every trade.

1st Chart - OTE Long after EqO, targeting BSL

2nd Chart - Short Judas Swing Possible above Equilibrium & Long after Stop Hunt and SMT with $NQ FVG&OB setup

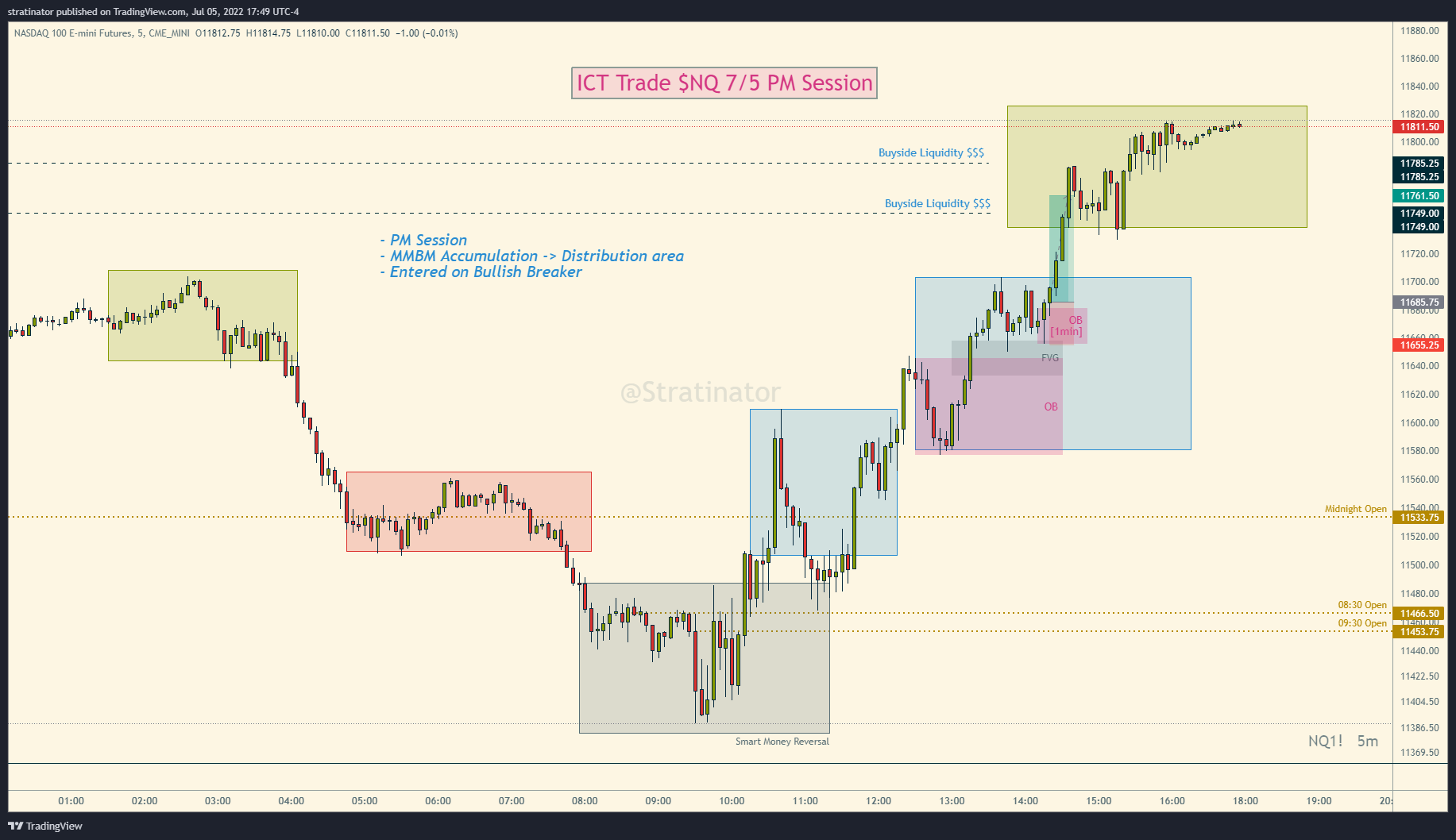

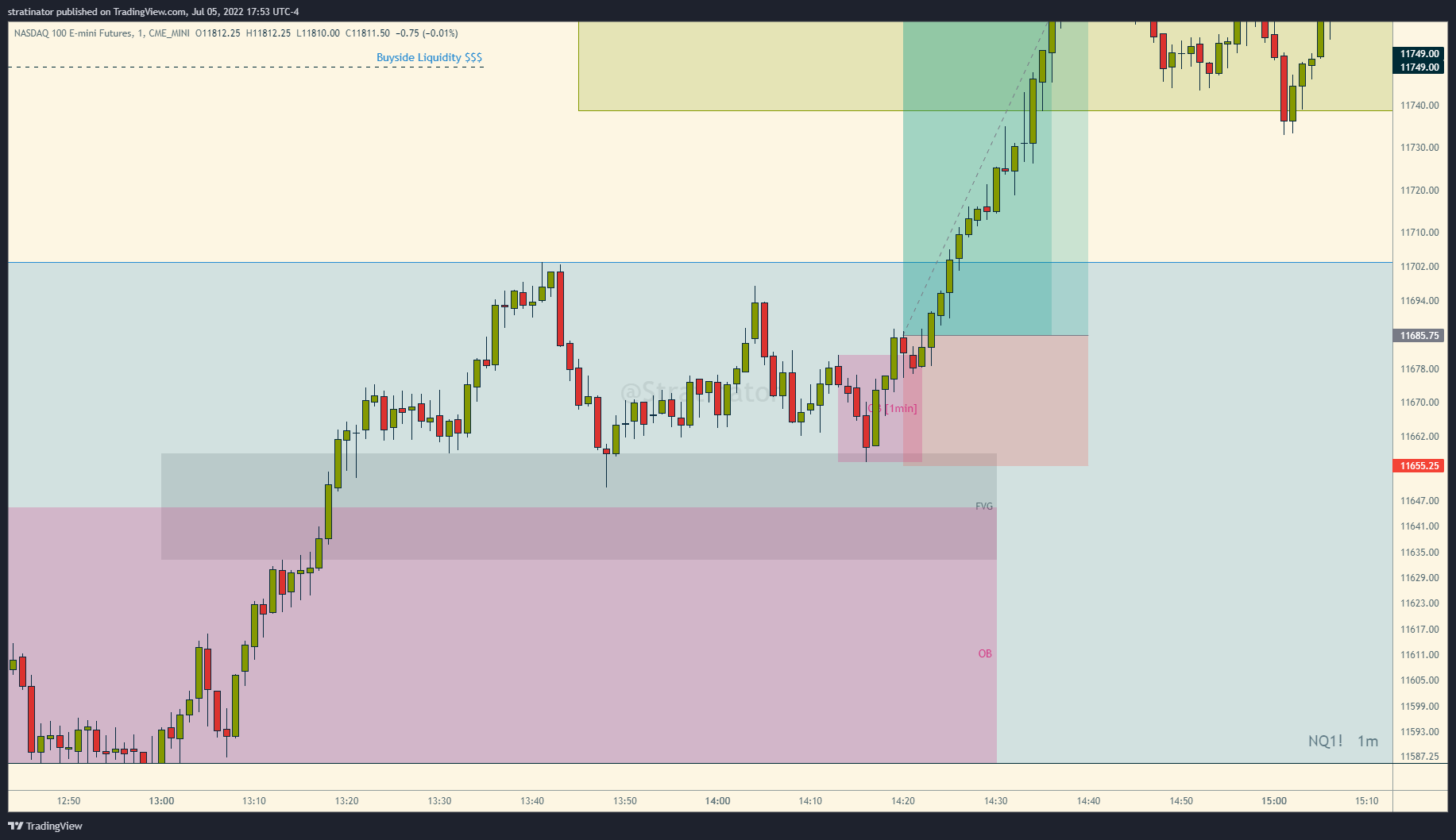

Hindsight $NQ_F PM session trade from #ICT today, annotated for my own study notes.

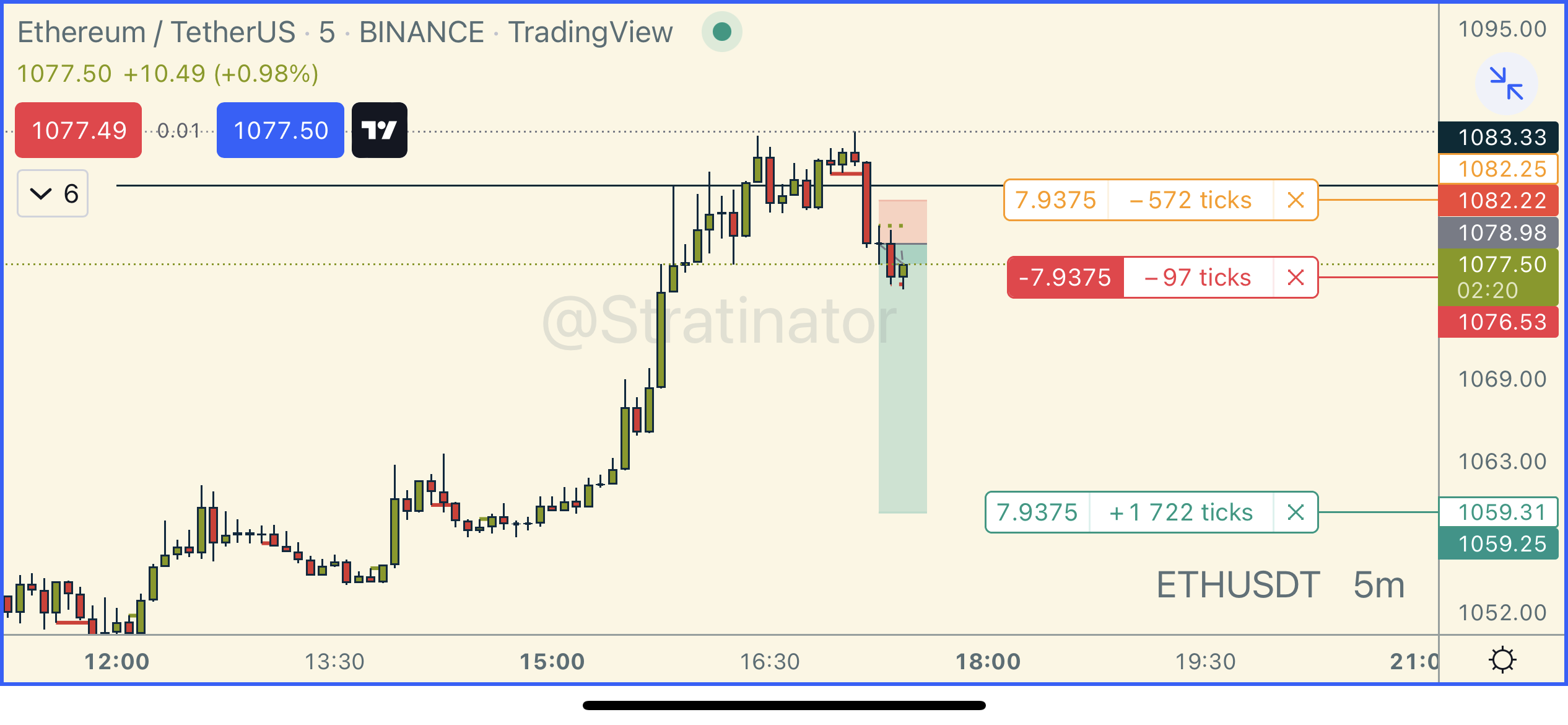

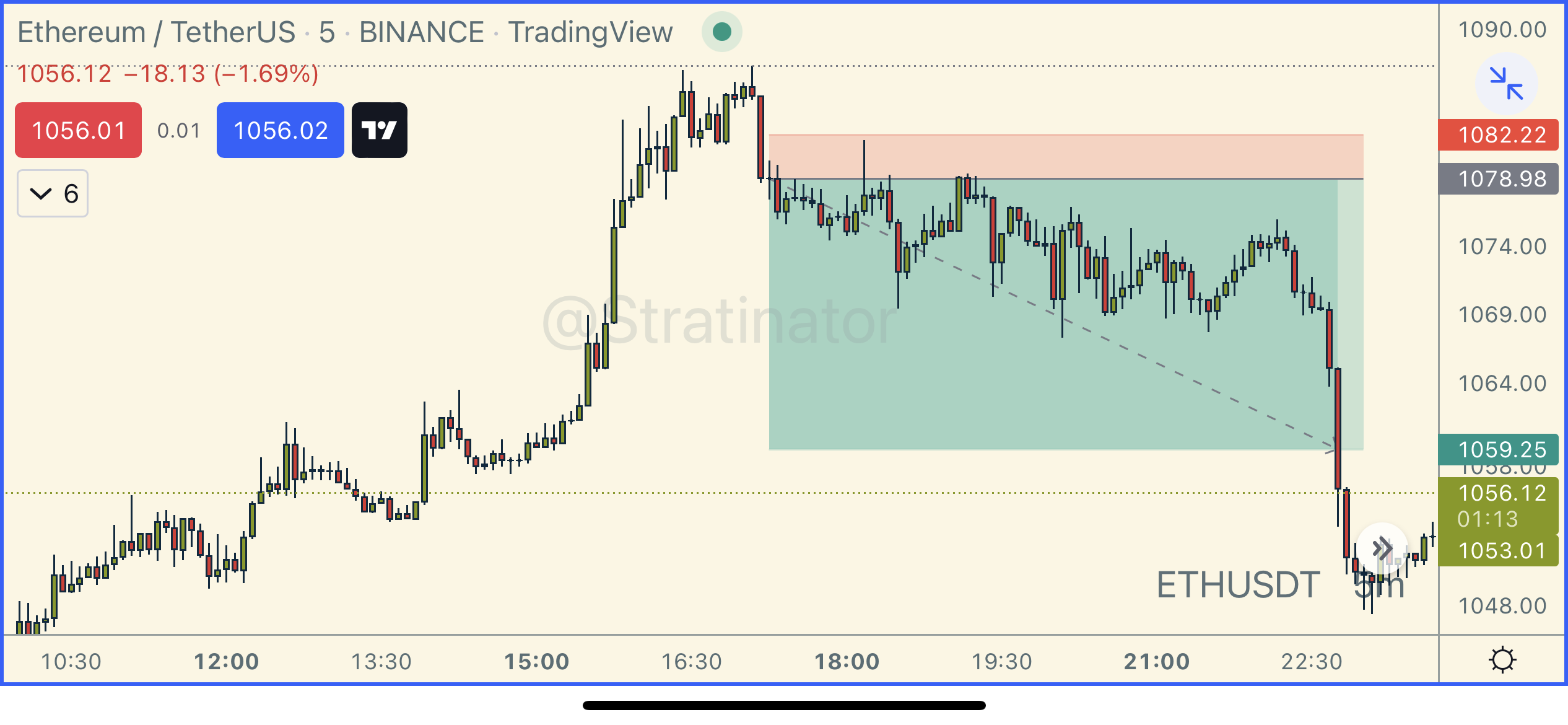

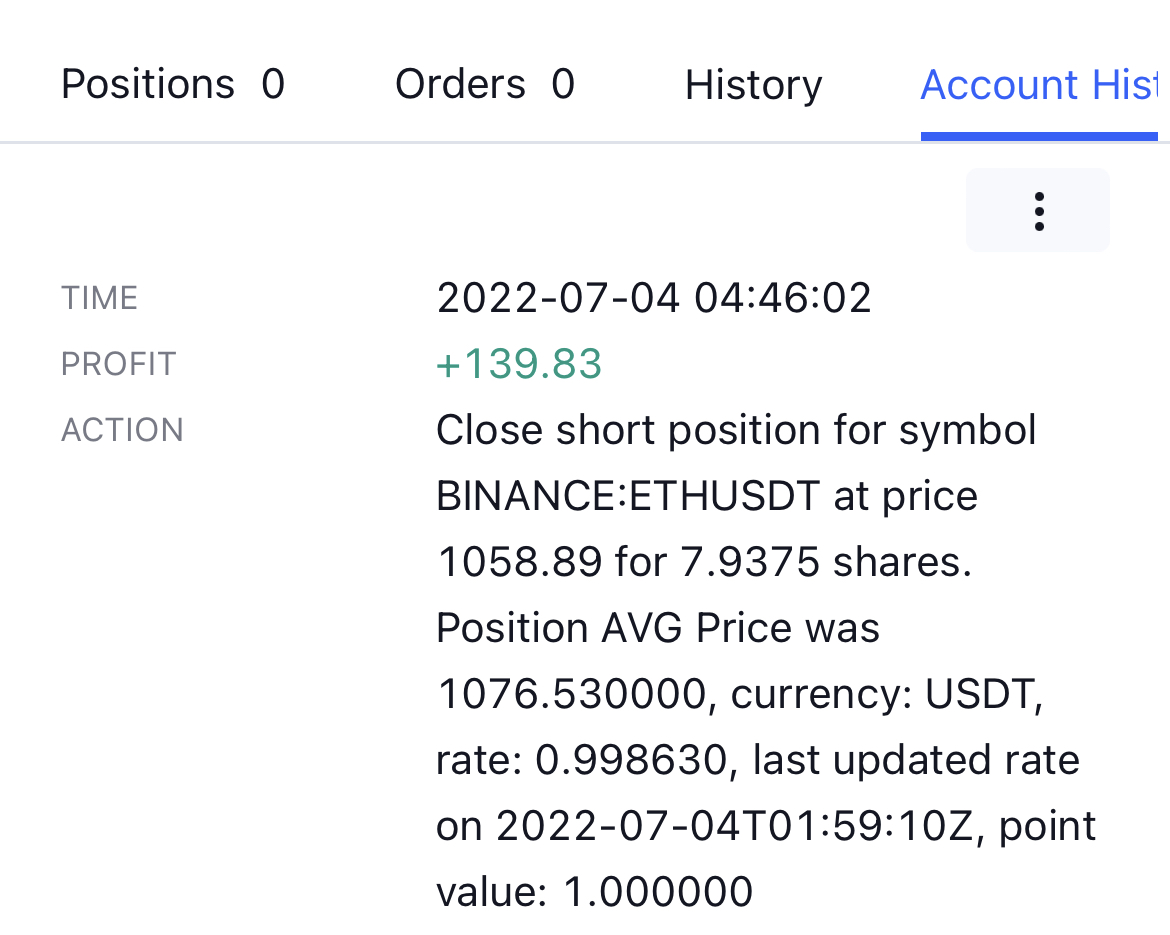

Tuesday, July 5, 2022

Good Morning, trying something new this month/week, maybe not what you expected but most of you might have seen that I switched to ICT methods and futures trading during the last couple of months. If you subscribed because of #TheStrat ideas and infos, I don’t think that I will and can provide …Tape reading practice $ETHUSDT, anticipated a move down, placed a short and went to bed. All on paper, I don’t trade crypts with real money. Woke up and that 1:6 R/R worked out nicely.

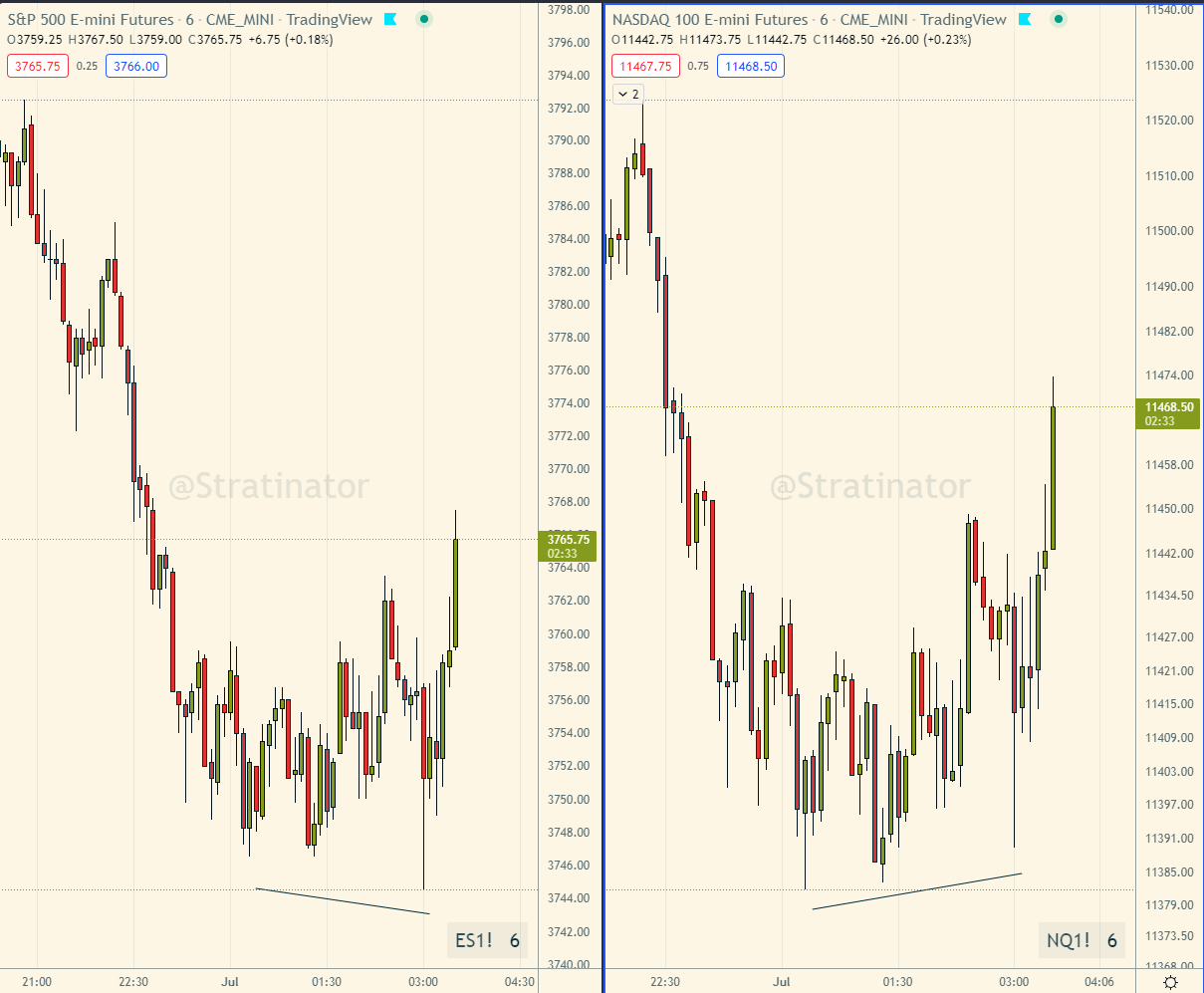

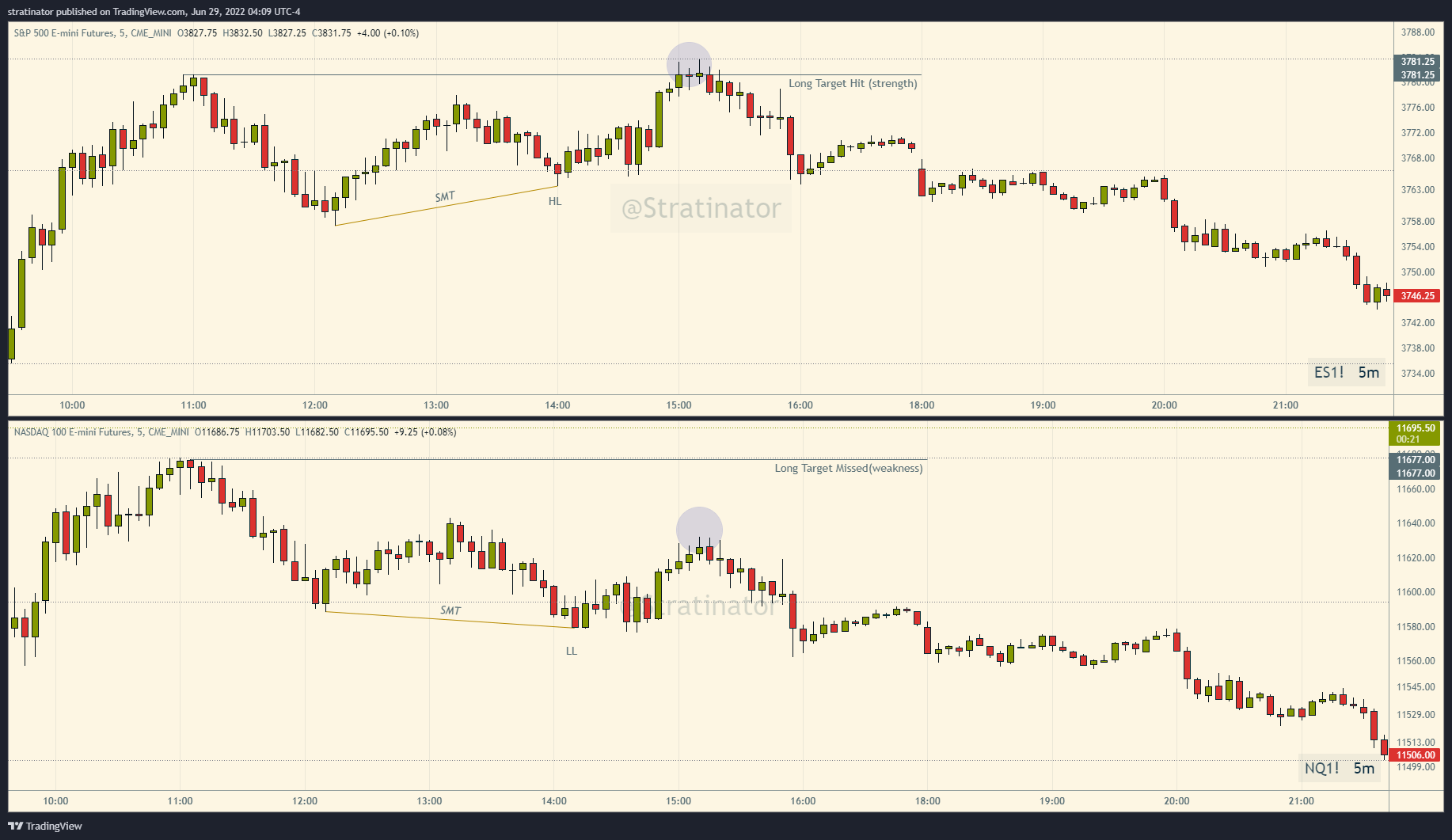

$NQ higher lowes, while $ES_F made lower lows in London session. #SMT, so powerful for getting the stronger index. #ICT

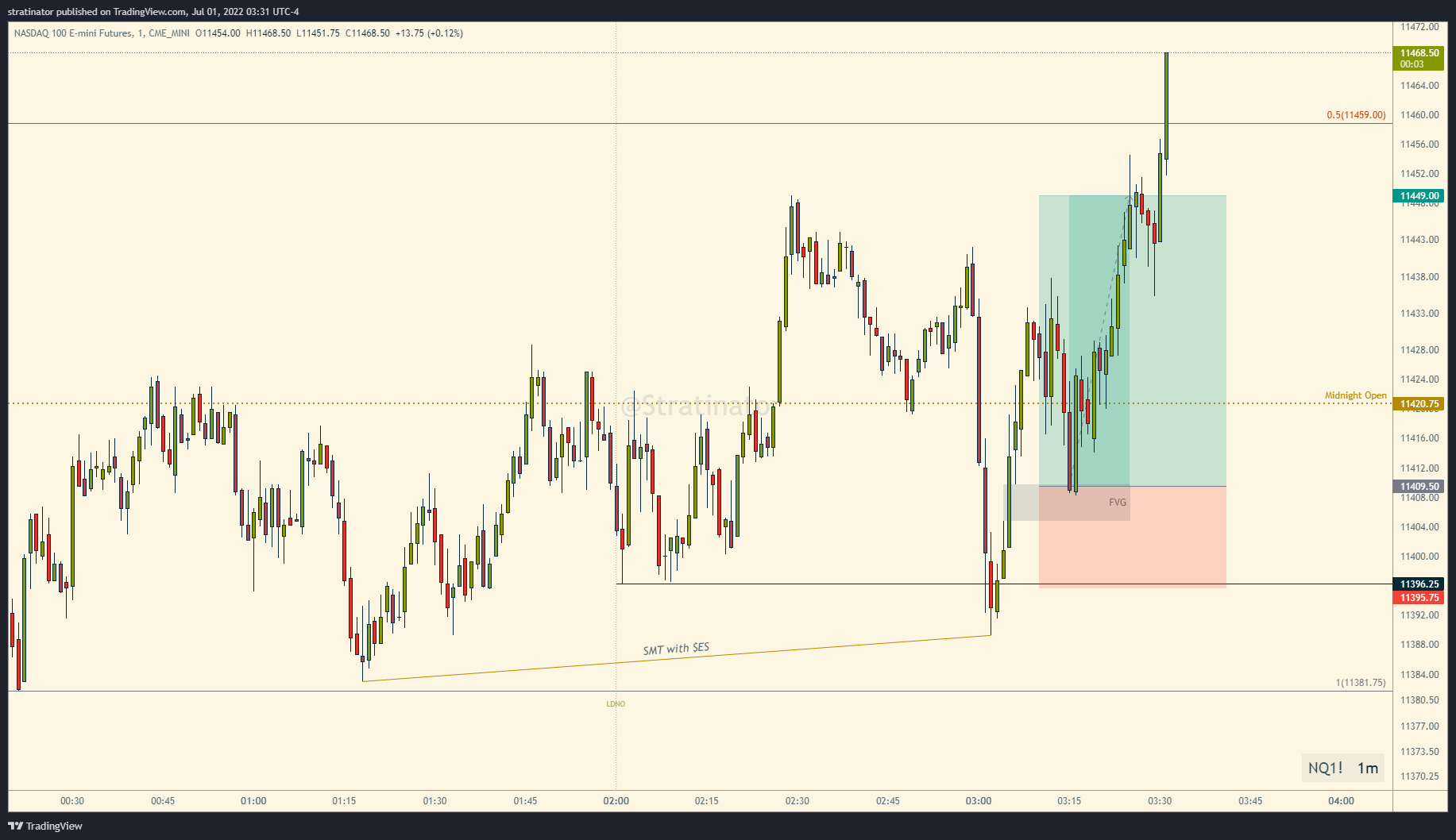

Possible #MMBM on $NQ 1min spotted, still training my eyes to see them before they “finish”. #ICT

Got some questions about #SMT

Related indexes ($ES, $NQ) trade in sympathy, spotting divergences in price can give advantage.

Looking for long setups on the index showing strength and short setups on an index showing weakness as a confirmation, not as entry!

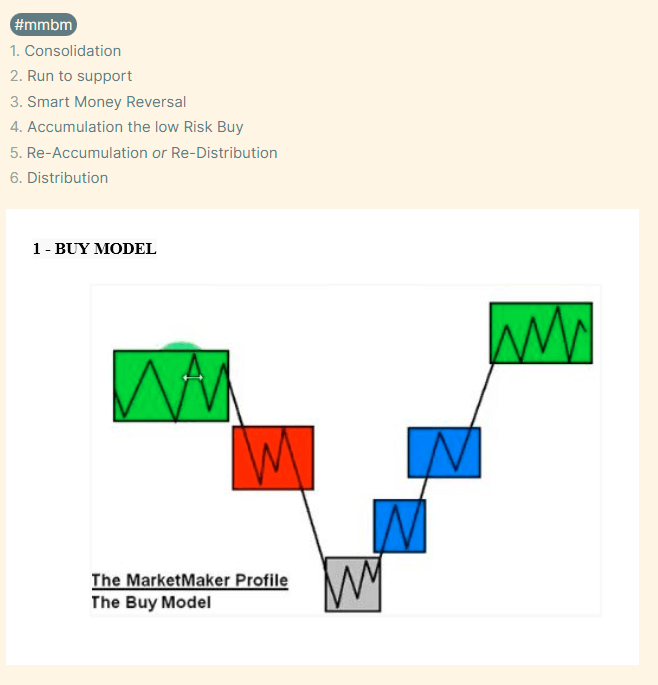

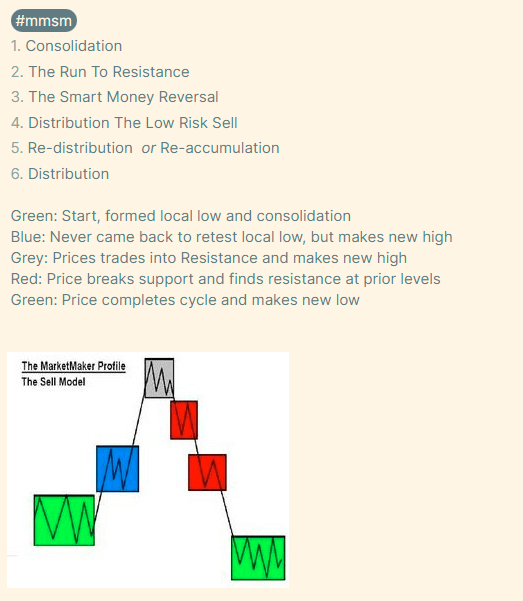

Since I saw that my quick notes to the #mmbm Market Maker Buy Model are floating around. For your convinience here are both together for you in one post. #mmsm Market Maker Sell Model.

Also, the video from #ICT is linked as well.

Happy learning!

That was a nice Market Maker Buy Model on $ES_F this afternoon session. #ICT

Still learning to spot it early and not when it “happened” to get a possible target to trade into.

Recap of 6/17 $SPX500 (futures $ES_F) with a little long trade. 5min annotated ala #ICT.

Adjusted the STP to quick after taking profit and got stopped out of my runner before target hit.

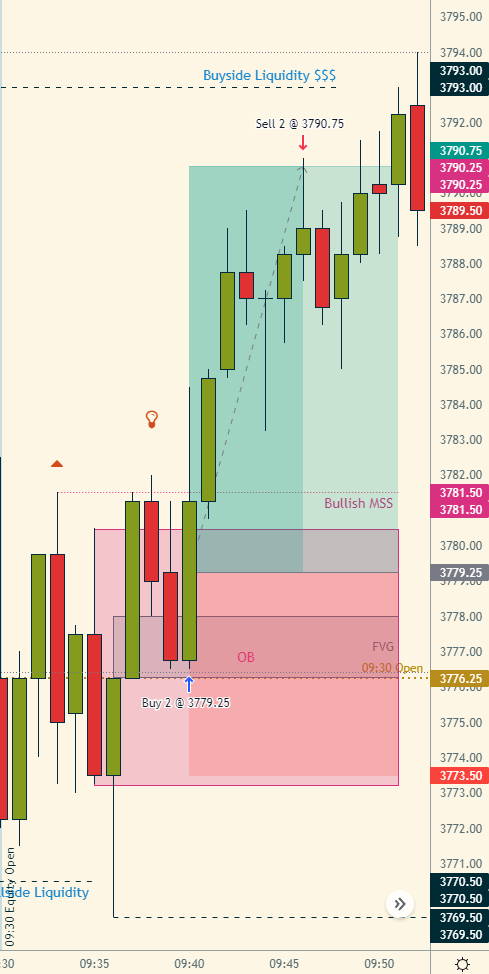

Instead of trading on a FOMC day (I don’t like the PA and Vol), I did some #ICT charting of the AM session on $ES_F. Traded the long at open on paper. In hindsight I should’ve aimed for the Buyside at 3793, but was happy with the 1:2 R/R on that trade.

The afternoon session on $ES had such a clean price action today.

Here is my take with the #ICT Mentorship Model.

Including a small trade I took based on this setup. 1:7.5 R/R, happy with that!

A very clean and nice price action currently in $ES in the afternoon session. I will definitely post my annotated #ICT chart here. I like it very much :-)

Sometimes I share my study notes of #ICT Mentorship 2022 Episode 38.

I have written a lot of notes of that Classic Buy Day in my PKM, here is an excerpt:

Forward-testing $NQ_F overnight session, when everything works like anticipated, feels so great every time! #ICT

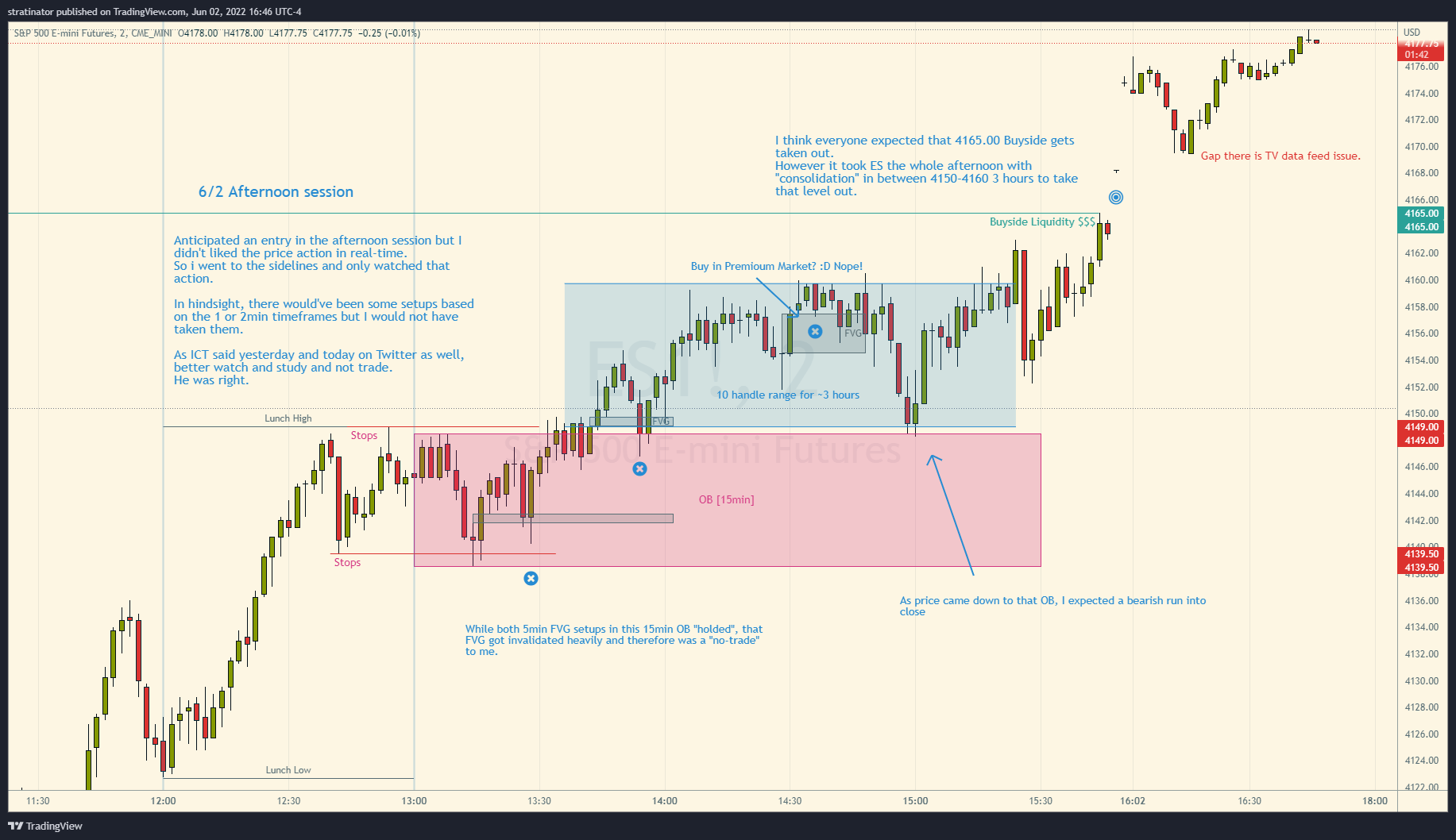

$ES_F 5min - My “no-trade” annotated #ICT chart of the 6/2 afternoon session. NFP-edition

In hindsight (obviously) it was a “missed” move, but during trading hours it felt best to not trade that setup today for me.

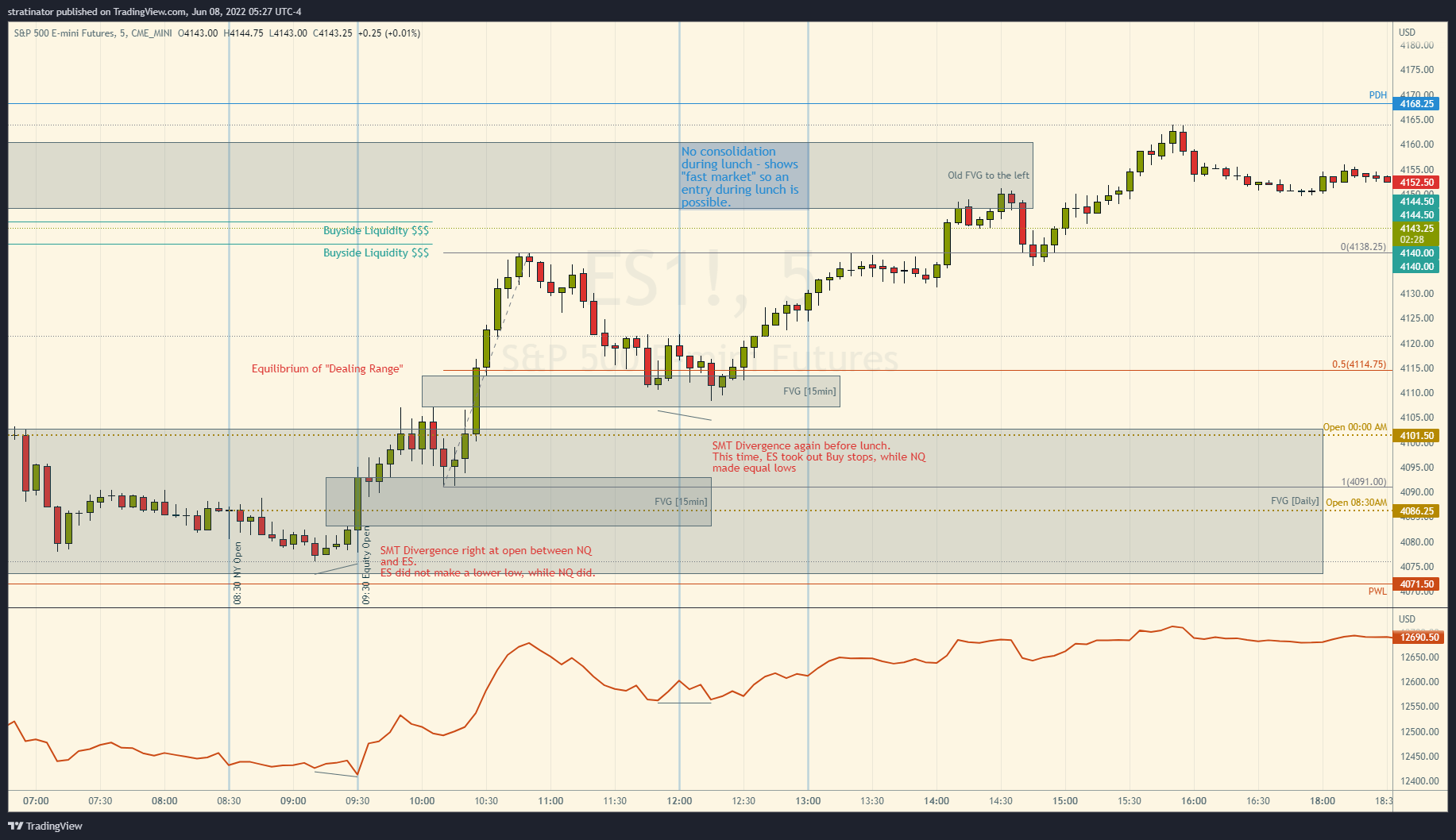

$ES_F 5min - my annotated chart from the morning session - entry long #ICT