Morning Brew 2/15 - #TheStrat style

Good Morning,

since Monday was a bit odd, lets have a look if Turnaround Tuesday is worth its name.

This issue is also available as a Newsletter in your inbox.

Turnaround Tuesday 2/15

The $NQ and $ES futures are bright green since open of the London session, so we might get some nice Bullish Kickers today on the $QQQ and $SPY as well as related stocks.

Strat-Education

For educated Stratters nothing new, for new folks I would like to educate some basic Strat-concepts once in a while in here.

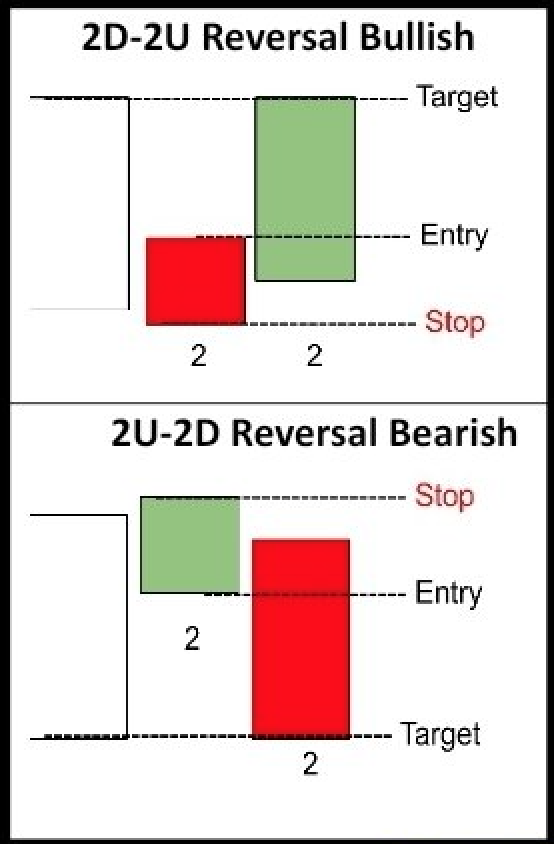

2-2 Reversals

Starting with the 2-2 Reversals, since $SPY and $QQQ also provide this setup today, so you can easily spot it for yourself on the Daily charts.

If you haven’t looked and downloaded Sara’s Strat Combo Sheet, you can find it on her Twitter profile in her pinned tweet

As seen in the image above, try to ignore the colors of the candles and focus on the 2u or 2d. If the low of a candle takes out the low of the previous candle, but not the highs, it is a 2d. For the highs the same, take out the high of the previous candles high, but not the low and it is a 2u. No matter which color the candle itself has.

The color comes into play to get a probably better setup for the next day, because it is more likely a 2d and green will setup a 2d-2u Bullish Reversal on the next candle, because it closed with a bullish sentiment.

I like to trade such setups that have a possible 2d-2u candle pattern if the stock is at the bottom of a Broadening Formation and is there “exhausted”, so the previous lows were taken out and now buyers step back in to bring the price up again.

You’ll see on $SPY and $QQQ today this exact Strat combo, to get the idea in pictures.

$SPY Possible 2-2 Bullish Reversal

Closed red yesterday with a 2d and also took out last weeks lows. This is why I’m bullish here, besides the overnight rally on the Futures.

The 2d-2u Bullish Reversal above 441.60 (pre-market currently 445.18!) would be the above mentioned Bullish Kicker. The gap might be a problem here and we have to look at the first 30-60 minutes to find a proper entry for a possible Gap&Go or Gap&Crap.

If $SPY runs higher, I would like to point your attention to 448.41 level, which is the 50% range of last week. If it trades above that level we might see an outside week with the target of 457.88.

$QQQ Possible 2d-2u Bullish Reversal

Target to look out for today is above 350.98 for the trigger of the 2d-2u Reversal (pre-market already above 354.56 as on time of this writing). Same as for $SPY above, watch out for the possible 50% week trigger above 356.31 to the next big magnitude 366.81 last weeks high.

As always, not financial advise! These are my ideas and triggers that I watch, please always research and manage your risk for yourself

Some tickers I have on my watchlist for a day trade are listed below.

TheStrat possible 2d-2u

My TrendSpider* scanners found the following 2-2 Reversal tickers for today:

JD, V, KO

MA (3-2d-2u)

$KO 2d-2u Daily 🐮

Possible 2d_2u Bullish Reversal today with a hammer-like 2d and green. Week is uncoupling today and we’ll see if price goes higher again.

Daily trigger for the reversal is 60.79, if price goes up and above 60.91 we have FTFC to the upside.

Also watch for 61.24 as possible 50% rule trigger on the weekly for a possible target of 62.32 (ATH).

$COIN 2-1-2d Daily 🐻

Not a 2-2 Reversal on the day, but possbile on the Weekly chart. $COIN looks bearish with a Shooter 2d (but green) yesterday. Trigger for the 2-1-2d Bearish Continuation is 193.46. The first target 191.02 triggers the week 2u-2d with the next target of 177.45.

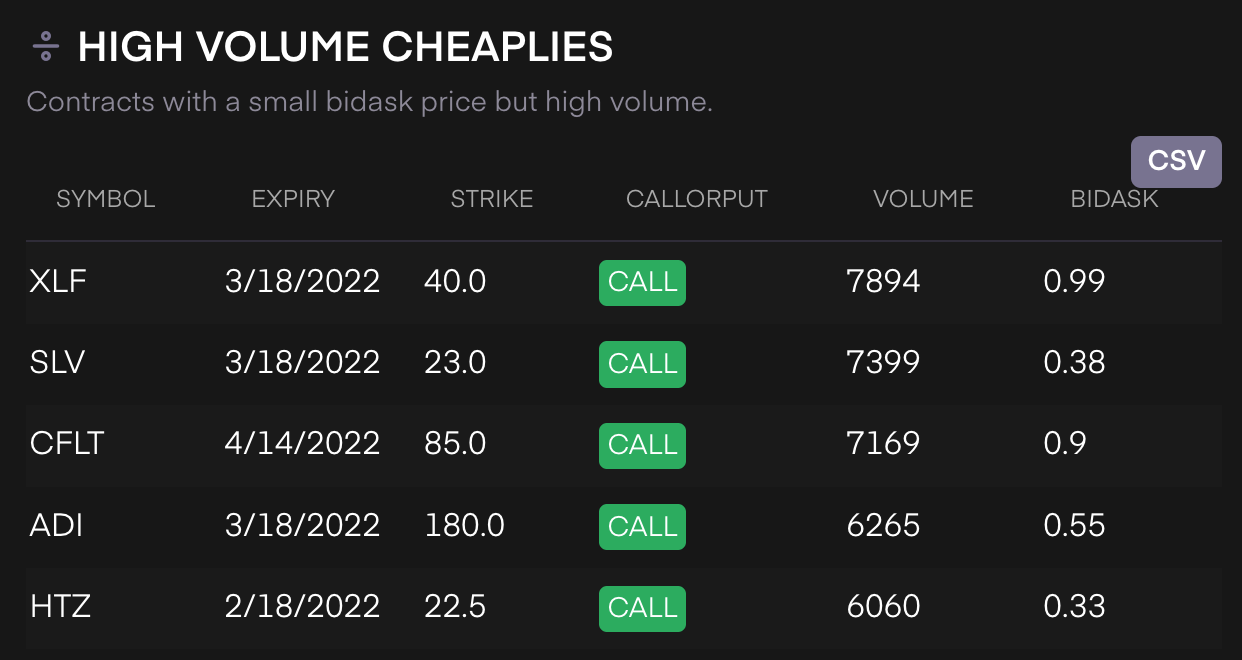

Tradytics on watch

Always on watch, cheap high volume contracts from yesterday:

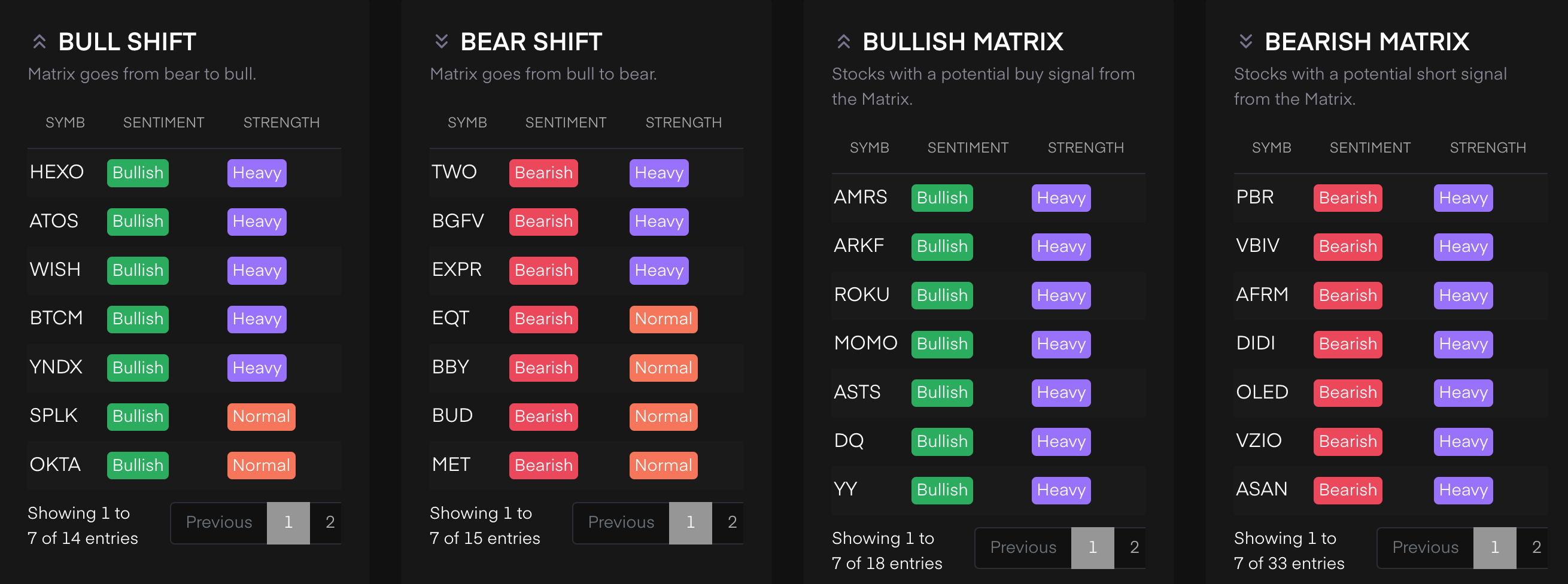

Also The new Tradytics Matrix Tool, which I need to pay more attention to, shows shifts from Bull to Bear and vice versa:

Final words

If you have any feedback, what you like or dislike or you don’t want to get that info at all in the morning, please feel free and let me know.

Wishing you all a nice green trading day!

Thanks!

–

René